FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fair value hedges<br />

As of December 31, 2012, <strong>KPN</strong> carried out a sensitivity analysis with regard to interest rate risk on the fair value hedges. <strong>KPN</strong> applies fair value<br />

hedge accounting on Euro-denominated bonds that are swapped from fixed rate to a floating rate. With all other variables held constant,<br />

<strong>KPN</strong> calculated the hypothetical impact of changes in interest rates based on various scenarios. The expected impact on the cash flow statement<br />

and the income statement is immaterial, since the hedges are expected to be highly effective. This results in minimal hedge ineffectiveness<br />

and P&L volatility.<br />

Derivatives held at fair value<br />

As of December 31, 2012, <strong>KPN</strong> carried out a sensitivity analysis with regard to the interest rate swaps for which no hedge accounting is applied.<br />

All changes in interest rates and resulting sensitivities have only profit & loss impact and no cash flow impact.<br />

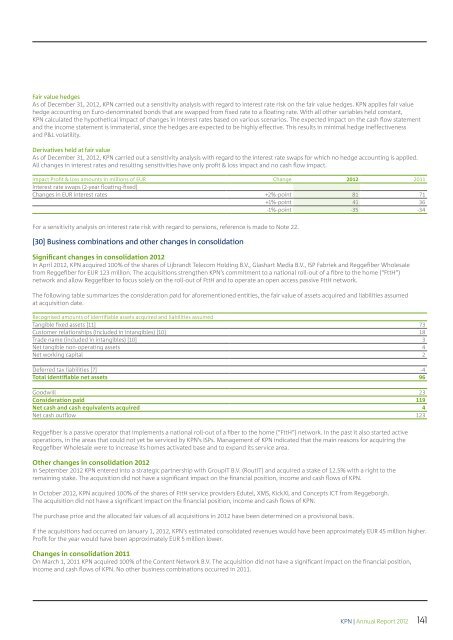

Impact Profit & loss amounts in millions of EUR Change 2012 2011<br />

Interest rate swaps (2-year floating-fixed)<br />

Changes in EUR interest rates +2%-point 81 71<br />

+1%-point 41 36<br />

-1%-point -35 -34<br />

For a sensitivity analysis on interest rate risk with regard to pensions, reference is made to Note 22.<br />

[30] Business combinations and other changes in consolidation<br />

Significant changes in consolidation 2012<br />

In April 2012, <strong>KPN</strong> acquired 100% of the shares of Lijbrandt Telecom Holding B.V., Glashart Media B.V., ISP Fabriek and Reggefiber Wholesale<br />

from Reggefiber for EUR 123 million. The acquisitions strengthen <strong>KPN</strong>’s commitment to a national roll-out of a fibre to the home (“FttH”)<br />

network and allow Reggefiber to focus solely on the roll-out of FttH and to operate an open access passive FttH network.<br />

The following table summarizes the consideration paid for aforementioned entities, the fair value of assets acquired and liabilities assumed<br />

at acquisition date.<br />

Recognised amounts of identifiable assets acquired and liabilities assumed<br />

Tangible fixed assets [11] 73<br />

Customer relationships (included in intangibles) [10] 18<br />

Trade name (included in intangibles) [10] 3<br />

Net tangible non-operating assets 4<br />

Net working capital 2<br />

Deferred tax liabilities [7] -4<br />

Total identifiable net assets 96<br />

Goodwill 23<br />

Consideration paid 119<br />

Net cash and cash equivalents acquired 4<br />

Net cash outflow 123<br />

Reggefiber is a passive operator that implements a national roll-out of a fiber to the home (“FttH”) network. In the past it also started active<br />

operations, in the areas that could not yet be serviced by <strong>KPN</strong>’s ISPs. Management of <strong>KPN</strong> indicated that the main reasons for acquiring the<br />

Reggefiber Wholesale were to increase its homes activated base and to expand its service area.<br />

Other changes in consolidation 2012<br />

In September 2012 <strong>KPN</strong> entered into a strategic partnership with GroupIT B.V. (RoutIT) and acquired a stake of 12.5% with a right to the<br />

remaining stake. The acquisition did not have a significant impact on the financial position, income and cash flows of <strong>KPN</strong>.<br />

In October 2012, <strong>KPN</strong> acquired 100% of the shares of FttH service providers Edutel, XMS, KickXL and Concepts ICT from Reggeborgh.<br />

The acquisition did not have a significant impact on the financial position, income and cash flows of <strong>KPN</strong>.<br />

The purchase price and the allocated fair values of all acquisitions in 2012 have been determined on a provisional basis.<br />

If the acquisitions had occurred on January 1, 2012, <strong>KPN</strong>’s estimated consolidated revenues would have been approximately EUR 45 million higher.<br />

Profit for the year would have been approximately EUR 5 million lower.<br />

Changes in consolidation 2011<br />

On March 1, 2011 <strong>KPN</strong> acquired 100% of the Content Network B.V. The acquisition did not have a significant impact on the financial position,<br />

income and cash flows of <strong>KPN</strong>. No other business combinations occurred in 2011.<br />

<strong>KPN</strong> | Annual Report 2012 141