Funding of Constitutional Officers - Virginia Joint Legislative Audit ...

Funding of Constitutional Officers - Virginia Joint Legislative Audit ...

Funding of Constitutional Officers - Virginia Joint Legislative Audit ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

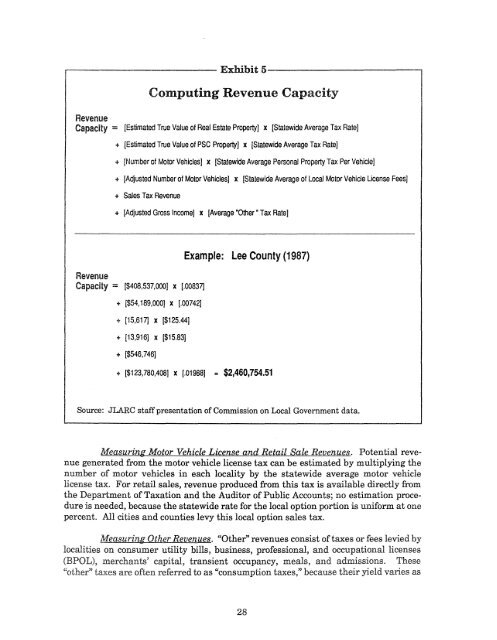

------------- Exhibit5-------------,<br />

Computing Revenue Capacity<br />

Revenue<br />

Capacity ::: [Estimated TnJe Value <strong>of</strong> Real Estate PropertyJ x [Statewide Average Tax RateJ<br />

... [Estimated True Value <strong>of</strong> PSC Property] x [Statewide Average Tax Rate]<br />

'" [Number <strong>of</strong> Motor Vehicles] x [Statewide Average Personal Property Tax Per Vehicle]<br />

'" [Adjusted Number <strong>of</strong> Motor VehiclesJ<br />

x [Statewide Average <strong>of</strong> Local Motor Vehicle License Fees]<br />

... Sales Tax Revenue<br />

... [Adjusted Gross Income] x [Average ·Other • Tax RateJ<br />

Revenue<br />

Capacity = [$408,537,oooJ x [.00837]<br />

... [$54,189,000] x [.00742]<br />

"" [15,617] x [$125.44]<br />

... [13,916] x [$15.83]<br />

... [$546,746]<br />

Example: lee County (1987)<br />

'*' [$123,780,408] x [.01988] = $2,460,754.51<br />

Source: JLARC staffpresentation <strong>of</strong> Commission on Local Government data.<br />

Measuring Motor Vehicle License and Retail Sale Revenues. Potential revenue<br />

generated from the motor vehicle license tax can be estimated by multiplying the<br />

number <strong>of</strong> motor vehicles in each locality by the statewide average motor vehicle<br />

license tax. For retail sales, revenue produced from this tax is available directly from<br />

the Department <strong>of</strong>Taxation and the <strong>Audit</strong>or <strong>of</strong> Public Accounts; no estimation procedure<br />

is needed, because the statewide rate for the local option portion is uniform at one<br />

percent. All cities and counties levy this local option sales tax.<br />

Measuring Other Revenues. "Other" revenues consist <strong>of</strong>taxes or fees levied by<br />

localities on consumer utility bills, business, pr<strong>of</strong>essional, and occupational licenses<br />

capital, transient occupancy, meals, and admissions. These<br />

referred to as "consumption taxes," because yield varies as<br />

28