Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

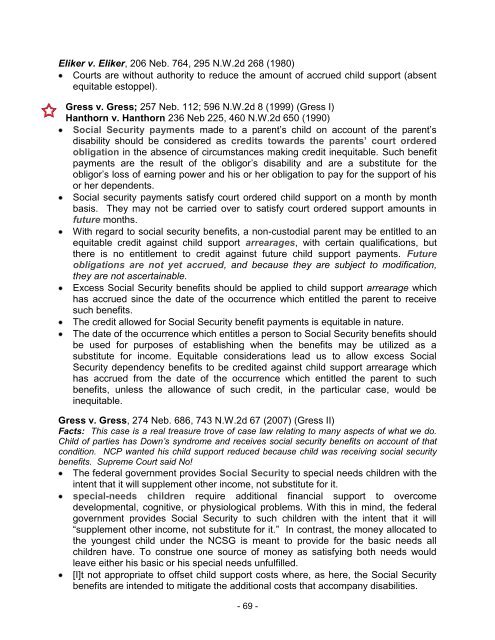

Eliker v. Eliker, 206 Neb. 764, 295 N.W.2d 268 (1980)<br />

Courts are without authority to reduce the amount of accrued child support (absent<br />

equitable estoppel).<br />

Gress v. Gress; 257 Neb. 112; 596 N.W.2d 8 (1999) (Gress I)<br />

Hanthorn v. Hanthorn 236 Neb 225, 460 N.W.2d 650 (1990)<br />

Social Security payments made to a parent’s child on account of the parent’s<br />

disability should be considered as credits towards the parents’ court ordered<br />

obligation in the absence of circumstances making credit inequitable. Such benefit<br />

payments are the result of the obligor’s disability and are a substitute for the<br />

obligor’s loss of earning power and his or her obligation to pay for the support of his<br />

or her dependents.<br />

Social security payments satisfy court ordered child support on a month by month<br />

basis. They may not be carried over to satisfy court ordered support amounts in<br />

future months.<br />

With regard to social security benefits, a non-custodial parent may be entitled to an<br />

equitable credit against child support arrearages, with certain qualifications, but<br />

there is no entitlement to credit against future child support payments. Future<br />

obligations are not yet accrued, and because they are subject to modification,<br />

they are not ascertainable.<br />

Excess Social Security benefits should be applied to child support arrearage which<br />

has accrued since the date of the occurrence which entitled the parent to receive<br />

such benefits.<br />

The credit allowed for Social Security benefit payments is equitable in nature.<br />

The date of the occurrence which entitles a person to Social Security benefits should<br />

be used for purposes of establishing when the benefits may be utilized as a<br />

substitute for income. Equitable considerations lead us to allow excess Social<br />

Security dependency benefits to be credited against child support arrearage which<br />

has accrued from the date of the occurrence which entitled the parent to such<br />

benefits, unless the allowance of such credit, in the particular case, would be<br />

inequitable.<br />

Gress v. Gress, 274 Neb. 686, 743 N.W.2d 67 (2007) (Gress II)<br />

Facts: This case is a real treasure trove of case law relating to many aspects of what we do.<br />

<strong>Child</strong> of parties has Down’s syndrome and receives social security benefits on account of that<br />

condition. NCP wanted his child support reduced because child was receiving social security<br />

benefits. Supreme Court said No!<br />

The federal government provides Social Security to special needs children with the<br />

intent that it will supplement other income, not substitute for it.<br />

special-needs children require additional financial support to overcome<br />

developmental, cognitive, or physiological problems. With this in mind, the federal<br />

government provides Social Security to such children with the intent that it will<br />

“supplement other income, not substitute for it.” In contrast, the money allocated to<br />

the youngest child under the NCSG is meant to provide for the basic needs all<br />

children have. To construe one source of money as satisfying both needs would<br />

leave either his basic or his special needs unfulfilled.<br />

[I]t not appropriate to offset child support costs where, as here, the Social Security<br />

benefits are intended to mitigate the additional costs that accompany disabilities.<br />

- 69 -