ANNUAL REPORT 2011 - Connacher Oil and Gas

ANNUAL REPORT 2011 - Connacher Oil and Gas

ANNUAL REPORT 2011 - Connacher Oil and Gas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AR <strong>2011</strong><br />

PG 79<br />

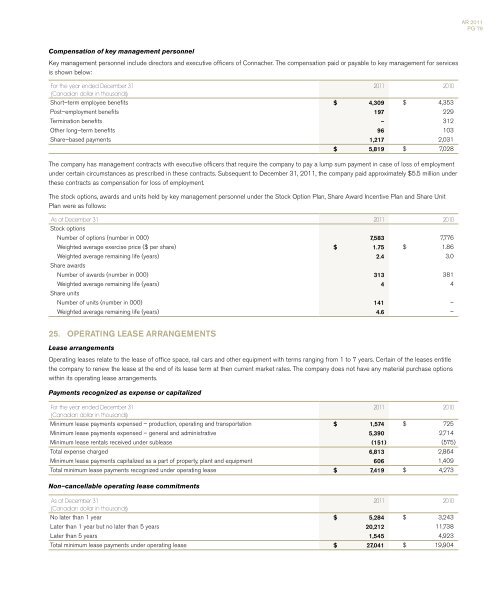

Compensation of key management personnel<br />

Key management personnel include directors <strong>and</strong> executive officers of <strong>Connacher</strong>. The compensation paid or payable to key management for services<br />

is shown below:<br />

For the year ended December 31<br />

<strong>2011</strong> 2010<br />

(Canadian dollar in thous<strong>and</strong>s)<br />

Short–term employee benefits $ 4,309 $ 4,353<br />

Post–employment benefits 197 229<br />

Termination benefits – 312<br />

Other long–term benefits 96 103<br />

Share–based payments 1,217 2,031<br />

$ 5,819 $ 7,028<br />

The company has management contracts with executive officers that require the company to pay a lump sum payment in case of loss of employment<br />

under certain circumstances as prescribed in these contracts. Subsequent to December 31, <strong>2011</strong>, the company paid approximately $5.5 million under<br />

these contracts as compensation for loss of employment.<br />

The stock options, awards <strong>and</strong> units held by key management personnel under the Stock Option Plan, Share Award Incentive Plan <strong>and</strong> Share Unit<br />

Plan were as follows:<br />

As at December 31 <strong>2011</strong> 2010<br />

Stock options<br />

Number of options (number in 000) 7,583 7,776<br />

Weighted average exercise price ($ per share) $ 1.75 $ 1.86<br />

Weighted average remaining life (years) 2.4 3.0<br />

Share awards<br />

Number of awards (number in 000) 313 381<br />

Weighted average remaining life (years) 4 4<br />

Share units<br />

Number of units (number in 000) 141 –<br />

Weighted average remaining life (years) 4.6 –<br />

25. Operating LEASE Arrangements<br />

Lease arrangements<br />

Operating leases relate to the lease of office space, rail cars <strong>and</strong> other equipment with terms ranging from 1 to 7 years. Certain of the leases entitle<br />

the company to renew the lease at the end of its lease term at then current market rates. The company does not have any material purchase options<br />

within its operating lease arrangements.<br />

Payments recognized as expense or capitalized<br />

For the year ended December 31<br />

<strong>2011</strong> 2010<br />

(Canadian dollar in thous<strong>and</strong>s)<br />

Minimum lease payments expensed – production, operating <strong>and</strong> transportation $ 1,574 $ 725<br />

Minimum lease payments expensed – general <strong>and</strong> administrative 5,390 2,714<br />

Minimum lease rentals received under sublease (151) (575)<br />

Total expense charged 6,813 2,864<br />

Minimum lease payments capitalized as a part of property, plant <strong>and</strong> equipment 606 1,409<br />

Total minimum lease payments recognized under operating lease $ 7,419 $ 4,273<br />

Non–cancellable operating lease commitments<br />

As at December 31<br />

<strong>2011</strong> 2010<br />

(Canadian dollar in thous<strong>and</strong>s)<br />

No later than 1 year $ 5,284 $ 3,243<br />

Later than 1 year but no later than 5 years 20,212 11,738<br />

Later than 5 years 1,545 4,923<br />

Total minimum lease payments under operating lease $ 27,041 $ 19,904