2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NET ASSET VALUE<br />

The Shopping Center Portfolio<br />

The value of <strong>Unibail</strong>’s shopping center portfolio is derived from the<br />

combination of the individual assets and not as a single entity.<br />

Accordingly, no value is placed on <strong>Unibail</strong>’s market share, even<br />

though this notion has a value in this sector.<br />

For each shopping center, the valuation methodology used by<br />

Healey & Baker involves capitalizing rental income net of charges,<br />

i.e. after taking into account a standard vacancy rate, management<br />

fees, administration costs, non-refundable expenses, letting fees,<br />

unpaid rents, litigation costs and provisions for maintenance works.<br />

The valuation is based on the situation at year-end <strong>2001</strong>.<br />

The valuation also takes into account: i) any future rental gains<br />

generated by the letting of vacant space (subject to a minimum<br />

standard vacancy rate); ii) any increase in rental income due to step<br />

rents; and iii) the renewal of leases due to expire in the near future.<br />

At year-end <strong>2001</strong>, Healey & Baker had valued 93% of <strong>Unibail</strong>’s<br />

shopping center portfolio. The remaining 7% mainly comprises the<br />

Carré Sénart shopping center and La Colline de La Défense, both at<br />

their book value recorded in the accounts as at year-end <strong>2001</strong>.<br />

The value of these assets rose by as much as € 146m, or 9.1%, on a<br />

like-for-like basis. Of this, 8.4% stems from the growth in annualized<br />

rental income, while only 0.7% is due to the decline in initial yields.<br />

The rental increase for signed leases stems from the combined<br />

impact of rent indexation (2.8%) and letting activities (5.6%).<br />

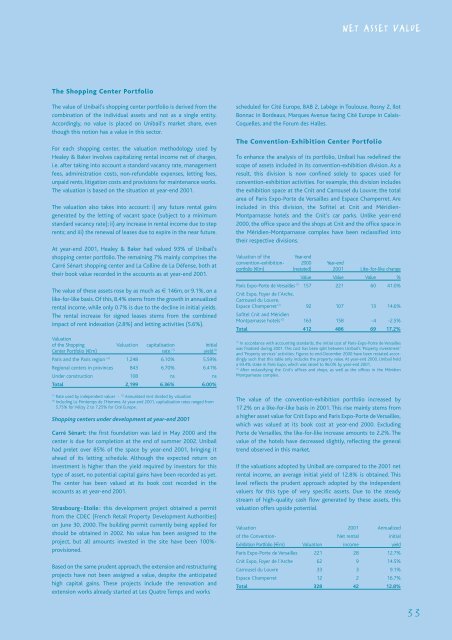

Valuation<br />

of the Shopping Valuation capitalisation Initial<br />

Center Portfolio (€m) rate (1) yield (2)<br />

Paris and the Paris region (3) 1,248 6.10% 5.59%<br />

Regional centers in provinces 843 6.70% 6.41%<br />

Under construction 108 ns ns<br />

Total 2,199 6.36% 6.00%<br />

(1)<br />

Rate used by independent valuer - (2) <strong>Annual</strong>ized rent divided by valuation<br />

(3)<br />

Including Le Printemps de l'Homme. At year-end <strong>2001</strong>, capitalization rates ranged from<br />

5.75% for Vélizy 2 to 7.25% for Cité Europe.<br />

Shopping centers under development at year-end <strong>2001</strong><br />

Carré Sénart: the first foundation was laid in May 2000 and the<br />

center is due for completion at the end of summer 2002. <strong>Unibail</strong><br />

had prelet over 85% of the space by year-end <strong>2001</strong>, bringing it<br />

