Annual Report 2003 2004

Annual Report 2003 2004

Annual Report 2003 2004

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

the balance sheet total by €204 million. Income tax liabilities remained<br />

nearly constant whereas deferred income tax liabilities increased. The<br />

balance sheet total increased by €940 million.<br />

Fixed assets decreased by €363 million or 2.3%, to €15,181 million.<br />

Taking into account the negative currency effects of €174 million,<br />

fixed assets adjusted by these effects declined by only €189 million,<br />

thus remaining nearly constant. Additions of €1,609 million exceeded<br />

depreciation of €1,516 million by €93 million. Disposals amounted to<br />

€345 million. Changes in the scope of consolidation, i.e. acquisition and<br />

divestitures of companies, increased the fixed assets by €63 million.<br />

Major individual transactions consisted of the acquisition of the Korean<br />

elevator companies Dongyang Group and a 60 % interest in the<br />

automotive sub-supplier Mercedes Benz Lenkungen (MB Lenk),<br />

resulting in a total increase of €245 million. The divestitures of major<br />

individual transactions led to a decline of €237 million.<br />

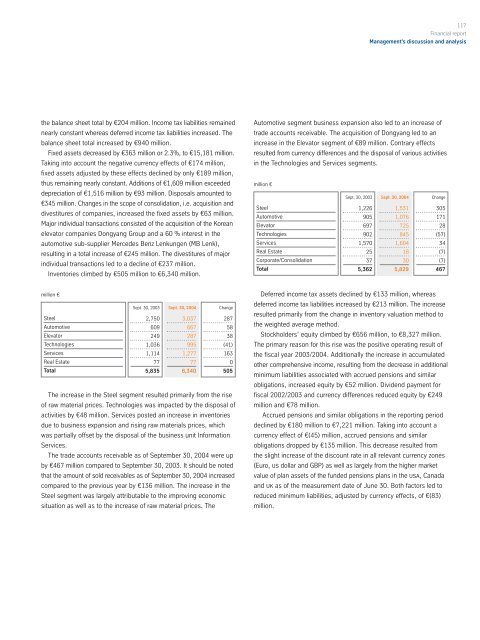

Inventories climbed by €505 million to €6,340 million.<br />

million €<br />

Steel<br />

Automotive<br />

Elevator<br />

Technologies<br />

Services<br />

Real Estate<br />

Total<br />

Sept. 30, <strong>2003</strong><br />

2,750<br />

Change<br />

The increase in the Steel segment resulted primarily from the rise<br />

of raw material prices. Technologies was impacted by the disposal of<br />

activities by €48 million. Services posted an increase in inventories<br />

due to business expansion and rising raw materials prices, which<br />

was partially offset by the disposal of the business unit Information<br />

Services.<br />

The trade accounts receivable as of September 30, <strong>2004</strong> were up<br />

by €467 million compared to September 30, <strong>2003</strong>. It should be noted<br />

that the amount of sold receivables as of September 30, <strong>2004</strong> increased<br />

compared to the previous year by €136 million. The increase in the<br />

Steel segment was largely attributable to the improving economic<br />

situation as well as to the increase of raw material prices. The<br />

609<br />

249<br />

1,036<br />

1,114<br />

77<br />

5,835<br />

Sept. 30, <strong>2004</strong><br />

3,037<br />

667<br />

287<br />

995<br />

1,277<br />

77<br />

6,340<br />

287<br />

58<br />

38<br />

(41)<br />

163<br />

0<br />

505<br />

117<br />

Financial report<br />

Management’s discussion and analysis<br />

Automotive segment business expansion also led to an increase of<br />

trade accounts receivable. The acquisition of Dongyang led to an<br />

increase in the Elevator segment of €89 million. Contrary effects<br />

resulted from currency differences and the disposal of various activities<br />

in the Technologies and Services segments.<br />

million €<br />

Steel<br />

Automotive<br />

Elevator<br />

Technologies<br />

Services<br />

Real Estate<br />

Corporate/Consolidation<br />

Total<br />

Sept. 30, <strong>2003</strong><br />

1,226<br />

Change<br />

Deferred income tax assets declined by €133 million, whereas<br />

deferred income tax liabilities increased by €213 million. The increase<br />

resulted primarily from the change in inventory valuation method to<br />

the weighted average method.<br />

Stockholders’ equity climbed by €656 million, to €8,327 million.<br />

The primary reason for this rise was the positive operating result of<br />

the fiscal year <strong>2003</strong>/<strong>2004</strong>. Additionally the increase in accumulated<br />

other comprehensive income, resulting from the decrease in additional<br />

minimum liabilities associated with accrued pensions and similar<br />

obligations, increased equity by €52 million. Dividend payment for<br />

fiscal 2002/<strong>2003</strong> and currency differences reduced equity by €249<br />

million and €78 million.<br />

Accrued pensions and similar obligations in the reporting period<br />

declined by €180 million to €7,221 million. Taking into account a<br />

currency effect of €(45) million, accrued pensions and similar<br />

obligations dropped by €135 million. This decrease resulted from<br />

the slight increase of the discount rate in all relevant currency zones<br />

(Euro, us dollar and GBP) as well as largely from the higher market<br />

value of plan assets of the funded pensions plans in the usa, Canada<br />

and uk as of the measurement date of June 30. Both factors led to<br />

reduced minimum liabilities, adjusted by currency effects, of €(83)<br />

million.<br />

905<br />

697<br />

902<br />

1,570<br />

25<br />

37<br />

5,362<br />

Sept. 30, <strong>2004</strong><br />

1,531<br />

1,076<br />

725<br />

845<br />

1,604<br />

18<br />

30<br />

5,829<br />

305<br />

171<br />

28<br />

(57)<br />

34<br />

(7)<br />

(7)<br />

467