Annual Report 2003 2004

Annual Report 2003 2004

Annual Report 2003 2004

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

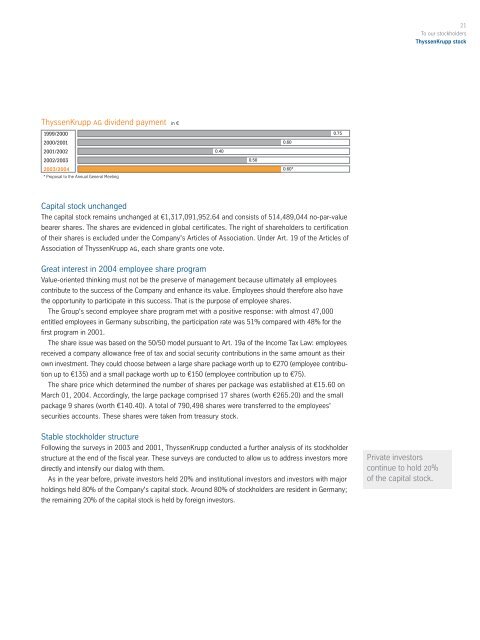

ThyssenKrupp ag dividend payment in €<br />

1999/2000<br />

2000/2001<br />

2001/2002<br />

2002/<strong>2003</strong><br />

<strong>2003</strong>/<strong>2004</strong><br />

* Proposal to the <strong>Annual</strong> General Meeting<br />

Capital stock unchanged<br />

The capital stock remains unchanged at €1,317,091,952.64 and consists of 514,489,044 no-par-value<br />

bearer shares. The shares are evidenced in global certificates. The right of shareholders to certification<br />

of their shares is excluded under the Company's Articles of Association. Under Art. 19 of the Articles of<br />

Association of ThyssenKrupp ag, each share grants one vote.<br />

Great interest in <strong>2004</strong> employee share program<br />

Value-oriented thinking must not be the preserve of management because ultimately all employees<br />

contribute to the success of the Company and enhance its value. Employees should therefore also have<br />

the opportunity to participate in this success. That is the purpose of employee shares.<br />

The Group's second employee share program met with a positive response: with almost 47,000<br />

entitled employees in Germany subscribing, the participation rate was 51% compared with 48% for the<br />

first program in 2001.<br />

The share issue was based on the 50/50 model pursuant to Art. 19a of the Income Tax Law: employees<br />

received a company allowance free of tax and social security contributions in the same amount as their<br />

own investment. They could choose between a large share package worth up to €270 (employee contribution<br />

up to €135) and a small package worth up to €150 (employee contribution up to €75).<br />

The share price which determined the number of shares per package was established at €15.60 on<br />

March 01, <strong>2004</strong>. Accordingly, the large package comprised 17 shares (worth €265.20) and the small<br />

package 9 shares (worth €140.40). A total of 790,498 shares were transferred to the employees'<br />

securities accounts. These shares were taken from treasury stock.<br />

Stable stockholder structure<br />

Following the surveys in <strong>2003</strong> and 2001, ThyssenKrupp conducted a further analysis of its stockholder<br />

structure at the end of the fiscal year. These surveys are conducted to allow us to address investors more<br />

directly and intensify our dialog with them.<br />

As in the year before, private investors held 20% and institutional investors and investors with major<br />

holdings held 80% of the Company's capital stock. Around 80% of stockholders are resident in Germany;<br />

the remaining 20% of the capital stock is held by foreign investors.<br />

0.40<br />

0.50<br />

0.60<br />

0.60*<br />

0.75<br />

Private investors<br />

continue to hold 20%<br />

of the capital stock.<br />

21<br />

To our stockholders<br />

ThyssenKrupp stock