Annual Report 2003 2004

Annual Report 2003 2004

Annual Report 2003 2004

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

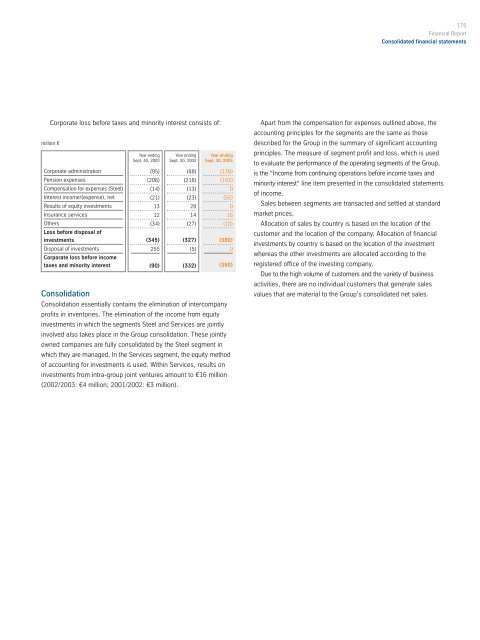

Corporate loss before taxes and minority interest consists of:<br />

million €<br />

Corporate administration<br />

Pension expenses<br />

Compensation for expenses (Steel)<br />

Interest income/(expense), net<br />

Results of equity investments<br />

Insurance services<br />

Others<br />

Loss before disposal of<br />

investments<br />

Disposal of investments<br />

Corporate loss before income<br />

taxes and minority interest<br />

Year ending<br />

Sept. 30, 2002<br />

Consolidation<br />

Consolidation essentially contains the elimination of intercompany<br />

profits in inventories. The elimination of the income from equity<br />

investments in which the segments Steel and Services are jointly<br />

involved also takes place in the Group consolidation. These jointly<br />

owned companies are fully consolidated by the Steel segment in<br />

which they are managed. In the Services segment, the equity method<br />

of accounting for investments is used. Within Services, results on<br />

investments from intra-group joint ventures amount to €16 million<br />

(2002/<strong>2003</strong>: €4 million; 2001/2002: €3 million).<br />

(95)<br />

(206)<br />

(14)<br />

(21)<br />

13<br />

12<br />

(34)<br />

(345)<br />

255<br />

(90)<br />

Year ending<br />

Sept. 30, <strong>2003</strong><br />

(88)<br />

(218)<br />

(13)<br />

(23)<br />

28<br />

14<br />

(27)<br />

(327)<br />

(5)<br />

(332)<br />

Year ending<br />

Sept. 30, <strong>2004</strong><br />

(138)<br />

(193)<br />

0<br />

(55)<br />

0<br />

16<br />

(10)<br />

(380)<br />

0<br />

(380)<br />

175<br />

Financial <strong>Report</strong><br />

Consolidated financial statements<br />

Apart from the compensation for expenses outlined above, the<br />

accounting principles for the segments are the same as those<br />

described for the Group in the summary of significant accounting<br />

principles. The measure of segment profit and loss, which is used<br />

to evaluate the performance of the operating segments of the Group,<br />

is the “Income from continuing operations before income taxes and<br />

minority interest“ line item presented in the consolidated statements<br />

of income.<br />

Sales between segments are transacted and settled at standard<br />

market prices.<br />

Allocation of sales by country is based on the location of the<br />

customer and the location of the company. Allocation of financial<br />

investments by country is based on the location of the investment<br />

whereas the other investments are allocated according to the<br />

registered office of the investing company.<br />

Due to the high volume of customers and the variety of business<br />

activities, there are no individual customers that generate sales<br />

values that are material to the Group’s consolidated net sales.