Annual Report 2003 2004

Annual Report 2003 2004

Annual Report 2003 2004

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

140<br />

The final purchase price allocation resulted in goodwill of €9 million<br />

which has been assigned entirely to the acquired company. No goodwill<br />

is deductible for tax purposes.<br />

On July 25, <strong>2003</strong>, ThyssenKrupp acquired 100% of the shares of<br />

Sofedit s.a., located in Versailles, France (“Sofedit”), in the Automotive<br />

segment, for a purchase price of €66 million consisting of €14 million<br />

in cash and the assumption of debt of €52 million. Sofedit produces<br />

automotive stampings and assemblies as well as chassis, body and<br />

cockpit modules in France, Brazil, Poland and Spain. The acquisition<br />

will strengthen ThyssenKrupp Automotive’s leading positions in the<br />

Body and Chassis businesses. The results of these operations have<br />

been included in the consolidated financial statements since July 01,<br />

<strong>2003</strong>.<br />

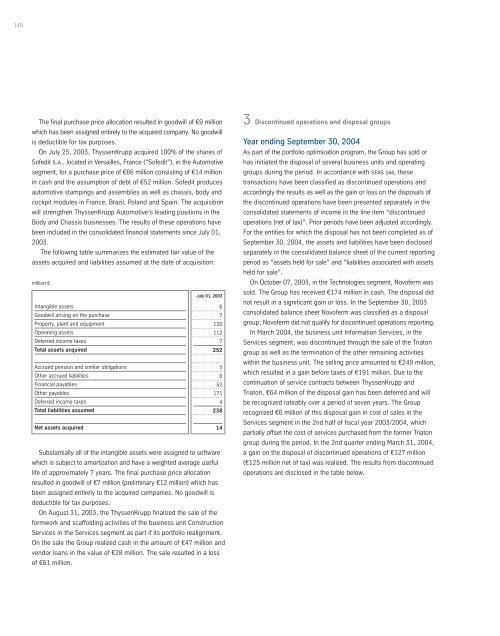

The following table summarizes the estimated fair value of the<br />

assets acquired and liabilities assumed at the date of acquisition:<br />

million €<br />

Intangible assets<br />

Goodwill arising on the purchase<br />

Property, plant and equipment<br />

Operating assets<br />

Deferred income taxes<br />

Total assets acquired<br />

Accrued pension and similar obligations<br />

Other accrued liabilities<br />

Financial payables<br />

Other payables<br />

Deferred income taxes<br />

Total liabilities assumed<br />

Net assets acquired<br />

July 01, <strong>2003</strong><br />

Substantially all of the intangible assets were assigned to software<br />

which is subject to amortization and have a weighted average useful<br />

life of approximately 7 years. The final purchase price allocation<br />

resulted in goodwill of €7 million (preliminary €12 million) which has<br />

been assigned entirely to the acquired companies. No goodwill is<br />

deductible for tax purposes.<br />

On August 31, <strong>2003</strong>, the ThyssenKrupp finalized the sale of the<br />

formwork and scaffolding activities of the business unit Construction<br />

Services in the Services segment as part if its portfolio realignment.<br />

On the sale the Group realized cash in the amount of €47 million and<br />

vendor loans in the value of €28 million. The sale resulted in a loss<br />

of €61 million.<br />

6<br />

7<br />

120<br />

112<br />

7<br />

252<br />

5<br />

6<br />

52<br />

171<br />

4<br />

238<br />

14<br />

3 Discontinued operations and disposal groups<br />

Year ending September 30, <strong>2004</strong><br />

As part of the portfolio optimization program, the Group has sold or<br />

has initiated the disposal of several business units and operating<br />

groups during the period. In accordance with sfas 144, these<br />

transactions have been classified as discontinued operations and<br />

accordingly the results as well as the gain or loss on the disposals of<br />

the discontinued operations have been presented separately in the<br />

consolidated statements of income in the line item “discontinued<br />

operations (net of tax)”. Prior periods have been adjusted accordingly.<br />

For the entities for which the disposal has not been completed as of<br />

September 30, <strong>2004</strong>, the assets and liabilities have been disclosed<br />

separately in the consolidated balance sheet of the current reporting<br />

period as “assets held for sale” and “liabilities associated with assets<br />

held for sale”.<br />

On October 07, <strong>2003</strong>, in the Technologies segment, Novoferm was<br />

sold. The Group has received €174 million in cash. The disposal did<br />

not result in a significant gain or loss. In the September 30, <strong>2003</strong><br />

consolidated balance sheet Novoferm was classified as a disposal<br />

group; Novoferm did not qualify for discontinued operations reporting.<br />

In March <strong>2004</strong>, the business unit Information Services, in the<br />

Services segment, was discontinued through the sale of the Triaton<br />

group as well as the termination of the other remaining activities<br />

within the business unit. The selling price amounted to €249 million,<br />

which resulted in a gain before taxes of €191 million. Due to the<br />

continuation of service contracts between ThyssenKrupp and<br />

Triaton, €64 million of the disposal gain has been deferred and will<br />

be recognized rateably over a period of seven years. The Group<br />

recognized €6 million of this disposal gain in cost of sales in the<br />

Services segment in the 2nd half of fiscal year <strong>2003</strong>/<strong>2004</strong>, which<br />

partially offset the cost of services purchased from the former Triaton<br />

group during the period. In the 2nd quarter ending March 31, <strong>2004</strong>,<br />

a gain on the disposal of discontinued operations of €127 million<br />

(€125 million net of tax) was realized. The results from discontinued<br />

operations are disclosed in the table below.