The Prudential Series Fund

The Prudential Series Fund

The Prudential Series Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Pruco Life Insurance Company<br />

Notes to Consolidated Financial Statements<br />

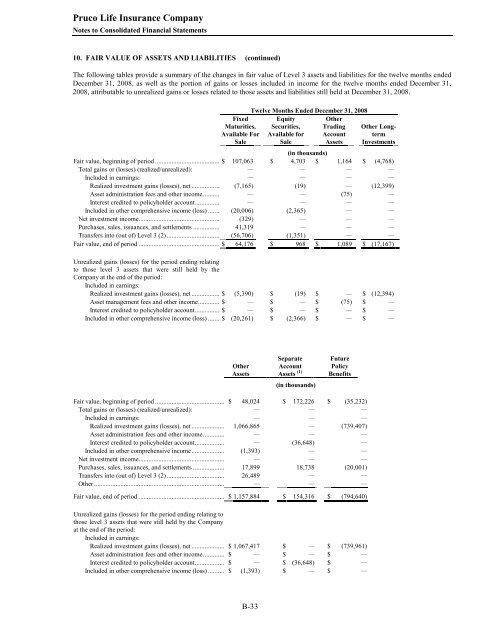

10. FAIR VALUE OF ASSETS AND LIABILITIES (continued)<br />

<strong>The</strong> following tables provide a summary of the changes in fair value of Level 3 assets and liabilities for the twelve months ended<br />

December 31, 2008, as well as the portion of gains or losses included in income for the twelve months ended December 31,<br />

2008, attributable to unrealized gains or losses related to those assets and liabilities still held at December 31, 2008.<br />

Fixed<br />

Maturities,<br />

Available For<br />

Sale<br />

Twelve Months Ended December 31, 2008<br />

Equity Other<br />

Securities, Trading<br />

Available for Account<br />

Sale<br />

Assets<br />

Other Longterm<br />

Investments<br />

(in thousands)<br />

Fair value, beginning of period ................................................... $ 107,063 $ 4,703 $ 1,164 $ (4,768)<br />

Total gains or (losses) (realized/unrealized): — — — —<br />

Included in earnings: — — — —<br />

Realized investment gains (losses), net ............................. (7,165) (19) — (12,399)<br />

Asset administration fees and other income ...................... — — (75) —<br />

Interest credited to policyholder account........................... — — — —<br />

Included in other comprehensive income (loss) ................... (20,006) (2,365) — —<br />

Net investment income............................................................. (329) — — —<br />

Purchases, sales, issuances, and settlements ............................ 41,319 — — —<br />

Transfers into (out of) Level 3 (2)............................................<br />

(56,706) (1,351) — —<br />

Fair value, end of period ............................................................. $ 64,176 $ 968 $ 1,089 $ (17,167)<br />

Unrealized gains (losses) for the period ending relating<br />

to those level 3 assets that were still held by the<br />

Company at the end of the period:<br />

Included in earnings:<br />

Realized investment gains (losses), net ............................. $ (5,390) $ (19) $ — $ (12,394)<br />

Asset management fees and other income ......................... $ — $ — $ (75) $ —<br />

Interest credited to policyholder account........................... $ — $ — $ — $ —<br />

Included in other comprehensive income (loss) ................... $ (20,261) $ (2,366) $ — $ —<br />

Other<br />

Assets<br />

Separate<br />

Account<br />

Assets (1)<br />

(in thousands)<br />

Future<br />

Policy<br />

Benefits<br />

Fair value, beginning of period ................................................... $ 48,024 $ 172,226 $ (35,232)<br />

Total gains or (losses) (realized/unrealized): — — —<br />

Included in earnings: — — —<br />

Realized investment gains (losses), net ............................. 1,066,865 — (739,407)<br />

Asset administration fees and other income ...................... — — —<br />

Interest credited to policyholder account........................... — (36,648) —<br />

Included in other comprehensive income ............................. (1,393) — —<br />

Net investment income............................................................. — — —<br />

Purchases, sales, issuances, and settlements ............................ 17,899 18,738 (20,001)<br />

Transfers into (out of) Level 3 (2)............................................ 26,489 — —<br />

Other ........................................................................................ — — —<br />

Fair value, end of period ............................................................. $ 1,157,884 $ 154,316 $ (794,640)<br />

Unrealized gains (losses) for the period ending relating to<br />

those level 3 assets that were still held by the Company<br />

at the end of the period:<br />

Included in earnings:<br />

Realized investment gains (losses), net ............................. $ 1,067,417 $ — $ (739,961)<br />

Asset administration fees and other income ...................... $ — $ — $ —<br />

Interest credited to policyholder account........................... $ — $ (36,648) $ —<br />

Included in other comprehensive income (loss) ................... $ (1,393) $ — $ —<br />

B-33