FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated Financial Statements<br />

Notes to the Consolidated Statement of Financial Position continued<br />

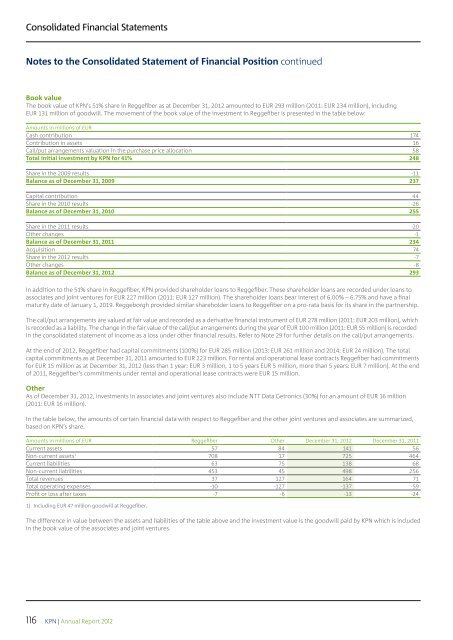

Book value<br />

The book value of <strong>KPN</strong>’s 51% share in Reggefiber as at December 31, 2012 amounted to EUR 293 million (2011: EUR 234 million), including<br />

EUR 131 million of goodwill. The movement of the book value of the investment in Reggefiber is presented in the table below:<br />

Amounts in millions of EUR<br />

Cash contribution 174<br />

Contribution in assets 16<br />

Call/put arrangements valuation in the purchase price allocation 58<br />

Total initial investment by <strong>KPN</strong> for 41% 248<br />

Share in the 2009 results -11<br />

Balance as of December 31, 2009 237<br />

Capital contribution 44<br />

Share in the 2010 results -26<br />

Balance as of December 31, 2010 255<br />

Share in the 2011 results -20<br />

Other changes -1<br />

Balance as of December 31, 2011 234<br />

Acquisition 74<br />

Share in the 2012 results -7<br />

Other changes -8<br />

Balance as of December 31, 2012 293<br />

In addition to the 51% share in Reggefiber, <strong>KPN</strong> provided shareholder loans to Reggefiber. These shareholder loans are recorded under loans to<br />

associates and joint ventures for EUR 227 million (2011: EUR 127 million). The shareholder loans bear interest of 6.00% – 6.75% and have a final<br />

maturity date of January 1, 2019. Reggeborgh provided similar shareholder loans to Reggefiber on a pro-rata basis for its share in the partnership.<br />

The call/put arrangements are valued at fair value and recorded as a derivative financial instrument of EUR 278 million (2011: EUR 203 million), which<br />

is recorded as a liability. The change in the fair value of the call/put arrangements during the year of EUR 100 million (2011: EUR 55 million) is recorded<br />

in the consolidated statement of income as a loss under other financial results. Refer to Note 29 for further details on the call/put arrangements.<br />

At the end of 2012, Reggefiber had capital commitments (100%) for EUR 285 million (2013: EUR 261 million and 2014: EUR 24 million). The total<br />

capital commitments as at December 31, 2011 amounted to EUR 223 million. For rental and operational lease contracts Reggefiber had commitments<br />

for EUR 15 million as at December 31, 2012 (less than 1 year: EUR 3 million, 1 to 5 years EUR 5 million, more than 5 years: EUR 7 million). At the end<br />

of 2011, Reggefiber’s commitments under rental and operational lease contracts were EUR 15 million.<br />

Other<br />

As of December 31, 2012, investments in associates and joint ventures also include NTT Data Getronics (30%) for an amount of EUR 16 million<br />

(2011: EUR 16 million).<br />

In the table below, the amounts of certain financial data with respect to Reggefiber and the other joint ventures and associates are summarized,<br />

based on <strong>KPN</strong>’s share.<br />

Amounts in millions of EUR Reggefiber Other December 31, 2012 December 31, 2011<br />

Current assets 57 84 141 56<br />

Non-current assets 1 708 17 725 464<br />

Current liabilities 63 75 138 68<br />

Non-current liabilities 453 45 498 256<br />

Total revenues 37 127 164 71<br />

Total operating expenses -10 -127 -137 -59<br />

Profit or loss after taxes -7 -6 -13 -24<br />

1) Including EUR 47 million goodwill at Reggefiber.<br />

The difference in value between the assets and liabilities of the table above and the investment value is the goodwill paid by <strong>KPN</strong> which is included<br />

in the book value of the associates and joint ventures.<br />

116<br />

<strong>KPN</strong> | Annual Report 2012