The Prudential Series Fund

The Prudential Series Fund

The Prudential Series Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

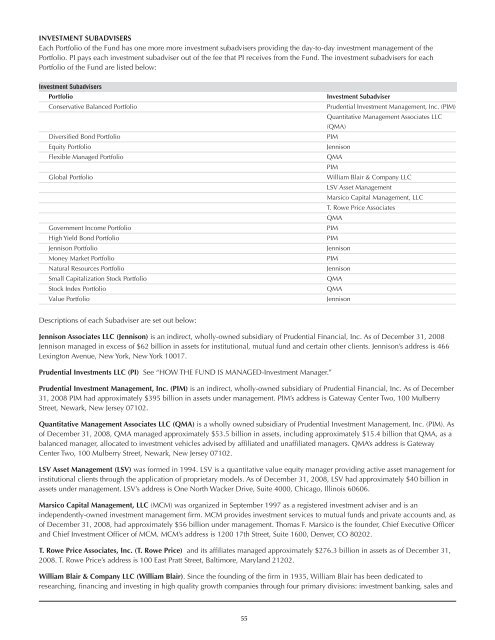

INVESTMENT SUBADVISERS<br />

Each Portfolio of the <strong>Fund</strong> has one more more investment subadvisers providing the day-to-day investment management of the<br />

Portfolio. PI pays each investment subadviser out of the fee that PI receives from the <strong>Fund</strong>. <strong>The</strong> investment subadvisers for each<br />

Portfolio of the <strong>Fund</strong> are listed below:<br />

Investment Subadvisers<br />

Portfolio<br />

Conservative Balanced Portfolio<br />

Diversified Bond Portfolio<br />

Equity Portfolio<br />

Flexible Managed Portfolio<br />

Global Portfolio<br />

Government Income Portfolio<br />

High Yield Bond Portfolio<br />

Jennison Portfolio<br />

Money Market Portfolio<br />

Natural Resources Portfolio<br />

Small Capitalization Stock Portfolio<br />

Stock Index Portfolio<br />

Value Portfolio<br />

Investment Subadviser<br />

<strong>Prudential</strong> Investment Management, Inc. (PIM)<br />

Quantitative Management Associates LLC<br />

(QMA)<br />

PIM<br />

Jennison<br />

QMA<br />

PIM<br />

William Blair & Company LLC<br />

LSV Asset Management<br />

Marsico Capital Management, LLC<br />

T. Rowe Price Associates<br />

QMA<br />

PIM<br />

PIM<br />

Jennison<br />

PIM<br />

Jennison<br />

QMA<br />

QMA<br />

Jennison<br />

Descriptions of each Subadviser are set out below:<br />

Jennison Associates LLC (Jennison) is an indirect, wholly-owned subsidiary of <strong>Prudential</strong> Financial, Inc. As of December 31, 2008<br />

Jennison managed in excess of $62 billion in assets for institutional, mutual fund and certain other clients. Jennison’s address is 466<br />

Lexington Avenue, New York, New York 10017.<br />

<strong>Prudential</strong> Investments LLC (PI) See “HOW THE FUND IS MANAGED-Investment Manager.”<br />

<strong>Prudential</strong> Investment Management, Inc. (PIM) is an indirect, wholly-owned subsidiary of <strong>Prudential</strong> Financial, Inc. As of December<br />

31, 2008 PIM had approximately $395 billion in assets under management. PIM’s address is Gateway Center Two, 100 Mulberry<br />

Street, Newark, New Jersey 07102.<br />

Quantitative Management Associates LLC (QMA) is a wholly owned subsidiary of <strong>Prudential</strong> Investment Management, Inc. (PIM). As<br />

of December 31, 2008, QMA managed approximately $53.5 billion in assets, including approximately $15.4 billion that QMA, as a<br />

balanced manager, allocated to investment vehicles advised by affiliated and unaffiliated managers. QMA’s address is Gateway<br />

Center Two, 100 Mulberry Street, Newark, New Jersey 07102.<br />

LSV Asset Management (LSV) was formed in 1994. LSV is a quantitative value equity manager providing active asset management for<br />

institutional clients through the application of proprietary models. As of December 31, 2008, LSV had approximately $40 billion in<br />

assets under management. LSV’s address is One North Wacker Drive, Suite 4000, Chicago, Illinois 60606.<br />

Marsico Capital Management, LLC (MCM) was organized in September 1997 as a registered investment adviser and is an<br />

independently-owned investment management firm. MCM provides investment services to mutual funds and private accounts and, as<br />

of December 31, 2008, had approximately $56 billion under management. Thomas F. Marsico is the founder, Chief Executive Officer<br />

and Chief Investment Officer of MCM. MCM’s address is 1200 17th Street, Suite 1600, Denver, CO 80202.<br />

T. Rowe Price Associates, Inc. (T. Rowe Price) and its affiliates managed approximately $276.3 billion in assets as of December 31,<br />

2008. T. Rowe Price’s address is 100 East Pratt Street, Baltimore, Maryland 21202.<br />

William Blair & Company LLC (William Blair). Since the founding of the firm in 1935, William Blair has been dedicated to<br />

researching, financing and investing in high quality growth companies through four primary divisions: investment banking, sales and<br />

55