FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

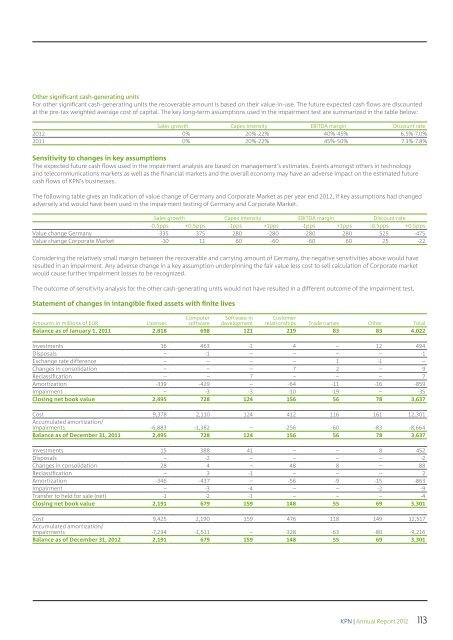

Other significant cash-generating units<br />

For other significant cash-generating units the recoverable amount is based on their value-in-use. The future expected cash flows are discounted<br />

at the pre-tax weighted average cost of capital. The key long-term assumptions used in the impairment test are summarized in the table below:<br />

Sales growth Capex intensity EBITDA margin Discount rate<br />

2012 0% 20%-22% 40%-45% 6.5%-7.0%<br />

2011 0% 20%-22% 45%-50% 7.3%-7.8%<br />

Sensitivity to changes in key assumptions<br />

The expected future cash flows used in the impairment analysis are based on management’s estimates. Events amongst others in technology<br />

and telecommunications markets as well as the financial markets and the overall economy may have an adverse impact on the estimated future<br />

cash flows of <strong>KPN</strong>’s businesses.<br />

The following table gives an indication of value change of Germany and Corporate Market as per year end 2012, if key assumptions had changed<br />

adversely and would have been used in the impairment testing of Germany and Corporate Market.<br />

Sales growth Capex intensity EBITDA margin Discount rate<br />

-0.5pps +0.5pps -1pps +1pps -1pps +1pps -0.5pps +0.5pps<br />

Value change Germany -335 375 280 -280 -280 280 525 -475<br />

Value change Corporate Market -10 11 60 -60 -60 60 25 -22<br />

Considering the relatively small margin between the recoverable and carrying amount of Germany, the negative sensitivities above would have<br />

resulted in an impairment. Any adverse change in a key assumption underpinning the fair value less cost to sell calculation of Corporate market<br />

would cause further impairment losses to be recognized.<br />

The outcome of sensitivity analysis for the other cash-generating units would not have resulted in a different outcome of the impairment test.<br />

Statement of changes in intangible fixed assets with finite lives<br />

Computer Software in Customer<br />

Amounts in millions of EUR<br />

Licenses software development relationships Trade names Other Total<br />

Balance as of January 1, 2011 2,818 698 121 219 83 83 4,022<br />

Investments 16 463 -1 4 – 12 494<br />

Disposals – -1 – – – – -1<br />

Exchange rate difference – – – – 1 -1 –<br />

Changes in consolidation – – – 7 2 – 9<br />

Reclassification – – 7 – – – 7<br />

Amortization -339 -429 – -64 -11 -16 -859<br />

Impairment – -3 -3 -10 -19 – -35<br />

Closing net book value 2,495 728 124 156 56 78 3,637<br />

Cost 9,378 2,110 124 412 116 161 12,301<br />

Accumulated amortization/<br />

impairments -6,883 -1,382 – -256 -60 -83 -8,664<br />

Balance as of December 31, 2011 2,495 728 124 156 56 78 3,637<br />

Investments 15 388 41 – – 8 452<br />

Disposals – -2 – – – – -2<br />

Changes in consolidation 28 4 – 48 8 – 88<br />

Reclassification – 3 -1 – – – 2<br />

Amortization -346 -437 – -56 -9 -15 -863<br />

Impairment – -3 -4 – – -2 -9<br />

Transfer to held for sale (net) -1 -2 -1 – – – -4<br />

Closing net book value 2,191 679 159 148 55 69 3,301<br />

Cost 9,425 2,190 159 476 118 149 12,517<br />

Accumulated amortization/<br />

impairments -7,234 -1,511 – -328 -63 -80 -9,216<br />

Balance as of December 31, 2012 2,191 679 159 148 55 69 3,301<br />

<strong>KPN</strong> | Annual Report 2012 113