FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated Financial Statements<br />

Notes to the Consolidated Statement of Financial Position continued<br />

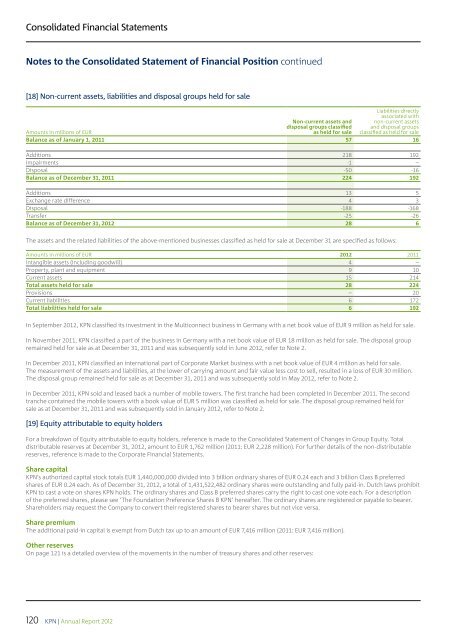

[18] Non-current assets, liabilities and disposal groups held for sale<br />

Liabilities directly<br />

associated with<br />

Amounts in millions of EUR<br />

Non-current assets and<br />

disposal groups classified<br />

as held for sale<br />

non-current assets<br />

and disposal groups<br />

classified as held for sale<br />

Balance as of January 1, 2011 57 16<br />

Additions 218 192<br />

Impairments -1 –<br />

Disposal -50 -16<br />

Balance as of December 31, 2011 224 192<br />

Additions 13 5<br />

Exchange rate difference 4 3<br />

Disposal -188 -168<br />

Transfer -25 -26<br />

Balance as of December 31, 2012 28 6<br />

The assets and the related liabilities of the above-mentioned businesses classified as held for sale at December 31 are specified as follows:<br />

Amounts in millions of EUR 2012 2011<br />

Intangible assets (including goodwill) 4 –<br />

Property, plant and equipment 9 10<br />

Current assets 15 214<br />

Total assets held for sale 28 224<br />

Provisions – 20<br />

Current liabilities 6 172<br />

Total liabilities held for sale 6 192<br />

In September 2012, <strong>KPN</strong> classified its investment in the Multiconnect business in Germany with a net book value of EUR 9 million as held for sale.<br />

In November 2011, <strong>KPN</strong> classified a part of the business in Germany with a net book value of EUR 18 million as held for sale. The disposal group<br />

remained held for sale as at December 31, 2011 and was subsequently sold in June 2012, refer to Note 2.<br />

In December 2011, <strong>KPN</strong> classified an international part of Corporate Market business with a net book value of EUR 4 million as held for sale.<br />

The measurement of the assets and liabilities, at the lower of carrying amount and fair value less cost to sell, resulted in a loss of EUR 30 million.<br />

The disposal group remained held for sale as at December 31, 2011 and was subsequently sold in May 2012, refer to Note 2.<br />

In December 2011, <strong>KPN</strong> sold and leased back a number of mobile towers. The first tranche had been completed in December 2011. The second<br />

tranche contained the mobile towers with a book value of EUR 5 million was classified as held for sale. The disposal group remained held for<br />

sale as at December 31, 2011 and was subsequently sold in January 2012, refer to Note 2.<br />

[19] Equity attributable to equity holders<br />

For a breakdown of Equity attributable to equity holders, reference is made to the Consolidated Statement of Changes in Group Equity. Total<br />

distributable reserves at December 31, 2012, amount to EUR 1,762 million (2011: EUR 2,228 million). For further details of the non-distributable<br />

reserves, reference is made to the Corporate Financial Statements.<br />

Share capital<br />

<strong>KPN</strong>’s authorized capital stock totals EUR 1,440,000,000 divided into 3 billion ordinary shares of EUR 0.24 each and 3 billion Class B preferred<br />

shares of EUR 0.24 each. As of December 31, 2012, a total of 1,431,522,482 ordinary shares were outstanding and fully paid-in. Dutch laws prohibit<br />

<strong>KPN</strong> to cast a vote on shares <strong>KPN</strong> holds. The ordinary shares and Class B preferred shares carry the right to cast one vote each. For a description<br />

of the preferred shares, please see ‘The Foundation Preference Shares B <strong>KPN</strong>’ hereafter. The ordinary shares are registered or payable to bearer.<br />

Shareholders may request the Company to convert their registered shares to bearer shares but not vice versa.<br />

Share premium<br />

The additional paid-in capital is exempt from Dutch tax up to an amount of EUR 7,416 million (2011: EUR 7,416 million).<br />

Other reserves<br />

On page 121 is a detailed overview of the movements in the number of treasury shares and other reserves:<br />

120<br />

<strong>KPN</strong> | Annual Report 2012