The Prudential Series Fund

The Prudential Series Fund

The Prudential Series Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Pruco Life Insurance Company<br />

Notes to Consolidated Financial Statements<br />

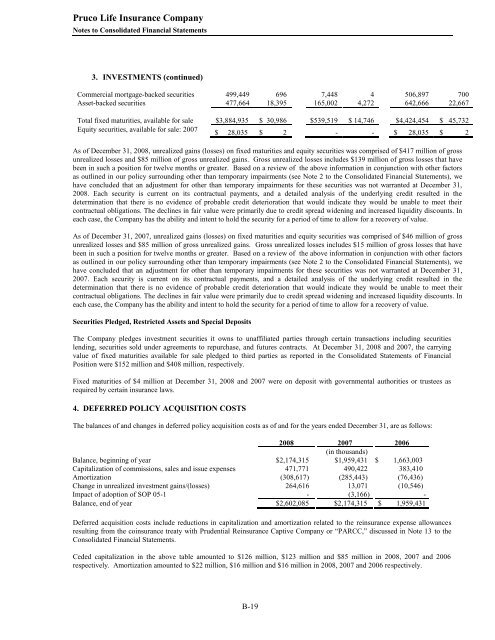

3. INVESTMENTS (continued)<br />

Commercial mortgage-backed securities 499,449 696 7,448 4 506,897 700<br />

Asset-backed securities 477,664 18,395 165,002 4,272 642,666 22,667<br />

Total fixed maturities, available for sale $3,884,935 $ 30,986 $539,519 $ 14,746 $4,424,454 $ 45,732<br />

Equity securities, available for sale: 2007<br />

$ 28,035 $ 2 - - $ 28,035 $ 2<br />

As of December 31, 2008, unrealized gains (losses) on fixed maturities and equity securities was comprised of $417 million of gross<br />

unrealized losses and $85 million of gross unrealized gains. Gross unrealized losses includes $139 million of gross losses that have<br />

been in such a position for twelve months or greater. Based on a review of the above information in conjunction with other factors<br />

as outlined in our policy surrounding other than temporary impairments (see Note 2 to the Consolidated Financial Statements), we<br />

have concluded that an adjustment for other than temporary impairments for these securities was not warranted at December 31,<br />

2008. Each security is current on its contractual payments, and a detailed analysis of the underlying credit resulted in the<br />

determination that there is no evidence of probable credit deterioration that would indicate they would be unable to meet their<br />

contractual obligations. <strong>The</strong> declines in fair value were primarily due to credit spread widening and increased liquidity discounts. In<br />

each case, the Company has the ability and intent to hold the security for a period of time to allow for a recovery of value.<br />

As of December 31, 2007, unrealized gains (losses) on fixed maturities and equity securities was comprised of $46 million of gross<br />

unrealized losses and $85 million of gross unrealized gains. Gross unrealized losses includes $15 million of gross losses that have<br />

been in such a position for twelve months or greater. Based on a review of the above information in conjunction with other factors<br />

as outlined in our policy surrounding other than temporary impairments (see Note 2 to the Consolidated Financial Statements), we<br />

have concluded that an adjustment for other than temporary impairments for these securities was not warranted at December 31,<br />

2007. Each security is current on its contractual payments, and a detailed analysis of the underlying credit resulted in the<br />

determination that there is no evidence of probable credit deterioration that would indicate they would be unable to meet their<br />

contractual obligations. <strong>The</strong> declines in fair value were primarily due to credit spread widening and increased liquidity discounts. In<br />

each case, the Company has the ability and intent to hold the security for a period of time to allow for a recovery of value.<br />

Securities Pledged, Restricted Assets and Special Deposits<br />

<strong>The</strong> Company pledges investment securities it owns to unaffiliated parties through certain transactions including securities<br />

lending, securities sold under agreements to repurchase, and futures contracts. At December 31, 2008 and 2007, the carrying<br />

value of fixed maturities available for sale pledged to third parties as reported in the Consolidated Statements of Financial<br />

Position were $152 million and $408 million, respectively.<br />

Fixed maturities of $4 million at December 31, 2008 and 2007 were on deposit with governmental authorities or trustees as<br />

required by certain insurance laws.<br />

4. DEFERRED POLICY ACQUISITION COSTS<br />

<strong>The</strong> balances of and changes in deferred policy acquisition costs as of and for the years ended December 31, are as follows:<br />

2008 2007 2006<br />

(in thousands)<br />

Balance, beginning of year $2,174,315 $1,959,431 $ 1,663,003<br />

Capitalization of commissions, sales and issue expenses 471,771 490,422 383,410<br />

Amortization (308,617) (285,443) (76,436)<br />

Change in unrealized investment gains/(losses) 264,616 13,071 (10,546)<br />

Impact of adoption of SOP 05-1 - (3,166) -<br />

Balance, end of year $2,602,085 $2,174,315 $ 1,959,431<br />

Deferred acquisition costs include reductions in capitalization and amortization related to the reinsurance expense allowances<br />

resulting from the coinsurance treaty with <strong>Prudential</strong> Reinsurance Captive Company or ―PARCC,‖ discussed in Note 13 to the<br />

Consolidated Financial Statements.<br />

Ceded capitalization in the above table amounted to $126 million, $123 million and $85 million in 2008, 2007 and 2006<br />

respectively. Amortization amounted to $22 million, $16 million and $16 million in 2008, 2007 and 2006 respectively.<br />

B-19