FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

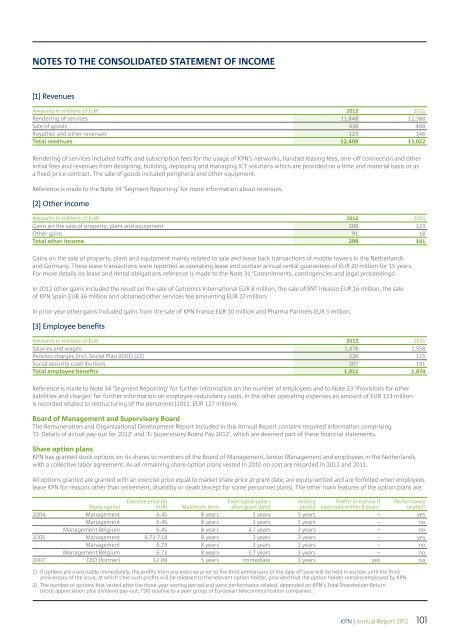

NOTES TO THE CONSOLIDATED STATEMENT OF INCOME<br />

[1] Revenues<br />

Amounts in millions of EUR 2012 2011<br />

Rendering of services 11,848 12,388<br />

Sale of goods 438 488<br />

Royalties and other revenues 123 146<br />

Total revenues 12,409 13,022<br />

Rendering of services included traffic and subscription fees for the usage of <strong>KPN</strong>’s networks, handset leasing fees, one-off connection and other<br />

initial fees and revenues from designing, building, deploying and managing ICT solutions which are provided on a time and material basis or as<br />

a fixed-price contract. The sale of goods included peripheral and other equipment.<br />

Reference is made to the Note 34 ‘Segment Reporting’ for more information about revenues.<br />

[2] Other income<br />

Amounts in millions of EUR 2012 2011<br />

Gains on the sale of property, plant and equipment 208 123<br />

Other gains 91 18<br />

Total other income 299 141<br />

Gains on the sale of property, plant and equipment mainly related to sale and lease back transactions of mobile towers in the Netherlands<br />

and Germany. These lease transactions were reported as operating lease and contain annual rental guarantees of EUR 20 million for 15 years.<br />

For more details on lease and rental obligations reference is made to the Note 31 ‘Commitments, contingencies and legal proceedings‘.<br />

In 2012 other gains included the result on the sale of Getronics International EUR 8 million, the sale of SNT Inkasso EUR 16 million, the sale<br />

of <strong>KPN</strong> Spain EUR 36 million and obtained other services fee amounting EUR 27 million.<br />

In prior year other gains included gains from the sale of <strong>KPN</strong> France EUR 10 million and Pharma Partners EUR 5 million.<br />

[3] Employee benefits<br />

Amounts in millions of EUR 2012 2011<br />

Salaries and wages 1,478 1,558<br />

Pension charges (incl. Social Plan 2001) [22] 226 125<br />

Social security contributions 207 191<br />

Total employee benefits 1,911 1,874<br />

Reference is made to Note 34 ‘Segment Reporting’ for further information on the number of employees and to Note 23 ‘Provisions for other<br />

liabilities and charges’ for further information on employee redundancy costs. In the other operating expenses an amount of EUR 123 million<br />

is recorded related to restructuring of the personnel (2011: EUR 127 million).<br />

Board of Management and Supervisory Board<br />

The Remuneration and Organizational Development Report included in this Annual Report contains required information comprising<br />

‘D: Details of actual pay-out for 2012’ and ‘E: Supervisory Board Pay 2012’, which are deemed part of these financial statements.<br />

Share option plans<br />

<strong>KPN</strong> has granted stock options on its shares to members of the Board of Management, Senior Management and employees in the Netherlands<br />

with a collective labor agreement. As all remaining share option plans vested in 2010 no cost are recorded in 2012 and 2011.<br />

All options granted are granted with an exercise price equal to market share price at grant date, are equity-settled and are forfeited when employees<br />

leave <strong>KPN</strong> for reasons other than retirement, disability or death (except for some personnel plans). The other main features of the option plans are:<br />

Exercise price (in<br />

EUR) Maximum term<br />

Exercisable (years<br />

after grant date)<br />

Vesting<br />

period<br />

Profits in escrow if<br />

exercised within 3 years 1<br />

Performance<br />

related 2<br />

Share capital<br />

2004 Management 6.45 8 years 3 years 3 years – yes<br />

Management 6.45 8 years 3 years 3 years – no<br />

Management Belgium 6.45 8 years 3.7 years 3 years – no<br />

2005 Management 6.73-7.18 8 years 3 years 3 years – yes<br />

Management 6.73 8 years 3 years 3 years – no<br />

Management Belgium 6.73 8 years 3.7 years 3 years – no<br />

2007 CEO (former) 12.09 5 years immediate 3 years yes no<br />

1) If options are exercisable immediately, the profits from any exercise prior to the third anniversary of the date of issue will be held in escrow until the third<br />

anniversary of the issue, at which time such profits will be released to the relevant option holder, provided that the option holder remains employed by <strong>KPN</strong>.<br />

2) The number of options that vested after the three-year vesting period and were performance related, depended on <strong>KPN</strong>’s Total Shareholder Return<br />

(stock appreciation plus dividend pay-out; TSR) relative to a peer group of European telecommunication companies.<br />

<strong>KPN</strong> | Annual Report 2012 101