FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated Financial Statements<br />

Notes to the Consolidated Statement of Income continued<br />

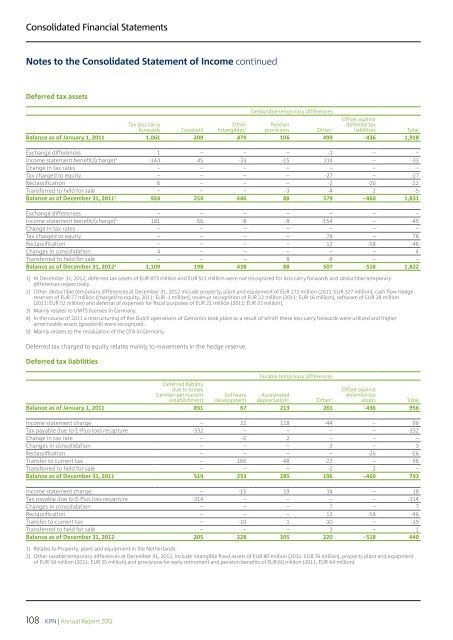

Deferred tax assets<br />

Deductible temporary differences<br />

forwards Goodwill intangibles 3<br />

liabilities Total<br />

Offset against<br />

Tax loss carry<br />

Other Pension<br />

provisions Other 2 deferred tax<br />

Balance as of January 1, 2011 1,061 209 479 106 499 -436 1,918<br />

Exchange differences 1 – – – -1 – −<br />

Income statement benefit/(charge) 4 -144 45 -33 -15 114 – -33<br />

Change in tax rates – – – – – – –<br />

Tax charged to equity – – – – -27 – -27<br />

Reclassification 6 – – – -2 -26 -22<br />

Transferred to held for sale – – – -3 -4 2 -5<br />

Balance as of December 31, 2011 1 924 254 446 88 579 −460 1,831<br />

Exchange differences – – – – – – –<br />

Income statement benefit/(charge) 5 181 -56 -8 -8 -154 – -45<br />

Change in tax rates – – – – – – –<br />

Tax charged to equity – – – – 78 – 78<br />

Reclassification – – – – 12 -58 -46<br />

Changes in consolidation 4 – – – – – 4<br />

Transferred to held for sale – – – 8 -8 – –<br />

Balance as of December 31, 2012 1 1,109 198 438 88 507 -518 1,822<br />

1) At December 31, 2012, deferred tax assets of EUR 873 million and EUR 511 million were not recognized for loss carry forwards and deductible temporary<br />

differences respectively.<br />

2) Other deductible temporary differences at December 31, 2012 include property, plant and equipment of EUR 272 million (2011: EUR 327 million), cash flow hedge<br />

reserves of EUR 77 million (charged to equity, 2011: EUR -1 million), revenue recognition of EUR 22 million (2011: EUR 16 million), software of EUR 28 million<br />

(2011: EUR 52 million) and deferral of expenses for fiscal purposes of EUR 21 million (2011: EUR 33 million).<br />

3) Mainly relates to UMTS licenses in Germany.<br />

4) In the course of 2011 a restructuring of the Dutch operations of Getronics took place as a result of which these loss carry forwards were utilized and higher<br />

amortizable assets (goodwill) were recognized.<br />

5) Mainly relates to the revaluation of the DTA in Germany.<br />

Deferred tax charged to equity relates mainly to movements in the hedge reserve.<br />

Deferred tax liabilities<br />

Taxable temporary differences<br />

Deferred liability<br />

due to losses<br />

German permanent<br />

establishment<br />

Software<br />

development<br />

Accelerated<br />

depreciation 1 Other 2 Offset against<br />

deferred tax<br />

assets Total<br />

Balance as of January 1, 2011 851 67 213 261 -436 956<br />

Income statement charge – 22 118 -44 – 96<br />

Tax payable due to E-Plus loss recapture -332 – – – – -332<br />

Change in tax rate – −2 2 − – –<br />

Changes in consolidation – – – 3 – 3<br />

Reclassification – – – – -26 -26<br />

Transfer to current tax – 166 -48 -22 – 96<br />

Transferred to held for sale – – – -2 2 –<br />

Balance as of December 31, 2011 519 253 285 196 −460 793<br />

Income statement charge – -15 19 14 – 18<br />

Tax payable due to E-Plus loss recapture -314 – – – – -314<br />

Changes in consolidation – – – 7 – 7<br />

Reclassification – – – 12 -58 -46<br />

Transfer to current tax – -10 1 -10 – -19<br />

Transferred to held for sale – – – 1 – 1<br />

Balance as of December 31, 2012 205 228 305 220 –518 440<br />

1) Relates to Property, plant and equipment in the Netherlands.<br />

2) Other taxable temporary differences at December 31, 2012, include intangible fixed assets of EUR 80 million (2011: EUR 76 million), property plant and equipment<br />

of EUR 58 million (2011: EUR 35 million) and provisions for early retirement and pension benefits of EUR 60 million (2011: EUR 64 million).<br />

108<br />

<strong>KPN</strong> | Annual Report 2012