2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

LEGAL INFORMATION<br />

Using his delegated powers, the Chairman of the Board of Directors<br />

decided to increase the share capital by FRF 208,150,000 by the issue<br />

of 2,081,500 shares of FRF 100, each carrying with it a warrant giving<br />

the right to purchase existing shares and/or to subscribe for new<br />

shares.<br />

These warrants can be exercised until May 11, 2004.The exercise ratio<br />

was originally of one <strong>Unibail</strong> share of FRF 100 nominal value for<br />

5warrants to purchase existing shares and/or to subscribe for new<br />

shares plus the payment of € 130. Following adjustments, this exercise<br />

ratio became 3.15 shares of € 5 nominal value for 5 warrants plus<br />

€130. As at December 31, <strong>2001</strong>, 170 warrants had been exercised,<br />

giving rise to the purchase of 108 <strong>Unibail</strong> shares. During <strong>2001</strong>,<br />

the Company bought back and subsequently cancelled 360,063 warrants<br />

in accordance with article L.225-159 of the Code of Commerce.<br />

As at December 31, <strong>2001</strong>, there were 1,721,052 outstanding warrants.<br />

• Convertible bonds: today no convertible bonds exist anymore.<br />

Other securities representing capital<br />

None<br />

Dividends<br />

The amount of dividends paid in the course of the last five financial<br />

years is given on page 76. During this period no payment of<br />

interim dividend has been made.<br />

The dividend is paid out from the profits and if necessary, from available<br />

premiums. Until today's date, no use has been made of the<br />

possibility provided by article 21 of the Articles of Association to<br />

distribute the dividend in the form of new shares.<br />

Dividends from <strong>Unibail</strong> treasury shares are recorded under retained<br />

earnings.<br />

Dividends that remain unclaimed for a period of five years from the<br />

date they are made available for payment and, in accordance with<br />

articles L 27 and R 46 of the ‘Code du Domaine de L’État’ (French<br />

State Property Code), are paid over to the French Treasury.<br />

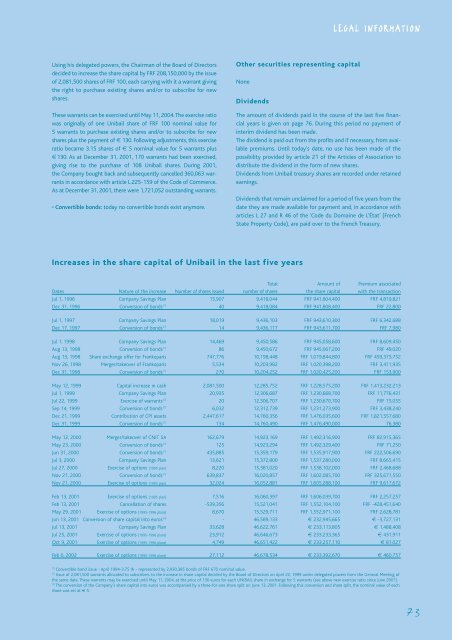

Increases in the share capital of <strong>Unibail</strong> in the last five years<br />

Total Amount of Premium associated<br />

Dates Nature of the increase Number of shares issued number of shares the share capital with the transaction<br />

Jul 1, 1996 Company Savings Plan 15,907 9,418,044 FRF 941,804,400 FRF 4,819,821<br />

Dec 31, 1996 Conversion of bonds (1) 40 9,418,084 FRF 941,808,400 FRF 22,800<br />

Jul 1, 1997 Company Savings Plan 18,019 9,436,103 FRF 943,610,300 FRF 6,342,688<br />

Dec 17, 1997 Conversion of bonds (1) 14 9,436,117 FRF 943,611,700 FRF 7,980<br />

Jul 1, 1998 Company Savings Plan 14,469 9,450,586 FRF 945,058,600 FRF 8,609,450<br />

Aug 13, 1998 Conversion of bonds (1) 86 9,450,672 FRF 945,067,200 FRF 49,020<br />

Aug 13, 1998 Share exchange offer for Frankoparis 747,776 10,198,448 FRF 1,019,844,800 FRF 459,373,752<br />

