Option-Implied Currency Risk Premia - Princeton University

Option-Implied Currency Risk Premia - Princeton University

Option-Implied Currency Risk Premia - Princeton University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

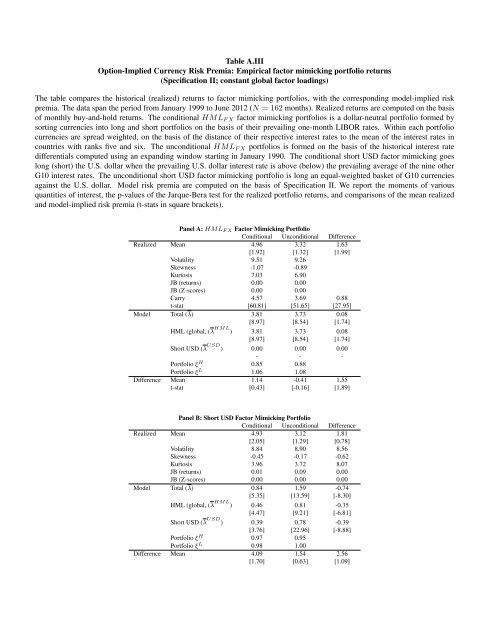

Table A.III<br />

<strong>Option</strong>-<strong>Implied</strong> <strong>Currency</strong> <strong>Risk</strong> <strong>Premia</strong>: Empirical factor mimicking portfolio returns<br />

(Specification II; constant global factor loadings)<br />

The table compares the historical (realized) returns to factor mimicking portfolios, with the corresponding model-implied risk<br />

premia. The data span the period from January 1999 to June 2012 (N = 162 months). Realized returns are computed on the basis<br />

of monthly buy-and-hold returns. The conditional HML F X factor mimicking portfolios is a dollar-neutral portfolio formed by<br />

sorting currencies into long and short portfolios on the basis of their prevailing one-month LIBOR rates. Within each portfolio<br />

currencies are spread weighted, on the basis of the distance of their respective interest rates to the mean of the interest rates in<br />

countries with ranks five and six. The unconditional HML F X portfolios is formed on the basis of the historical interest rate<br />

differentials computed using an expanding window starting in January 1990. The conditional short USD factor mimicking goes<br />

long (short) the U.S. dollar when the prevailing U.S. dollar interest rate is above (below) the prevailing average of the nine other<br />

G10 interest rates. The unconditional short USD factor mimicking portfolio is long an equal-weighted basket of G10 currencies<br />

against the U.S. dollar. Model risk premia are computed on the basis of Specification II. We report the moments of various<br />

quantities of interest, the p-values of the Jarque-Bera test for the realized portfolio returns, and comparisons of the mean realized<br />

and model-implied risk premia (t-stats in square brackets).<br />

Panel A: HML F X Factor Mimicking Portfolio<br />

Conditional Unconditional Difference<br />

Realized Mean 4.96 3.32 1.63<br />

[1.92] [1.32] [1.99]<br />

Volatility 9.51 9.26<br />

Skewness -1.07 -0.89<br />

Kurtosis 7.03 6.90<br />

JB (returns) 0.00 0.00<br />

JB (Z-scores) 0.00 0.00<br />

Carry 4.57 3.69 0.88<br />

t-stat [60.81] [51.65] [27.95]<br />

Model Total (λ) 3.81 3.73 0.08<br />

[8.97] [8.54] [1.74]<br />

HML (global, (λ HML ) 3.81 3.73 0.08<br />

[8.97] [8.54] [1.74]<br />

Short USD (λ USD ) 0.00 0.00 0.00<br />

- - -<br />

Portfolio ξ H 0.85 0.88<br />

Portfolio ξ L 1.06 1.08<br />

Difference Mean 1.14 -0.41 1.55<br />

t-stat [0.43] [-0.16] [1.89]<br />

Panel B: Short USD Factor Mimicking Portfolio<br />

Conditional Unconditional Difference<br />

Realized Mean 4.93 3.12 1.81<br />

[2.05] [1.29] [0.78]<br />

Volatility 8.84 8.90 8.56<br />

Skewness -0.45 -0.17 -0.62<br />

Kurtosis 3.96 3.72 8.07<br />

JB (returns) 0.01 0.09 0.00<br />

JB (Z-scores) 0.00 0.00 0.00<br />

Model Total (λ) 0.84 1.59 -0.74<br />

[5.35] [13.59] [-8.30]<br />

HML (global, (λ HML ) 0.46 0.81 -0.35<br />

[4.47] [9.21] [-6.81]<br />

Short USD (λ USD ) 0.39 0.78 -0.39<br />

[3.76] [22.96] [-8.88]<br />

Portfolio ξ H 0.97 0.95<br />

Portfolio ξ L 0.98 1.00<br />

Difference Mean 4.09 1.54 2.56<br />

[1.70] [0.63] [1.09]