ANNUAL REPORT 2011 - Connacher Oil and Gas

ANNUAL REPORT 2011 - Connacher Oil and Gas

ANNUAL REPORT 2011 - Connacher Oil and Gas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AR <strong>2011</strong><br />

PG 78<br />

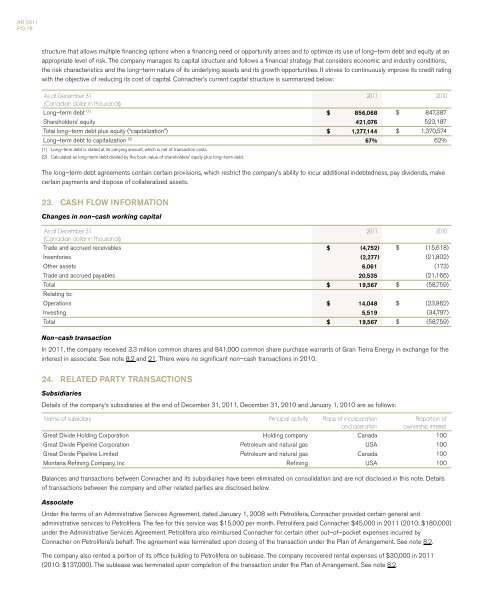

structure that allows multiple financing options when a financing need or opportunity arises <strong>and</strong> to optimize its use of long–term debt <strong>and</strong> equity at an<br />

appropriate level of risk. The company manages its capital structure <strong>and</strong> follows a financial strategy that considers economic <strong>and</strong> industry conditions,<br />

the risk characteristics <strong>and</strong> the long–term nature of its underlying assets <strong>and</strong> its growth opportunities. It strives to continuously improve its credit rating<br />

with the objective of reducing its cost of capital. <strong>Connacher</strong>’s current capital structure is summarized below:<br />

As at December 31<br />

<strong>2011</strong> 2010<br />

(Canadian dollar in thous<strong>and</strong>s)<br />

Long–term debt (1) $ 856,068 $ 847,387<br />

Shareholders’ equity 421,076 523,187<br />

Total long–term debt plus equity (“capitalization”) $ 1,277,144 $ 1,370,574<br />

Long–term debt to capitalization (2) 67% 62%<br />

(1) Long–term debt is stated at its carrying amount, which is net of transaction costs.<br />

(2) Calculated as long–term debt divided by the book value of shareholders’ equity plus long–term debt.<br />

The long–term debt agreements contain certain provisions, which restrict the company’s ability to incur additional indebtedness, pay dividends, make<br />

certain payments <strong>and</strong> dispose of collateralized assets.<br />

23. CASH flow information<br />

Changes in non–cash working capital<br />

As at December 31<br />

<strong>2011</strong> 2010<br />

(Canadian dollar in thous<strong>and</strong>s)<br />

Trade <strong>and</strong> accrued receivables $ (4,752) $ (15,618)<br />

Inventories (2,277) (21,802)<br />

Other assets 6,061 (173)<br />

Trade <strong>and</strong> accrued payables 20,535 (21,166)<br />

Total $ 19,567 $ (58,759)<br />

Relating to:<br />

Operations $ 14,048 $ (23,962)<br />

Investing 5,519 (34,797)<br />

Total $ 19,567 $ (58,759)<br />

Non–cash transaction<br />

In <strong>2011</strong>, the company received 3.3 million common shares <strong>and</strong> 841,000 common share purchase warrants of Gran Tierra Energy in exchange for the<br />

interest in associate. See note 8.2 <strong>and</strong> 21. There were no significant non–cash transactions in 2010.<br />

24. RELATED PARTY Transactions<br />

Subsidiaries<br />

Details of the company’s subsidiaries at the end of December 31, <strong>2011</strong>, December 31, 2010 <strong>and</strong> January 1, 2010 are as follows:<br />

Name of subsidiary Principal activity Place of incorporation<br />

<strong>and</strong> operation<br />

Proportion of<br />

ownership interest<br />

Great Divide Holding Corporation Holding company Canada 100<br />

Great Divide Pipeline Corporation Petroleum <strong>and</strong> natural gas USA 100<br />

Great Divide Pipeline Limited Petroleum <strong>and</strong> natural gas Canada 100<br />

Montana Refining Company, Inc Refining USA 100<br />

Balances <strong>and</strong> transactions between <strong>Connacher</strong> <strong>and</strong> its subsidiaries have been eliminated on consolidation <strong>and</strong> are not disclosed in this note. Details<br />

of transactions between the company <strong>and</strong> other related parties are disclosed below.<br />

Associate<br />

Under the terms of an Administrative Services Agreement, dated January 1, 2008 with Petrolifera, <strong>Connacher</strong> provided certain general <strong>and</strong><br />

administrative services to Petrolifera. The fee for this service was $15,000 per month. Petrolifera paid <strong>Connacher</strong> $45,000 in <strong>2011</strong> (2010: $180,000)<br />

under the Administrative Services Agreement. Petrolifera also reimbursed <strong>Connacher</strong> for certain other out–of–pocket expenses incurred by<br />

<strong>Connacher</strong> on Petrolifera’s behalf. The agreement was terminated upon closing of the transaction under the Plan of Arrangement. See note 8.2.<br />

The company also rented a portion of its office building to Petrolifera on sublease. The company recovered rental expenses of $30,000 in <strong>2011</strong><br />

(2010: $137,000). The sublease was terminated upon completion of the transaction under the Plan of Arrangement. See note 8.2.