The Prudential Series Fund

The Prudential Series Fund

The Prudential Series Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

During the year ended December 31, 2008, the Partnership spent approximately $3.7 million on capital improvements<br />

to various existing properties. Approximately $1.2 million was associated with the renovation of the hotel property in<br />

Lake Oswego, Oregon; approximately $0.7 million funded renovation and tenant improvements costs at the office<br />

property in Lisle, Illinois; approximately $0.7 million contributed to interior renovations at one of the office properties in<br />

Brentwood, Tennessee; and approximately $0.4 million financed tenant improvements at the retail property in Dunn,<br />

North Carolina. <strong>The</strong> remaining $0.7 million was associated with minor capital improvements and transaction costs<br />

associated with leasing expenses related to other properties in the Partnership. Additionally, $6.3 million of capital<br />

improvements was funded at the retail property in Ocean City, Maryland through the aforementioned third party loan.<br />

(b) Results of Operations<br />

<strong>The</strong> following is a comparison of the Partnership’s results of operations for the periods ended December 31, 2008 and<br />

2007.<br />

Net Investment Income Overview<br />

<strong>The</strong> Partnership’s net investment income for the year ended December 31, 2008 was approximately $11.1 million, a<br />

decrease of approximately $1.5 million from the prior year. <strong>The</strong> decrease in net investment income was primarily<br />

attributable to a $1.4 million increase in other net investment loss from the prior year. Additionally, the retail, office, and<br />

hotel sectors’ net investment income declined approximately $0.9 million, $0.1 million, and $0.1 million, respectively<br />

during the year ended December 31, 2008 from the prior year. Partially offsetting these decreases was an increase in<br />

the apartment sector’s net investment income of approximately $1.0 million from the prior year. <strong>The</strong> industrial sector’s<br />

net investment income remained relatively unchanged. <strong>The</strong> components of this net investment income are discussed<br />

below by investment type.<br />

Valuation Overview<br />

<strong>The</strong> Partnership did not have any realized gains for the year ended December 31, 2008, compared with a net realized<br />

gain of approximately $0.7 million for the prior year. <strong>The</strong> Partnership recorded a net unrealized loss of approximately<br />

$44.2 million for the year ended December 31, 2008, compared with a net unrealized gain of approximately $4.8<br />

million for the prior year. <strong>The</strong> Partnership recorded a net realized and unrealized loss of approximately $44.2 million for<br />

the year ended December 31, 2008, compared with a net realized and unrealized gain of approximately $5.5 million for<br />

the prior year. <strong>The</strong> net unrealized loss of approximately $44.2 million for the year ended December 31, 2008 was<br />

attributable to valuation declines in every sector primarily due to increased investment rates suggesting an industrywide<br />

repricing. Investment rates include direct and terminal capitalization rates, and discount rates, which reflect<br />

investors’ yield requirements on investments. <strong>The</strong> increase in investment rates was caused by the national economic<br />

downturn, frozen credit markets, weakening market fundamentals, and deteriorated demand for commercial real<br />

estate. <strong>The</strong> components of these valuation losses are discussed below by investment type.<br />

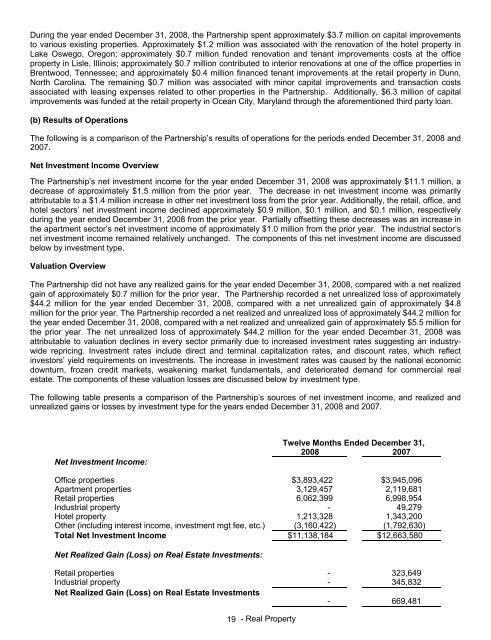

<strong>The</strong> following table presents a comparison of the Partnership’s sources of net investment income, and realized and<br />

unrealized gains or losses by investment type for the years ended December 31, 2008 and 2007.<br />

Net Investment Income:<br />

Twelve Months Ended December 31,<br />

2008 2007<br />

Office properties $3,893,422 $3,945,096<br />

Apartment properties 3,129,457 2,119,681<br />

Retail properties 6,062,399 6,998,954<br />

Industrial property - 49,279<br />

Hotel property 1,213,328 1,343,200<br />

Other (including interest income, investment mgt fee, etc.) (3,160,422) (1,792,630)<br />

Total Net Investment Income $11,138,184 $12,663,580<br />

Net Realized Gain (Loss) on Real Estate Investments:<br />

Retail properties - 323,649<br />

Industrial property - 345,832<br />

Net Realized Gain (Loss) on Real Estate Investments<br />

- 669,481<br />

19 - Real Property