2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CONSOLIDATED FINANCIAL STATEMENTS<br />

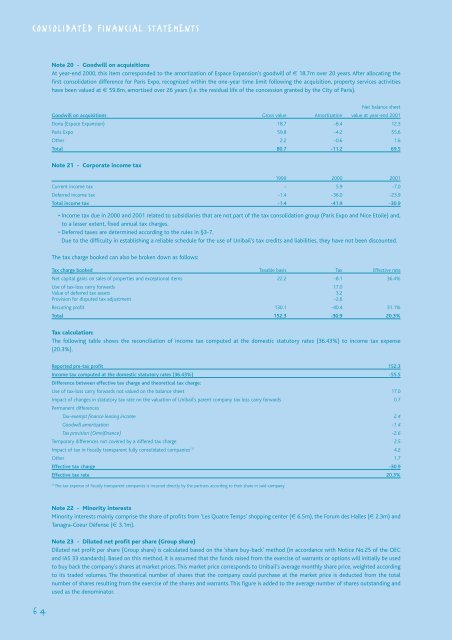

Note 20 - Goodwill on acquisitions<br />

At year-end 2000, this item corresponded to the amortization of Espace Expansion’s goodwill of € 18.7m over 20 years. After allocating the<br />

first consolidation difference for Paris Expo, recognized within the one-year time limit following the acquisition, property services activities<br />

have been valued at € 59.8m, amortized over 26 years (i.e. the residual life of the concession granted by the City of Paris).<br />

Net balance sheet<br />

Goodwill on acquisitions Gross value Amortization value at year-end <strong>2001</strong><br />

Doria (Espace Expansion) 18.7 -6.4 12.3<br />

Paris Expo 59.8 -4.2 55.6<br />

Other 2.2 -0.6 1.6<br />

Total 80.7 -11.2 69.5<br />

Note 21 - Corporate income tax<br />

1999 2000 <strong>2001</strong><br />

Current income tax - 5.9 -7.0<br />

Deferred income tax -1.4 -36.0 -23.9<br />

Total income tax -1.4 -41.9 -30.9<br />

• Income tax due in 2000 and <strong>2001</strong> related to subsidiaries that are not part of the tax consolidation group (Paris Expo and Nice Etoile) and,<br />

to a lesser extent, fixed annual tax charges.<br />

• Deferred taxes are determined according to the rules in §3-7.<br />

Due to the difficulty in establishing a reliable schedule for the use of <strong>Unibail</strong>’s tax credits and liabilities, they have not been discounted.<br />

The tax charge booked can also be broken down as follows:<br />

Tax charge booked Taxable basis Tax Effective rate<br />

Net capital gains on sales of properties and exceptional items 22.2 -8.1 36.4%<br />

Use of tax-loss carry forwards 17.0<br />

Value of deferred tax assets 3.2<br />

Provision for disputed tax adjustment -2.6<br />

Recurring profit 130.1 -40.4 31.1%<br />

Total 152.3 -30.9 20.3%<br />

Tax calculation:<br />

The following table shows the reconciliation of income tax computed at the domestic statutory rates (36.43%) to income tax expense<br />

(20.3%).<br />

<strong>Report</strong>ed pre-tax profit 152.3<br />

Income tax computed at the domestic statutory rates (36.43%) -55.5<br />

Difference between effective tax charge and theoretical tax charge:<br />

Use of tax-loss carry forwards not valued on the balance sheet 17.0<br />

Impact of changes in statutory tax rate on the valuation of <strong>Unibail</strong>’s parent company tax loss carry forwards 0.7<br />

Permanent differences<br />

Tax-exempt finance leasing income 2.4<br />

Goodwill amortization -1.4<br />

Tax provision (Omnifinance) -2.6<br />

Temporary differences not covered by a differed tax charge 2.5<br />

Impact of tax in fiscally transparent fully consolidated companies (1) 4.2<br />

Other 1.7<br />

Effective tax charge -30.9<br />

Effective tax rate 20.3%<br />

(1)<br />

The tax expense of fiscally transparent companies is incurred directly by the partners according to their share in said-company.<br />

Note 22 - Minority interests<br />

Minority interests mainly comprise the share of profits from 'Les Quatre Temps' shopping center (€ 6.5m), the Forum des Halles (€ 2.3m) and<br />

Tanagra-Coeur Défense (€ 3.1m).<br />

64<br />

Note 23 - Diluted net profit per share (Group share)<br />

Diluted net profit per share (Group share) is calculated based on the ‘share buy-back’ method (in accordance with Notice No.25 of the OEC<br />

and IAS 33 standards). Based on this method, it is assumed that the funds raised from the exercise of warrants or options will initially be used<br />

to buy back the company’s shares at market prices.This market price corresponds to <strong>Unibail</strong>’s average monthly share price, weighted according<br />

to its traded volumes. The theoretical number of shares that the company could purchase at the market price is deducted from the total<br />

number of shares resulting from the exercise of the shares and warrants. This figure is added to the average number of shares outstanding and<br />

used as the denominator.