ANNUAL REPORT 2011 - Connacher Oil and Gas

ANNUAL REPORT 2011 - Connacher Oil and Gas

ANNUAL REPORT 2011 - Connacher Oil and Gas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AR <strong>2011</strong><br />

PG 73<br />

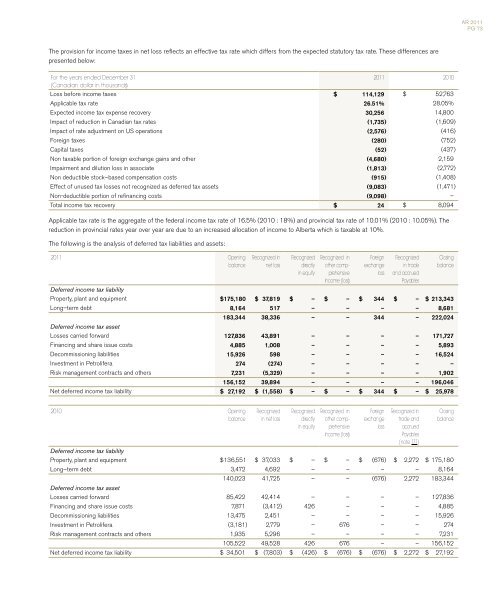

The provision for income taxes in net loss reflects an effective tax rate which differs from the expected statutory tax rate. These differences are<br />

presented below:<br />

For the years ended December 31<br />

<strong>2011</strong> 2010<br />

(Canadian dollar in thous<strong>and</strong>s)<br />

Loss before income taxes $ 114,129 $ 52,763<br />

Applicable tax rate 26.51% 28.05%<br />

Expected income tax expense recovery 30,256 14,800<br />

Impact of reduction in Canadian tax rates (1,735) (1,609)<br />

Impact of rate adjustment on US operations (2,576) (416)<br />

Foreign taxes (280) (752)<br />

Capital taxes (52) (437)<br />

Non taxable portion of foreign exchange gains <strong>and</strong> other (4,680) 2,159<br />

Impairment <strong>and</strong> dilution loss in associate (1,813) (2,772)<br />

Non deductible stock–based compensation costs (915) (1,408)<br />

Effect of unused tax losses not recognized as deferred tax assets (9,083) (1,471)<br />

Non-deductible portion of refinancing costs (9,098) –<br />

Total income tax recovery $ 24 $ 8,094<br />

Applicable tax rate is the aggregate of the federal income tax rate of 16.5% (2010 : 18%) <strong>and</strong> provincial tax rate of 10.01% (2010 : 10.05%). The<br />

reduction in provincial rates year over year are due to an increased allocation of income to Alberta which is taxable at 10%.<br />

The following is the analysis of deferred tax liabilities <strong>and</strong> assets:<br />

<strong>2011</strong> Opening<br />

balance<br />

Recognized in<br />

net loss<br />

Recognized<br />

directly<br />

in equity<br />

Recognized in<br />

other compprehensive<br />

Income (loss)<br />

Foreign<br />

exchange<br />

loss<br />

Recognized<br />

in trade<br />

<strong>and</strong> accrued<br />

Payables<br />

Deferred income tax liability<br />

Property, plant <strong>and</strong> equipment $ 175,180 $ 37,819 $ – $ – $ 344 $ – $ 213,343<br />

Long–term debt 8,164 517 – – – – 8,681<br />

183,344 38,336 – – 344 – 222,024<br />

Deferred income tax asset<br />

Losses carried forward 127,836 43,891 – – – – 171,727<br />

Financing <strong>and</strong> share issue costs 4,885 1,008 – – – – 5,893<br />

Decommissioning liabilities 15,926 598 – – – – 16,524<br />

Investment in Petrolifera 274 (274) – – – – –<br />

Risk management contracts <strong>and</strong> others 7,231 (5,329) – – – – 1,902<br />

156,152 39,894 – – – – 196,046<br />

Net deferred income tax liability $ 27,192 $ (1,558) $ – $ – $ 344 $ – $ 25,978<br />

Closing<br />

balance<br />

2010 Opening<br />

balance<br />

Recognized<br />

in net loss<br />

Recognized<br />

directly<br />

in equity<br />

Recognized in<br />

other compprehensive<br />

Income (loss)<br />

Foreign<br />

exchange<br />

loss<br />

Recognized in<br />

trade <strong>and</strong><br />

accrued<br />

Payables<br />

(note 17.1)<br />

Deferred income tax liability<br />

Property, plant <strong>and</strong> equipment $ 136,551 $ 37,033 $ – $ – $ (676) $ 2,272 $ 175,180<br />

Long–term debt 3,472 4,692 – – – – 8,164<br />

140,023 41,725 – – (676) 2,272 183,344<br />

Deferred income tax asset<br />

Losses carried forward 85,422 42,414 – – – – 127,836<br />

Financing <strong>and</strong> share issue costs 7,871 (3,412) 426 – – – 4,885<br />

Decommissioning liabilities 13,475 2,451 – – – – 15,926<br />

Investment in Petrolifera (3,181) 2,779 – 676 – – 274<br />

Risk management contracts <strong>and</strong> others 1,935 5,296 – – – – 7,231<br />

105,522 49,528 426 676 – – 156,152<br />

Net deferred income tax liability $ 34,501 $ (7,803) $ (426) $ (676) $ (676) $ 2,272 $ 27,192<br />

Closing<br />

balance