Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

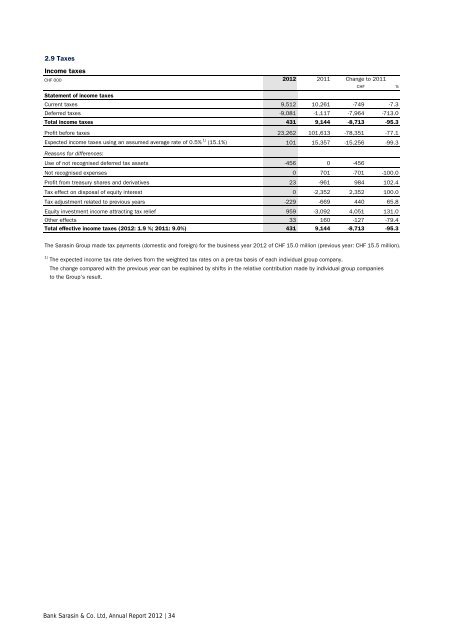

2.9 Taxes<br />

Income taxes<br />

CHF 000 <strong>2012</strong> 2011<br />

Statement of income taxes<br />

Change to 2011<br />

CHF %<br />

Current taxes 9,512 10,261 -749 -7.3<br />

Deferred taxes -9,081 -1,117 -7,964 -713.0<br />

Total income taxes 431 9,144 -8,713 -95.3<br />

Profit before taxes 23,262 101,613 -78,351 -77.1<br />

Expected income taxes using an assumed average rate of 0.5% 1) (15.1%) 101 15,357 -15,256 -99.3<br />

Reasons for differences:<br />

Use of not recognised deferred tax assets -456 0 -456<br />

Not recognised expenses 0 701 -701 -100.0<br />

Profit from treasury shares and derivatives 23 -961 984 102.4<br />

Tax effect on disposal of equity interest 0 -2,352 2,352 100.0<br />

Tax adjustment related to previous years -229 -669 440 65.8<br />

Equity investment income attracting tax relief 959 -3,092 4,051 131.0<br />

Other effects 33 160 -127 -79.4<br />

Total effective income taxes (<strong>2012</strong>: 1.9 %; 2011: 9.0%) 431 9,144 -8,713 -95.3<br />

The <strong>Sarasin</strong> Group made tax payments (domestic and foreign) for the business year <strong>2012</strong> of CHF 15.0 million (previous year: CHF 15.5 million).<br />

1) The expected income tax rate derives from the weighted tax rates on a pre-tax basis of each individual group company.<br />

The change compared with the previous year can be explained by shifts in the relative contribution made by individual group companies<br />

to the Group’s result.<br />

<strong>Bank</strong> <strong>Sarasin</strong> & Co. Ltd, <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> | 34