Option-Implied Currency Risk Premia - Princeton University

Option-Implied Currency Risk Premia - Princeton University

Option-Implied Currency Risk Premia - Princeton University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

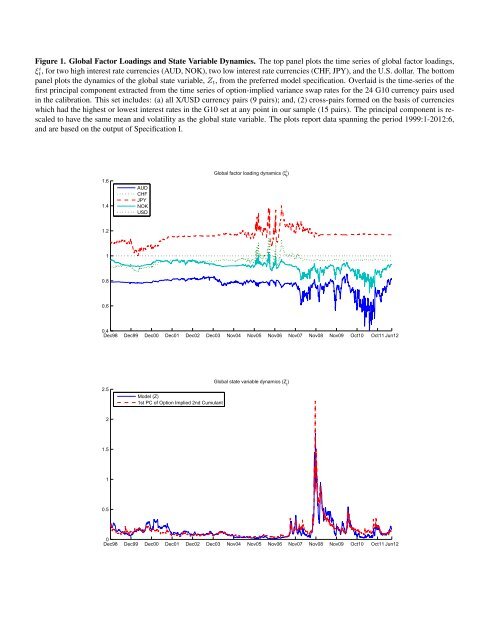

Figure 1. Global Factor Loadings and State Variable Dynamics. The top panel plots the time series of global factor loadings,<br />

ξ i t, for two high interest rate currencies (AUD, NOK), two low interest rate currencies (CHF, JPY), and the U.S. dollar. The bottom<br />

panel plots the dynamics of the global state variable, Z t , from the preferred model specification. Overlaid is the time-series of the<br />

first principal component extracted from the time series of option-implied variance swap rates for the 24 G10 currency pairs used<br />

in the calibration. This set includes: (a) all X/USD currency pairs (9 pairs); and, (2) cross-pairs formed on the basis of currencies<br />

which had the highest or lowest interest rates in the G10 set at any point in our sample (15 pairs). The principal component is rescaled<br />

to have the same mean and volatility as the global state variable. The plots report data spanning the period 1999:1-2012:6,<br />

and are based on the output of Specification I.<br />

1.6<br />

1.4<br />

AUD<br />

CHF<br />

JPY<br />

NOK<br />

USD<br />

Global factor loading dynamics (ξ t i )<br />

1.2<br />

1<br />

0.8<br />

0.6<br />

0.4<br />

Dec98 Dec99 Dec00 Dec01 Dec02 Dec03 Nov04 Nov05 Nov06 Nov07 Nov08 Nov09 Oct10 Oct11 Jun12<br />

2.5<br />

Model (Z)<br />

1st PC of <strong>Option</strong> <strong>Implied</strong> 2nd Cumulant<br />

Global state variable dynamics (Z t<br />

)<br />

2<br />

1.5<br />

1<br />

0.5<br />

0<br />

Dec98 Dec99 Dec00 Dec01 Dec02 Dec03 Nov04 Nov05 Nov06 Nov07 Nov08 Nov09 Oct10 Oct11 Jun12