Nov 26, 1998 Merger/takeover of Frankoparis 5,534 10,203,982 FRF 1,020,398,200 FRF 3,411,935<br />

Dec 31, 1998 Conversion of bonds (1) 270 10,204,252 FRF 1,020,425,200 FRF 153,900<br />

May 12, 1999 Capital increase in cash 2,081,500 12,285,752 FRF 1,228,575,200 FRF 1,413,232,213<br />

Jul 1, 1999 Company Savings Plan 20,935 12,306,687 FRF 1,230,668,700 FRF 11,776,431<br />

Jul 22, 1999 Exercise of warrants (2) 20 12,306,707 FRF 1,230,670,700 FRF 15,055<br />

Sep 14, 1999 Conversion of bonds (1) 6,032 12,312,739 FRF 1,231,273,900 FRF 3,438,240<br />

Dec 21, 1999 Contribution of CPI assets 2,447,617 14,760,356 FRF 1,476,035,600 FRF 1,821,557,680<br />

Dec 31, 1999 Conversion of bonds (1) 134 14,760,490 FRF 1,476,490,000 76,380<br />

May 12, 2000 Merger/takeover of CNIT SA 162,679 14,923,169 FRF 1,492,316,900 FRF 82,915,365<br />

May 23, 2000 Conversion of bonds (1) 125 14,923,294 FRF 1,492,329,400 FRF 71,250<br />

Jun 31, 2000 Conversion of bonds (1) 435,885 15,359,179 FRF 1,535,917,900 FRF 222,506,690<br />

Jul 3, 2000 Company Savings Plan 13,621 15,372,800 FRF 1,537,280,000 FRF 8,665,415<br />

Jul 27, 2000 Exercise of options (1995 plan) 8,220 15,381,020 FRF 1,538,102,000 FRF 2,468,688<br />

Nov 21, 2000 Conversion of bonds (1) 639,837 16,020,857 FRF 1,602,085,700 FRF 325,671,550<br />

Nov 21, 2000 Exercise of options (1995 plan) 32,024 16,052,881 FRF 1,605,288,100 FRF 9,617,672<br />

Feb 13, <strong>2001</strong> Exercise of options (1995 plan) 7,516 16,060,397 FRF 1,606,039,700 FRF 2,257,257<br />

Feb 13, <strong>2001</strong> Cancellation of shares -539,356 15,521,041 FRF 1,552,104,100 FRF -428,451,640<br />

May 29, <strong>2001</strong> Exercise of options (1995-1996 plans) 8,670 15,529,711 FRF 1,552,971,100 FRF 2,628,781<br />

Jun 13, <strong>2001</strong> Conversion of share capital into euros (3) - 46,589,133 € 232,945,665 € -3,727,131<br />

Jul 13, <strong>2001</strong> Company Savings Plan 33,628 46,622,761 € 233,113,805 € 1,488,408<br />

Jul 25, <strong>2001</strong> Exercise of options (1995-1996 plans) 23,912 46,646,673 € 233,233,365 € 431,911<br />

Oct 9, <strong>2001</strong> Exercise of options (1995-1996 plans) 4,749 46,651,422 € 233,257,110 € 81,027<br />

Feb 6, 2002 Exercise of options (1995-1996 plans) 27,112 46,678,534 € 233,392,670 € 460,757<br />

(1)<br />

Convertible bond issue - April 1994-3.75 % - represented by 2,930,385 bonds of FRF 670 nominal value.<br />

(2)<br />

Issue of 2,081,500 warrants allocated to subscribers to the increase in share capital decided by the Board of Directors on April 22, 1999 under delegated powers from the General Meeting of<br />

the same date. These warrants may be exercised until May 11, 2004, at the price of 130 euros for each UNIBAIL share in exchange for 5 warrants (see above new exercise ratio since June <strong>2001</strong>).<br />

(3)<br />

The conversion of the Company’s share capital into euros was accompanied by a three-for-one share split on June 13, <strong>2001</strong>. Following this conversion and share split, the nominal value of each<br />

share was set at € 5.<br />

73