FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated Financial Statements<br />

Notes to the Consolidated Statement of Income continued<br />

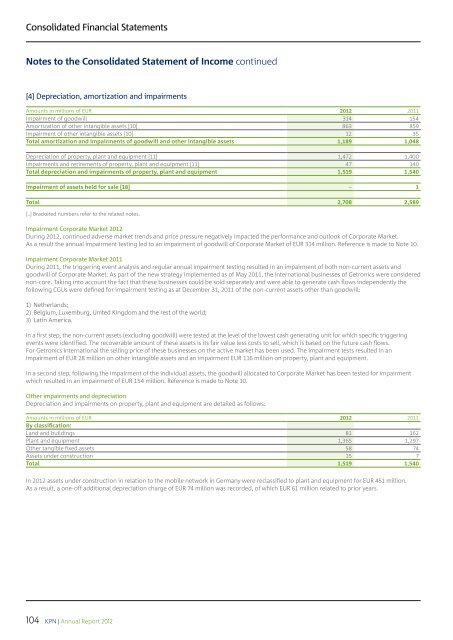

[4] Depreciation, amortization and impairments<br />

Amounts in millions of EUR 2012 2011<br />

Impairment of goodwill 314 154<br />

Amortization of other intangible assets [10] 863 859<br />

Impairment of other intangible assets [10] 12 35<br />

Total amortization and impairments of goodwill and other intangible assets 1,189 1,048<br />

Depreciation of property, plant and equipment [11] 1,472 1,400<br />

Impairments and retirements of property, plant and equipment [11] 47 140<br />

Total depreciation and impairments of property, plant and equipment 1,519 1,540<br />

Impairment of assets held for sale [18] – 1<br />

Total 2,708 2,589<br />

[..] Bracketed numbers refer to the related notes.<br />

Impairment Corporate Market 2012<br />

During 2012, continued adverse market trends and price pressure negatively impacted the performance and outlook of Corporate Market.<br />

As a result the annual impairment testing led to an impairment of goodwill of Corporate Market of EUR 314 million. Reference is made to Note 10. <br />

Impairment Corporate Market 2011<br />

During 2011, the triggering event analysis and regular annual impairment testing resulted in an impairment of both non-current assets and<br />

goodwill of Corporate Market. As part of the new strategy implemented as of May 2011, the international businesses of Getronics were considered<br />

non-core. Taking into account the fact that these businesses could be sold separately and were able to generate cash flows independently the<br />

following CGUs were defined for impairment testing as at December 31, 2011 of the non-current assets other than goodwill:<br />

1) Netherlands;<br />

2) Belgium, Luxemburg, United Kingdom and the rest of the world;<br />

3) Latin America.<br />

In a first step, the non-current assets (excluding goodwill) were tested at the level of the lowest cash generating unit for which specific triggering<br />

events were identified. The recoverable amount of these assets is its fair value less costs to sell, which is based on the future cash flows.<br />

For Getronics International the selling price of these businesses on the active market has been used. The impairment tests resulted in an<br />

impairment of EUR 28 million on other intangible assets and an impairment EUR 116 million on property, plant and equipment.<br />

In a second step, following the impairment of the individual assets, the goodwill allocated to Corporate Market has been tested for impairment<br />

which resulted in an impairment of EUR 154 million. Reference is made to Note 10.<br />

Other impairments and depreciation<br />

Depreciation and impairments on property, plant and equipment are detailed as follows:<br />

Amounts in millions of EUR 2012 2011<br />

By classification:<br />

Land and buildings 81 162<br />

Plant and equipment 1,365 1,297<br />

Other tangible fixed assets 58 74<br />

Assets under construction 15 7<br />

Total 1,519 1,540<br />

In 2012 assets under construction in relation to the mobile network in Germany were reclassified to plant and equipment for EUR 451 million.<br />

As a result, a one-off additional depreciation charge of EUR 74 million was recorded, of which EUR 61 million related to prior years.<br />

104<br />

<strong>KPN</strong> | Annual Report 2012