Benefit Reference Guide - The School District of Palm Beach County

Benefit Reference Guide - The School District of Palm Beach County

Benefit Reference Guide - The School District of Palm Beach County

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

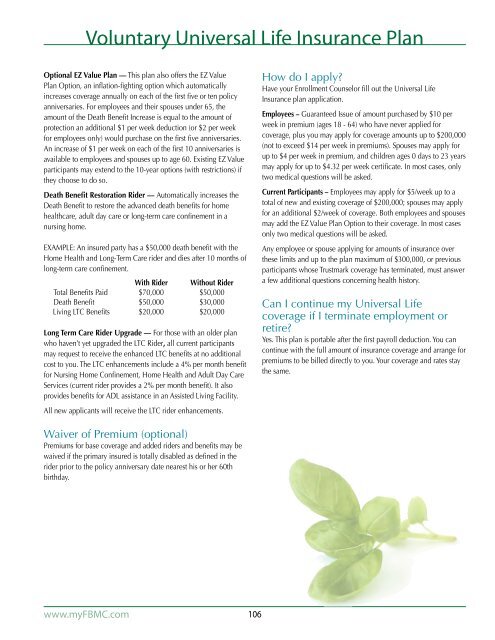

Voluntary Universal Life Insurance Plan<br />

Optional EZ Value Plan — This plan also <strong>of</strong>fers the EZ Value<br />

Plan Option, an inflation-fighting option which automatically<br />

increases coverage annually on each <strong>of</strong> the first five or ten policy<br />

anniversaries. For employees and their spouses under 65, the<br />

amount <strong>of</strong> the Death <strong>Benefit</strong> Increase is equal to the amount <strong>of</strong><br />

protection an additional $1 per week deduction (or $2 per week<br />

for employees only) would purchase on the first five anniversaries.<br />

An increase <strong>of</strong> $1 per week on each <strong>of</strong> the first 10 anniversaries is<br />

available to employees and spouses up to age 60. Existing EZ Value<br />

participants may extend to the 10-year options (with restrictions) if<br />

they choose to do so.<br />

Death <strong>Benefit</strong> Restoration Rider — Automatically increases the<br />

Death <strong>Benefit</strong> to restore the advanced death benefits for home<br />

healthcare, adult day care or long-term care confinement in a<br />

nursing home.<br />

Example: An insured party has a $50,000 death benefit with the<br />

Home Health and Long-Term Care rider and dies after 10 months <strong>of</strong><br />

long-term care confinement.<br />

With Rider Without Rider<br />

Total <strong>Benefit</strong>s Paid $70,000 $50,000<br />

Death <strong>Benefit</strong> $50,000 $30,000<br />

Living LTC <strong>Benefit</strong>s $20,000 $20,000<br />

Long Term Care Rider Upgrade — For those with an older plan<br />

who haven’t yet upgraded the LTC Rider, all current participants<br />

may request to receive the enhanced LTC benefits at no additional<br />

cost to you. <strong>The</strong> LTC enhancements include a 4% per month benefit<br />

for Nursing Home Confinement, Home Health and Adult Day Care<br />

Services (current rider provides a 2% per month benefit). It also<br />

provides benefits for ADL assistance in an Assisted Living Facility.<br />

All new applicants will receive the LTC rider enhancements.<br />

How do I apply?<br />

Have your Enrollment Counselor fill out the Universal Life<br />

Insurance plan application.<br />

Employees – Guaranteed Issue <strong>of</strong> amount purchased by $10 per<br />

week in premium (ages 18 - 64) who have never applied for<br />

coverage, plus you may apply for coverage amounts up to $200,000<br />

(not to exceed $14 per week in premiums). Spouses may apply for<br />

up to $4 per week in premium, and children ages 0 days to 23 years<br />

may apply for up to $4.32 per week certificate. In most cases, only<br />

two medical questions will be asked.<br />

Current Participants – Employees may apply for $5/week up to a<br />

total <strong>of</strong> new and existing coverage <strong>of</strong> $200,000; spouses may apply<br />

for an additional $2/week <strong>of</strong> coverage. Both employees and spouses<br />

may add the EZ Value Plan Option to their coverage. In most cases<br />

only two medical questions will be asked.<br />

Any employee or spouse applying for amounts <strong>of</strong> insurance over<br />

these limits and up to the plan maximum <strong>of</strong> $300,000, or previous<br />

participants whose Trustmark coverage has terminated, must answer<br />

a few additional questions concerning health history.<br />

Can I continue my Universal Life<br />

coverage if I terminate employment or<br />

retire?<br />

Yes. This plan is portable after the first payroll deduction. You can<br />

continue with the full amount <strong>of</strong> insurance coverage and arrange for<br />

premiums to be billed directly to you. Your coverage and rates stay<br />

the same.<br />

Waiver <strong>of</strong> Premium (optional)<br />

Premiums for base coverage and added riders and benefits may be<br />

waived if the primary insured is totally disabled as defined in the<br />

rider prior to the policy anniversary date nearest his or her 60th<br />

birthday.<br />

www.myFBMC.com<br />

106