Funding of Constitutional Officers - Virginia Joint Legislative Audit ...

Funding of Constitutional Officers - Virginia Joint Legislative Audit ...

Funding of Constitutional Officers - Virginia Joint Legislative Audit ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

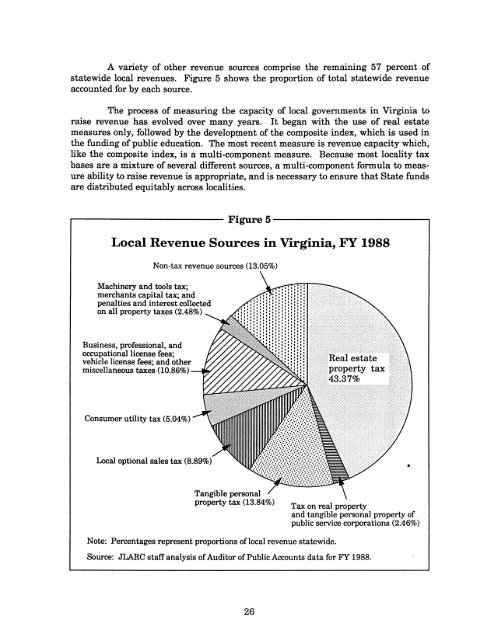

A variety <strong>of</strong> other revenue sources comprise the remaining 57 percent <strong>of</strong><br />

statewide local revenues. Figure 5 shows the proportion <strong>of</strong> total statewide revenue<br />

accounted for by each source.<br />

The process <strong>of</strong> measuring the capacity <strong>of</strong> local governments in <strong>Virginia</strong> to<br />

raise revenue has evolved over many years. It began with the use <strong>of</strong> real estate<br />

measures only, followed by the development <strong>of</strong> the composite index, which is used in<br />

the funding <strong>of</strong>public education. The most recent measure is revenue capacity which,<br />

like the composite index, is a multi-component measure. Because most locality tax<br />

bases are a mixture <strong>of</strong> several different sources, a multi-component formula to measure<br />

ability to raise revenue is appropriate, and is necessary to ensure that State funds<br />

are distributed equitably across localities.<br />

,..-------------- Figure 5-------------.,<br />

Local Revenue Sources in <strong>Virginia</strong>, FY 1988<br />

Non-tax revenue sources (13.05%)<br />

Machinery and tools tax;<br />

merchants capital tax; and<br />

penalties and interest collected<br />

on all property taxes (2.48%)<br />

Business, pr<strong>of</strong>essional, and<br />

occupational license fees;<br />

vehicle license fees; and other<br />

miscellaneous taxes (10.86%)<br />

Consumer utility tax (5.04%)<br />

Local optional sales tax (8.89%)<br />

•<br />

Tangible personal<br />

property tax (13.84%)<br />

Tax on real property<br />

and tangible personal property <strong>of</strong><br />

public service corporations (2.46%)<br />

Note: Percentages represent proportions <strong>of</strong>local revenue statewide.<br />

Source: JLARC staffanalysis <strong>of</strong><strong>Audit</strong>or <strong>of</strong> Public Accounts data for FY 1988.<br />

26