FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated Financial Statements<br />

Notes to the Consolidated Statement of Financial Position continued<br />

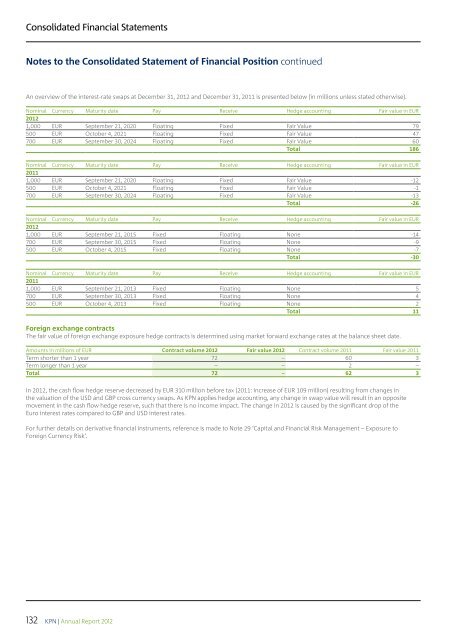

An overview of the interest-rate swaps at December 31, 2012 and December 31, 2011 is presented below (in millions unless stated otherwise).<br />

Nominal Currency Maturity date Pay Receive Hedge accounting Fair value in EUR<br />

2012<br />

1,000 EUR September 21, 2020 Floating Fixed Fair Value 79<br />

500 EUR October 4, 2021 Floating Fixed Fair Value 47<br />

700 EUR September 30, 2024 Floating Fixed Fair Value 60<br />

Total 186<br />

Nominal Currency Maturity date Pay Receive Hedge accounting Fair value in EUR<br />

2011<br />

1,000 EUR September 21, 2020 Floating Fixed Fair Value -12<br />

500 EUR October 4, 2021 Floating Fixed Fair Value -1<br />

700 EUR September 30, 2024 Floating Fixed Fair Value -13<br />

Total -26<br />

Nominal Currency Maturity date Pay Receive Hedge accounting Fair value in EUR<br />

2012<br />

1,000 EUR September 21, 2015 Fixed Floating None -14<br />

700 EUR September 30, 2015 Fixed Floating None -9<br />

500 EUR October 4, 2015 Fixed Floating None -7<br />

Total -30<br />

Nominal Currency Maturity date Pay Receive Hedge accounting Fair value in EUR<br />

2011<br />

1,000 EUR September 21, 2013 Fixed Floating None 5<br />

700 EUR September 30, 2013 Fixed Floating None 4<br />

500 EUR October 4, 2013 Fixed Floating None 2<br />

Total 11<br />

Foreign exchange contracts<br />

The fair value of foreign exchange exposure hedge contracts is determined using market forward exchange rates at the balance sheet date.<br />

Amounts in millions of EUR Contract volume 2012 Fair value 2012 Contract volume 2011 Fair value 2011<br />

Term shorter than 1 year 72 – 60 3<br />

Term longer than 1 year – – 2 –<br />

Total 72 – 62 3<br />

In 2012, the cash flow hedge reserve decreased by EUR 310 million before tax (2011: increase of EUR 109 million) resulting from changes in<br />

the valuation of the USD and GBP cross currency swaps. As <strong>KPN</strong> applies hedge accounting, any change in swap value will result in an opposite<br />

movement in the cash flow hedge reserve, such that there is no income impact. The change in 2012 is caused by the significant drop of the<br />

Euro interest rates compared to GBP and USD interest rates.<br />

For further details on derivative financial instruments, reference is made to Note 29 ‘Capital and Financial Risk Management – Exposure to<br />

Foreign Currency Risk’.<br />

132<br />

<strong>KPN</strong> | Annual Report 2012