FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated Financial Statements<br />

Other Notes to the Consolidated Financial Statements continued<br />

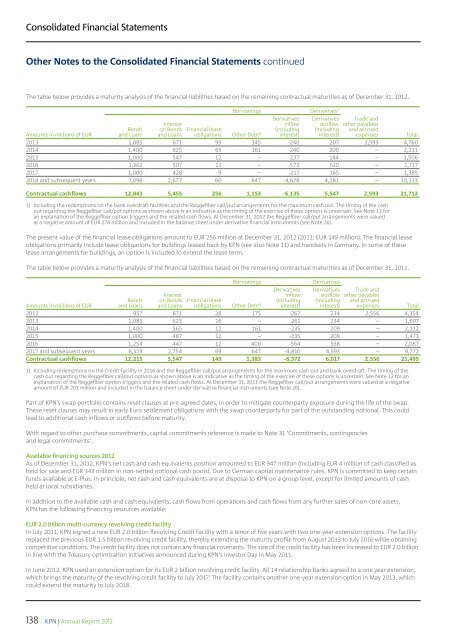

The table below provides a maturity analysis of the financial liabilities based on the remaining contractual maturities as of December 31, 2012.<br />

Other Debt 1 Amounts in millions of EUR<br />

and Loan 1 and Loans<br />

interest) interest) expenses<br />

Total<br />

Derivatives Derivatives<br />

Borrowings Derivatives 1<br />

Interest<br />

inflow<br />

Trade and<br />

outflow other payables<br />

Bonds on Bonds Financial lease<br />

obligations<br />

(including (including and accrued<br />

2013 1,085 671 99 345 -240 207 2,593 4,760<br />

2014 1,400 625 65 161 -240 200 – 2,211<br />

2015 1,000 547 12 – -237 184 – 1,506<br />

2016 1,262 507 11 – -573 510 – 1,717<br />

2017 1,000 428 9 – -217 165 – 1,385<br />

2018 and subsequent years 7,096 2,677 60 647 -4,628 4,281 – 10,133<br />

Contractual cashflows 12,843 5,455 256 1,153 -6,135 5,547 2,593 21,712<br />

1) Including the redemptions on the bank overdraft facilities and the Reggefiber call/put arrangements for the maximum cash out. The timing of the cash<br />

out regarding the Reggefiber call/put options as shown above is an indicative as the timing of the exercise of these options is uncertain. See Note 12 for<br />

an explanation of the Reggefiber option triggers and the related cash flows. At December 31, 2012 the Reggefiber call/put arrangements were valued<br />

at a negative amount of EUR 278 million and included in the balance sheet under derivative financial instruments (see Note 26).<br />

The present value of the financial lease obligations amount to EUR 256 million at December 31, 2012 (2011: EUR 149 million). The financial lease<br />

obligations primarily include lease obligations for buildings leased back by <strong>KPN</strong> (see also Note 11) and handsets in Germany. In some of these<br />

lease arrangements for buildings, an option is included to extend the lease term.<br />

The table below provides a maturity analysis of the financial liabilities based on the remaining contractual maturities as of December 31, 2011.<br />

Other Debt 1<br />

Borrowings<br />

Derivatives<br />

Amounts in millions of EUR and Loans and Loans<br />

interest) interest) expenses<br />

Total<br />

Derivatives Derivatives Trade and<br />

Interest<br />

inflow outflow other payables<br />

Bonds on Bonds Financial lease<br />

obligations<br />

(including (including and accrued<br />

2012 957 671 28 175 -267 234 2,556 4,354<br />

2013 1,085 623 16 – -261 234 – 1,697<br />

2014 1,400 565 12 161 -235 209 – 2,112<br />

2015 1,000 487 12 – -235 209 – 1,473<br />

2016 1,254 447 12 400 -564 538 – 2,087<br />

2017 and subsequent years 6,519 2,754 69 647 -4,810 4,593 – 9,772<br />

Contractual cashflows 12,215 5,547 149 1,383 -6,372 6,017 2,556 21,495<br />

1) Including redemptions on the Credit Facility in 2016 and the Reggefiber call/put arrangements for the maximum cash out and bank overdraft. The timing of the<br />

cash out regarding the Reggefiber call/put options as shown above is an indicative as the timing of the exercise of these options is uncertain. See Note 12 for an<br />

explanation of the Reggefiber option triggers and the related cash flows. At December 31, 2011 the Reggefiber call/put arrangements were valued at a negative<br />

amount of EUR 203 million and included in the balance sheet under derivative financial instruments (see Note 26).<br />

Part of <strong>KPN</strong>’s swap portfolio contains reset clauses at pre-agreed dates, in order to mitigate counterparty exposure during the life of the swap.<br />

These reset clauses may result in early Euro settlement obligations with the swap counterparty for part of the outstanding notional. This could<br />

lead to additional cash inflows or outflows before maturity.<br />

With regard to other purchase commitments, capital commitments reference is made to Note 31 ‘Commitments, contingencies<br />

and legal commitments’.<br />

Available financing sources 2012<br />

As of December 31, 2012, <strong>KPN</strong>’s net cash and cash equivalents position amounted to EUR 947 million (including EUR 4 million of cash classified as<br />

held for sale and EUR 343 million in non-netted notional cash pools). Due to German capital maintenance rules, <strong>KPN</strong> is committed to keep certain<br />

funds available at E-Plus. In principle, net cash and cash equivalents are at disposal to <strong>KPN</strong> on a group level, except for limited amounts of cash<br />

held at local subsidiaries.<br />

In addition to the available cash and cash equivalents, cash flows from operations and cash flows from any further sales of non-core assets,<br />

<strong>KPN</strong> has the following financing resources available:<br />

EUR 2.0 billion multi-currency revolving credit facility<br />

In July 2011, <strong>KPN</strong> signed a new EUR 2.0 billion Revolving Credit Facility with a tenor of five years with two one-year extension options. The facility<br />

replaced the previous EUR 1.5 billion revolving credit facility, thereby extending the maturity profile from August 2013 to July 2016 while obtaining<br />

competitive conditions. The credit facility does not contain any financial covenants. The size of the credit facility has been increased to EUR 2.0 billion<br />

in line with the Treasury optimization initiatives announced during <strong>KPN</strong>’s Investor Day in May 2011.<br />

In June 2012, <strong>KPN</strong> used an extension option for its EUR 2 billion revolving credit facility. All 14 relationship banks agreed to a one year extension,<br />

which brings the maturity of the revolving credit facility to July 2017. The facility contains another one-year extension option in May 2013, which<br />

could extend the maturity to July 2018.<br />

138<br />

<strong>KPN</strong> | Annual Report 2012