Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

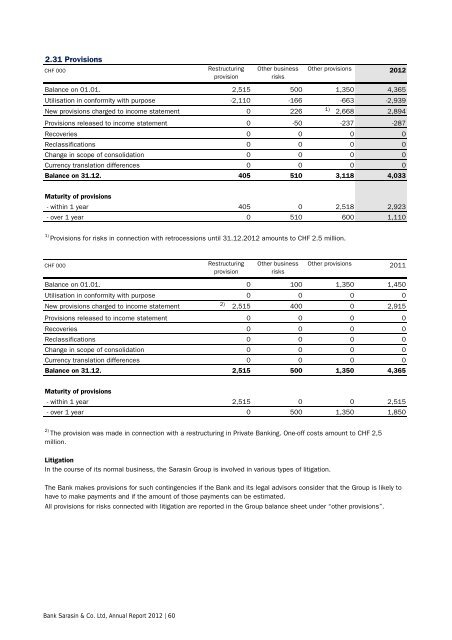

2.31 Provisions<br />

CHF 000 Restructuring Other business Other provisions<br />

<strong>2012</strong><br />

provision<br />

risks<br />

Balance on 01.01. 2,515 500 1,350 4,365<br />

Utilisation in conformity with purpose -2,110 -166 -663 -2,939<br />

New provisions charged to income statement 0 226 1) 2,668 2,894<br />

Provisions released to income statement 0 -50 -237 -287<br />

Recoveries 0 0 0 0<br />

Reclassifications 0 0 0 0<br />

Change in scope of consolidation 0 0 0 0<br />

Currency translation differences 0 0 0 0<br />

Balance on 31.12. 405 510 3,118 4,033<br />

Maturity of provisions<br />

- within 1 year 405 0 2,518 2,923<br />

- over 1 year 0 510 600 1,110<br />

1)<br />

Provisions for risks in connection with retrocessions until 31.12.<strong>2012</strong> amounts to CHF 2.5 million.<br />

CHF 000 Restructuring Other business Other provisions<br />

2011<br />

provision<br />

risks<br />

Balance on 01.01. 0 100 1,350 1,450<br />

Utilisation in conformity with purpose 0 0 0 0<br />

New provisions charged to income statement 2) 2,515 400 0 2,915<br />

Provisions released to income statement 0 0 0 0<br />

Recoveries 0 0 0 0<br />

Reclassifications 0 0 0 0<br />

Change in scope of consolidation 0 0 0 0<br />

Currency translation differences 0 0 0 0<br />

Balance on 31.12. 2,515 500 1,350 4,365<br />

Maturity of provisions<br />

- within 1 year 2,515 0 0 2,515<br />

- over 1 year 0 500 1,350 1,850<br />

2)<br />

The provision was made in connection with a restructuring in Private <strong>Bank</strong>ing. One-off costs amount to CHF 2,5<br />

million.<br />

Litigation<br />

In the course of its normal business, the <strong>Sarasin</strong> Group is involved in various types of litigation.<br />

The <strong>Bank</strong> makes provisions for such contingencies if the <strong>Bank</strong> and its legal advisors consider that the Group is likely to<br />

have to make payments and if the amount of those payments can be estimated.<br />

All provisions for risks connected with litigation are reported in the Group balance sheet under “other provisions”.<br />

<strong>Bank</strong> <strong>Sarasin</strong> & Co. Ltd, <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> | 60