2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CONSOLIDATED FINANCIAL STATEMENTS<br />

Remuneration of the Board of Directors and Management<br />

Attendance fees paid to the members of the Board of Directors in <strong>2001</strong> totaled € 0.2m.<br />

The total amount of remuneration paid in <strong>2001</strong> to the authorized senior executive of the parent company came to € 0.736m.<br />

Loans or guaranties granted to directors: none.<br />

Transactions with directors: none.<br />

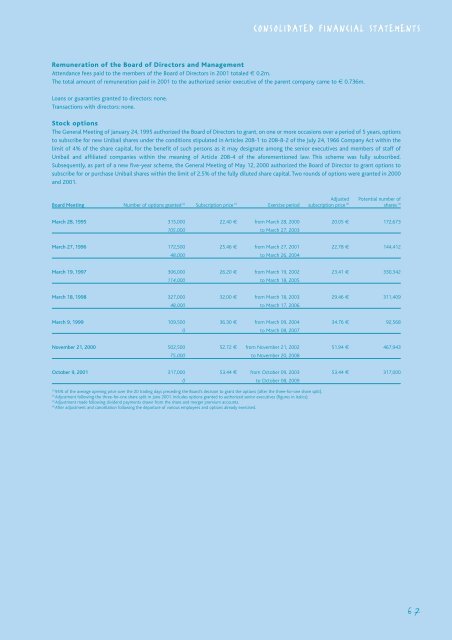

Stock options<br />

The General Meeting of January 24, 1995 authorized the Board of Directors to grant, on one or more occasions over a period of 5 years, options<br />

to subscribe for new <strong>Unibail</strong> shares under the conditions stipulated in Articles 208-1 to 208-8-2 of the July 24, 1966 Company Act within the<br />

limit of 4% of the share capital, for the benefit of such persons as it may designate among the senior executives and members of staff of<br />

<strong>Unibail</strong> and affiliated companies within the meaning of Article 208-4 of the aforementioned law. This scheme was fully subscribed.<br />

Subsequently, as part of a new five-year scheme, the General Meeting of May 12, 2000 authorized the Board of Director to grant options to<br />

subscribe for or purchase <strong>Unibail</strong> shares within the limit of 2.5% of the fully diluted share capital. Two rounds of options were granted in 2000<br />

and <strong>2001</strong>.<br />

Adjusted Potential number of<br />

Board Meeting Number of options granted (2) Subscription price (1) Exercise period subscription price (3) shares (4)<br />

March 28, 1995 315,000 22.40 € from March 28, 2000 20.05 € 172,673<br />

105,000 to March 27, 2003<br />

March 27, 1996 172,500 25.46 € from March 27, <strong>2001</strong> 22.78 € 144,412<br />

48,000 to March 26, 2004<br />

March 19, 1997 306,000 26.20 € from March 19, 2002 23.41 € 330,342<br />

114,000 to March 18, 2005<br />

March 18, 1998 327,000 32.00 € from March 18, 2003 29.46 € 311,409<br />

48,000 to March 17, 2006<br />

March 9, 1999 109,500 36.30 € from March 09, 2004 34.76 € 92,568<br />

0 to March 08, 2007<br />

November 21, 2000 502,500 52.72 € from November 21, 2002 51.94 € 467,943<br />

75,000 to November 20, 2008<br />

October 9, <strong>2001</strong> 317,000 53.44 € from October 09, 2003 53.44 € 317,000<br />

0 to October 08, 2009<br />

(1)<br />

95% of the average opening price over the 20 trading days preceding the Board’s decision to grant the options (after the three-for-one share split).<br />

(2)<br />

Adjustment following the three-for-one share split in June <strong>2001</strong>. Includes options granted to authorized senior executives (figures in italics).<br />

(3)<br />

Adjustment made following dividend payments drawn from the share and merger premium accounts.<br />

(4)<br />

After adjustment and cancellation following the departure of various employees and options already exercised.<br />

67