Annual Report 2003 2004

Annual Report 2003 2004

Annual Report 2003 2004

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

134<br />

Research and development costs<br />

Research and development costs are expensed as incurred.<br />

Earnings per share<br />

Basic earnings per share are computed by dividing the Group’s net<br />

income by the weighted average number of shares outstanding.<br />

Shares issued during the period and shares reacquired during the<br />

period are weighted for the portion of the period that they were<br />

outstanding. There were no dilutive securities in the periods<br />

presented.<br />

Intangible assets<br />

Purchased intangible assets with definite useful lives are capitalized<br />

and amortized on a straight-line basis over their estimated useful<br />

lives. For identifiable internally developed intangible assets, only the<br />

direct external costs incurred in generating these assets are<br />

capitalized and amortized on a straight-line basis over their<br />

estimated useful life. The Group reviews its intangible assets with<br />

definite useful lives for impairment whenever events or changes in<br />

circumstances indicate that the carrying amount of its assets may<br />

not be recoverable.<br />

Costs incurred in connection with the acquisition and selfdevelopment<br />

of internally used computer software, inclusive of the<br />

costs for transforming such software into an operational condition,<br />

are capitalized and amortized on a straight-line basis over its<br />

estimated useful life, usually 3 to 5 years.<br />

Costs incurred during the preliminary stage of internal use<br />

computer software projects are expensed as incurred.<br />

In accordance with sfas 142, the Group evaluates goodwill and<br />

indefinite lived intangible assets for impairment on an annual basis<br />

and between annual test dates if events or changes in<br />

circumstances indicate that the asset may be impaired. The<br />

adoption of sfas 142 resulted in a goodwill impairment of €347<br />

million (€338 million net of tax) or €0.66 per share, which has been<br />

reported as a change in accounting principle in fiscal year<br />

2001/2002. Based on the Group’s annual impairment test, no<br />

goodwill impairment charges have been necessary since the<br />

adoption of the Standard.<br />

Property, plant and equipment<br />

Property, plant and equipment are valued at acquisition or<br />

production cost less accumulated depreciation. Capitalized<br />

production costs for internally developed assets include direct<br />

material, labor, and allocable material and manufacturing overhead<br />

costs. When production activities are performed over an extended<br />

period, interest costs incurred during production are capitalized.<br />

Administrative costs are capitalized only if such costs are directly<br />

related to production. Maintenance and repair costs are expensed as<br />

incurred. Costs for activities that lead to the prolongation of useful<br />

life or to expand future use capabilities of an asset are capitalized.<br />

Property, plant and equipment are primarily depreciated using the<br />

straight-line method. Upon sale or retirement, the acquisition or<br />

production cost and related accumulated depreciation are removed<br />

from the balance sheet and any gain or loss is included in the<br />

consolidated statement of income.<br />

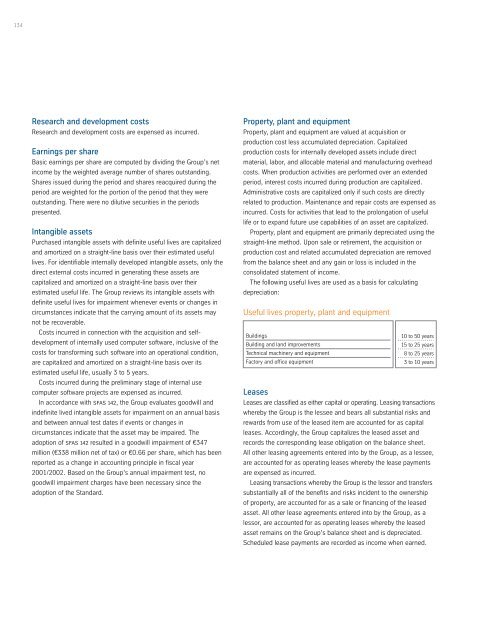

The following useful lives are used as a basis for calculating<br />

depreciation:<br />

Useful lives property, plant and equipment<br />

Buildings<br />

Building and land improvements<br />

Technical machinery and equipment<br />

Factory and office equipment<br />

10 to 50 years<br />

15 to 25 years<br />

8 to 25 years<br />

3 to 10 years<br />

Leases<br />

Leases are classified as either capital or operating. Leasing transactions<br />

whereby the Group is the lessee and bears all substantial risks and<br />

rewards from use of the leased item are accounted for as capital<br />

leases. Accordingly, the Group capitalizes the leased asset and<br />

records the corresponding lease obligation on the balance sheet.<br />

All other leasing agreements entered into by the Group, as a lessee,<br />

are accounted for as operating leases whereby the lease payments<br />

are expensed as incurred.<br />

Leasing transactions whereby the Group is the lessor and transfers<br />

substantially all of the benefits and risks incident to the ownership<br />

of property, are accounted for as a sale or financing of the leased<br />

asset. All other lease agreements entered into by the Group, as a<br />

lessor, are accounted for as operating leases whereby the leased<br />

asset remains on the Group’s balance sheet and is depreciated.<br />

Scheduled lease payments are recorded as income when earned.