Option-Implied Currency Risk Premia - Princeton University

Option-Implied Currency Risk Premia - Princeton University

Option-Implied Currency Risk Premia - Princeton University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

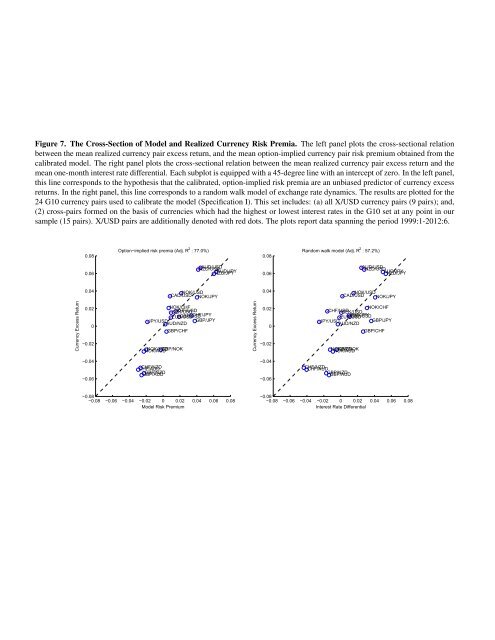

Figure 7. The Cross-Section of Model and Realized <strong>Currency</strong> <strong>Risk</strong> <strong>Premia</strong>. The left panel plots the cross-sectional relation<br />

between the mean realized currency pair excess return, and the mean option-implied currency pair risk premium obtained from the<br />

calibrated model. The right panel plots the cross-sectional relation between the mean realized currency pair excess return and the<br />

mean one-month interest rate differential. Each subplot is equipped with a 45-degree line with an intercept of zero. In the left panel,<br />

this line corresponds to the hypothesis that the calibrated, option-implied risk premia are an unbiased predictor of currency excess<br />

returns. In the right panel, this line corresponds to a random walk model of exchange rate dynamics. The results are plotted for the<br />

24 G10 currency pairs used to calibrate the model (Specification I). This set includes: (a) all X/USD currency pairs (9 pairs); and,<br />

(2) cross-pairs formed on the basis of currencies which had the highest or lowest interest rates in the G10 set at any point in our<br />

sample (15 pairs). X/USD pairs are additionally denoted with red dots. The plots report data spanning the period 1999:1-2012:6.<br />

0.08<br />

<strong>Option</strong>−implied risk premia (Adj. R 2 : 77.0%)<br />

0.08<br />

Random walk model (Adj. R 2 : 57.2%)<br />

0.06<br />

NZD/USD AUD/USD<br />

NZD/JPY AUD/JPY<br />

0.06<br />

AUD/USD NZD/USD<br />

AUD/JPY NZD/JPY<br />

0.04<br />

NOK/USD<br />

CAD/USD NOK/JPY<br />

0.04<br />

NOK/USD<br />

CAD/USD NOK/JPY<br />

<strong>Currency</strong> Excess Return<br />

0.02<br />

0<br />

−0.02<br />

NOK/CHF<br />

SEK/USD CHF/USD<br />

EUR/USD GBP/USD CHF/JPY<br />

JPY/USD<br />

GBP/JPY<br />

AUD/NZD<br />

GBP/CHF<br />

NOK/AUD<br />

NOK/NZD GBP/NOK<br />

<strong>Currency</strong> Excess Return<br />

0.02<br />

0<br />

−0.02<br />

NOK/CHF<br />

CHF/USD SEK/USD<br />

EUR/USD<br />

CHF/JPY GBP/USD<br />

JPY/USD<br />

GBP/JPY<br />

AUD/NZD<br />

GBP/CHF<br />

NOK/NZD<br />

NOK/AUD GBP/NOK<br />

−0.04<br />

−0.06<br />

CHF/AUD CHF/NZD<br />

GBP/AUD GBP/NZD<br />

−0.04<br />

−0.06<br />

CHF/NZD CHF/AUD<br />

GBP/NZD GBP/AUD<br />

−0.08<br />

−0.08 −0.06 −0.04 −0.02 0 0.02 0.04 0.06 0.08<br />

Model <strong>Risk</strong> Premium<br />

−0.08<br />

−0.08 −0.06 −0.04 −0.02 0 0.02 0.04 0.06 0.08<br />

Interest Rate Differential