Option-Implied Currency Risk Premia - Princeton University

Option-Implied Currency Risk Premia - Princeton University

Option-Implied Currency Risk Premia - Princeton University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

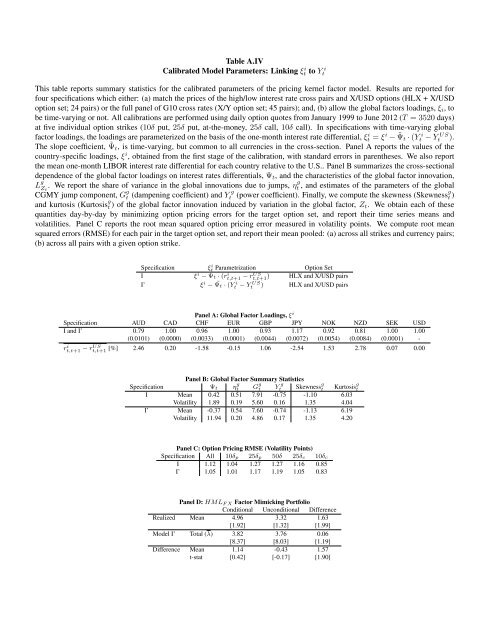

Table A.IV<br />

Calibrated Model Parameters: Linking ξ i t to Y i<br />

t<br />

This table reports summary statistics for the calibrated parameters of the pricing kernel factor model. Results are reported for<br />

four specifications which either: (a) match the prices of the high/low interest rate cross pairs and X/USD options (HLX + X/USD<br />

option set; 24 pairs) or the full panel of G10 cross rates (X/Y option set; 45 pairs); and, (b) allow the global factors loadings, ξ i , to<br />

be time-varying or not. All calibrations are performed using daily option quotes from January 1999 to June 2012 (T = 3520 days)<br />

at five individual option strikes (10δ put, 25δ put, at-the-money, 25δ call, 10δ call). In specifications with time-varying global<br />

factor loadings, the loadings are parameterized on the basis of the one-month interest rate differential, ξt i = ξ i − ˜Ψ t · (Yt i − Yt US ).<br />

The slope coefficient, ˜Ψ t , is time-varying, but common to all currencies in the cross-section. Panel A reports the values of the<br />

country-specific loadings, ξ i , obtained from the first stage of the calibration, with standard errors in parentheses. We also report<br />

the mean one-month LIBOR interest rate differential for each country relative to the U.S.. Panel B summarizes the cross-sectional<br />

dependence of the global factor loadings on interest rates differentials, Ψ t , and the characteristics of the global factor innovation,<br />

L g Z t<br />

. We report the share of variance in the global innovations due to jumps, η g t , and estimates of the parameters of the global<br />

CGMY jump component, G g t (dampening coefficient) and Y g<br />

t (power coefficient). Finally, we compute the skewness (Skewness g t )<br />

and kurtosis (Kurtosis g t ) of the global factor innovation induced by variation in the global factor, Z t . We obtain each of these<br />

quantities day-by-day by minimizing option pricing errors for the target option set, and report their time series means and<br />

volatilities. Panel C reports the root mean squared option pricing error measured in volatility points. We compute root mean<br />

squared errors (RMSE) for each pair in the target option set, and report their mean pooled: (a) across all strikes and currency pairs;<br />

(b) across all pairs with a given option strike.<br />

Specification ξt i Parametrization <strong>Option</strong> Set<br />

I<br />

ξ i − Ψ t · (rt,t+1 i − rUS t,t+1 ) HLX and X/USD pairs<br />

I’ ξ i − ˜Ψ t · (Yt i t US ) HLX and X/USD pairs<br />

Panel A: Global Factor Loadings, ξ i<br />

Specification AUD CAD CHF EUR GBP JPY NOK NZD SEK USD<br />

I and I’ 0.79 1.00 0.96 1.00 0.93 1.17 0.92 0.81 1.00 1.00<br />

(0.0101) (0.0000) (0.0033) (0.0001) (0.0044) (0.0072) (0.0054) (0.0084) (0.0001) -<br />

rt,t+1 i − rUS t,t+1 [%] 2.46 0.20 -1.58 -0.15 1.06 -2.54 1.53 2.78 0.07 0.00<br />

Panel B: Global Factor Summary Statistics<br />

Specification Ψ t η g t G g t Y g<br />

t Skewness g t Kurtosis g t<br />

I Mean 0.42 0.51 7.91 -0.75 -1.10 6.03<br />

Volatility 1.89 0.19 5.60 0.16 1.35 4.04<br />

I’ Mean -0.37 0.54 7.60 -0.74 -1.13 6.19<br />

Volatility 11.94 0.20 4.86 0.17 1.35 4.20<br />

Panel C: <strong>Option</strong> Pricing RMSE (Volatility Points)<br />

Specification All 10δ p 25δ p 50δ 25δ c 10δ c<br />

I 1.12 1.04 1.27 1.27 1.16 0.85<br />

I’ 1.05 1.01 1.17 1.19 1.05 0.83<br />

Panel D: HML F X Factor Mimicking Portfolio<br />

Conditional Unconditional Difference<br />

Realized Mean 4.96 3.32 1.63<br />

[1.92] [1.32] [1.99]<br />

Model I’ Total (λ) 3.82 3.76 0.06<br />

[8.37] [8.03] [1.19]<br />

Difference Mean 1.14 -0.43 1.57<br />

t-stat [0.42] [-0.17] [1.90]