ahead of its letting schedule. Although the expected return on<br />

investment is higher than the yield required by investors for this<br />

type of asset, no potential capital gains have been recorded as yet.<br />

The center has been valued at its book cost recorded in the<br />

accounts as at year-end <strong>2001</strong>.<br />

Strasbourg - Etoile : this development project obtained a permit<br />

from the CDEC (French Retail Property Development Authorities)<br />

on June 30, 2000. The building permit currently being applied for<br />

should be obtained in 2002. No value has been assigned to the<br />

project, but all amounts invested in the site have been 100%-<br />

provisioned.<br />

Based on the same prudent approach, the extension and restructuring<br />

projects have not been assigned a value, despite the anticipated<br />

high capital gains. These projects include the renovation and<br />

extension works already started at Les Quatre Temps and works<br />

scheduled for Cité Europe, BAB 2, Labège in Toulouse, Rosny 2, Ilot<br />

Bonnac in Bordeaux, Marques Avenue facing Cité Europe in Calais-<br />

Coquelles, and the Forum des Halles.<br />

The Convention-Exhibition Center Portfolio<br />

To enhance the analysis of its portfolio, <strong>Unibail</strong> has redefined the<br />

scope of assets included in its convention-exhibition division. As a<br />

result, this division is now confined solely to spaces used for<br />

convention-exhibition activities. For example, this division includes<br />

the exhibition space at the Cnit and Carrousel du Louvre; the total<br />

area of Paris Expo-Porte de Versailles and Espace Champerret. Are<br />

included in this division, the Sofitel at Cnit and Méridien-<br />

Montparnasse hotels and the Cnit’s car parks. Unlike year-end<br />

2000, the office space and the shops at Cnit and the office space in<br />

the Méridien-Montparnasse complex have been reclassified into<br />

their respective divisions.<br />

Valuation of the Year-end<br />

convention-exhibition- 2000 Year-end<br />

portfolio (€m) (restated) <strong>2001</strong> Like-for-like change<br />

Value Value Value %<br />

Paris Expo-Porte de Versailles (1) 157 221 60 41.0%<br />

Cnit Expo, Foyer de l’Arche,<br />

Carrousel du Louvre,<br />

Espace Champerret (2) 92 107 13 14.6%<br />

Sofitel Cnit and Méridien<br />

Montparnasse hotels (2) 163 158 -4 -2.5%<br />

Total 412 486 69 17.2%<br />

(1)<br />

In accordance with accounting standards, the initial cost of Paris-Expo-Porte de Versailles<br />

was finalized during <strong>2001</strong>. This cost has been split between <strong>Unibail</strong>’s ‘Property investment’<br />

and ‘Property services’ activities. Figures to end-December 2000 have been restated accordingly<br />

such that this table only includes the property value. At year-end 2000, <strong>Unibail</strong> held<br />

a 93.4% stake in Paris Expo, which was raised to 96.0% by year-end <strong>2001</strong>.<br />

(2)<br />

After reclassifying the Cnit’s offices and shops, as well as the offices in the Méridien<br />

Montparnasse complex.<br />

The value of the convention-exhibition portfolio increased by<br />

17.2% on a like-for-like basis in <strong>2001</strong>. This rise mainly stems from<br />

a higher asset value for Cnit Expo and Paris Expo-Porte de Versailles,<br />

which was valued at its book cost at year-end 2000. Excluding<br />

Porte de Versailles, the like-for-like increase amounts to 2.2%. The<br />

value of the hotels have decreased slightly, reflecting the general<br />

trend observed in this market.<br />

If the valuations adopted by <strong>Unibail</strong> are compared to the <strong>2001</strong> net<br />

rental income, an average initial yield of 12.8% is obtained. This<br />

level reflects the prudent approach adopted by the independent<br />

valuers for this type of very specific assets. Due to the steady<br />

stream of high-quality cash flow generated by these assets, this<br />

valuation offers upside potential.<br />

Valuation <strong>2001</strong> <strong>Annual</strong>ized<br />

of the Convention- Net rental initial<br />

Exhibition Portfolio (€m) Valuation income yield<br />

Paris Expo-Porte de Versailles 221 28 12.7%<br />

Cnit Expo, Foyer de l’Arche 62 9 14.5%<br />

Carrousel du Louvre 33 3 9.1%<br />

Espace Champerret 12 2 16.7%<br />

Total 328 42 12.8%<br />

33