FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated Financial Statements<br />

Notes to the Consolidated Statement of Income continued<br />

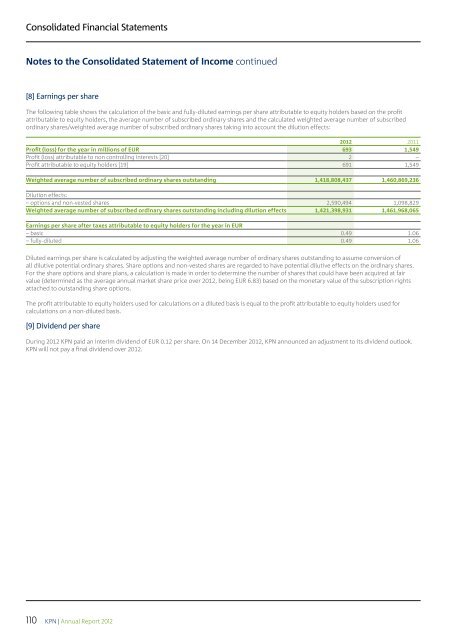

[8] Earnings per share<br />

The following table shows the calculation of the basic and fully-diluted earnings per share attributable to equity holders based on the profit<br />

attributable to equity holders, the average number of subscribed ordinary shares and the calculated weighted average number of subscribed<br />

ordinary shares/weighted average number of subscribed ordinary shares taking into account the dilution effects:<br />

2012 2011<br />

Profit (loss) for the year in millions of EUR 693 1,549<br />

Profit (loss) attributable to non controlling Interests [20] 2 –<br />

Profit attributable to equity holders [19] 691 1,549<br />

Weighted average number of subscribed ordinary shares outstanding 1,418,808,437 1,460,869,236<br />

Dilution effects:<br />

– options and non-vested shares 2,590,494 1,098,829<br />

Weighted average number of subscribed ordinary shares outstanding including dilution effects 1,421,398,931 1,461,968,065<br />

Earnings per share after taxes attributable to equity holders for the year in EUR<br />

– basic 0.49 1.06<br />

– fully-diluted 0.49 1.06<br />

Diluted earnings per share is calculated by adjusting the weighted average number of ordinary shares outstanding to assume conversion of<br />

all dilutive potential ordinary shares. Share options and non-vested shares are regarded to have potential dilutive effects on the ordinary shares.<br />

For the share options and share plans, a calculation is made in order to determine the number of shares that could have been acquired at fair<br />

value (determined as the average annual market share price over 2012, being EUR 6.83) based on the monetary value of the subscription rights<br />

attached to outstanding share options.<br />

The profit attributable to equity holders used for calculations on a diluted basis is equal to the profit attributable to equity holders used for<br />

calculations on a non-diluted basis.<br />

[9] Dividend per share<br />

During 2012 <strong>KPN</strong> paid an interim dividend of EUR 0.12 per share. On 14 December 2012, <strong>KPN</strong> announced an adjustment to its dividend outlook.<br />

<strong>KPN</strong> will not pay a final dividend over 2012.<br />

110<br />

<strong>KPN</strong> | Annual Report 2012