Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

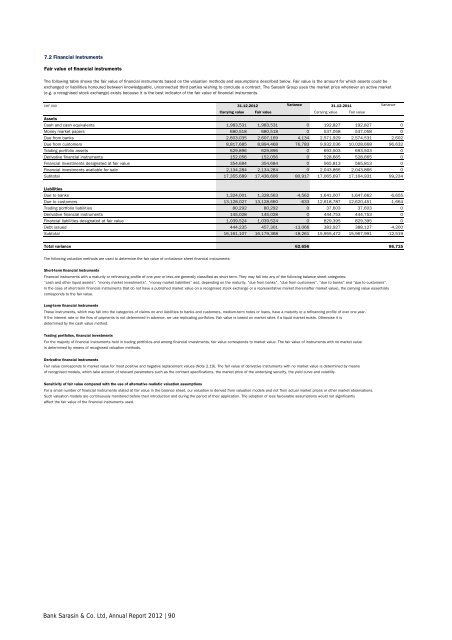

7.2 Financial Instruments<br />

Fair value of financial instruments<br />

The following table shows the fair value of financial instruments based on the valuation methods and assumptions described below. Fair value is the amount for which assets could be<br />

exchanged or liabilities honoured between knowledgeable, unconnected third parties wishing to conclude a contract. The <strong>Sarasin</strong> Group uses the market price whenever an active market<br />

(e.g. a recognised stock exchange) exists because it is the best indicator of the fair value of financial instruments.<br />

CHF 000 31.12.<strong>2012</strong> Variance 31.12.2011<br />

Variance<br />

Carrying value Fair value Carrying value Fair value<br />

Assets<br />

Cash and cash equivalents 1,983,531 1,983,531 0 192,827 192,827 0<br />

Money market papers 680,518 680,518 0 537,058 537,058 0<br />

Due from banks 2,603,035 2,607,169 4,134 2,571,929 2,574,531 2,602<br />

Due from customers 8,817,685 8,894,468 76,783 9,932,036 10,028,668 96,632<br />

Trading portfolio assets 629,896 629,896 0 693,503 693,503 0<br />

Derivative financial instruments 152,056 152,056 0 528,665 528,665 0<br />

Financial investments designated at fair value 354,684 354,684 0 565,813 565,813 0<br />

Financial investments available for sale 2,134,284 2,134,284 0 2,043,866 2,043,866 0<br />

Subtotal 17,355,689 17,436,606 80,917 17,065,697 17,164,931 99,234<br />

Liabilities<br />

Due to banks 1,324,001 1,328,563 -4,562 1,641,007 1,647,662 -6,655<br />

Due to customers 13,128,027 13,128,660 -633 12,618,787 12,620,451 -1,664<br />

Trading portfolio liabilities 80,292 80,292 0 37,603 37,603 0<br />

Derivative financial instruments 145,028 145,028 0 444,753 444,753 0<br />

Financial liabilities designated at fair value 1,039,524 1,039,524 0 829,395 829,395 0<br />

Debt issued 444,235 457,301 -13,066 383,927 388,127 -4,200<br />

Subtotal 16,161,107 16,179,368 -18,261 15,955,472 15,967,991 -12,519<br />

Total variance 62,656 86,715<br />

The following valuation methods are used to determine the fair value of on-balance sheet financial instruments:<br />

Short-term financial instruments<br />

Financial instruments with a maturity or refinancing profile of one year or less are generally classified as short term. They may fall into any of the following balance sheet categories:<br />

“cash and other liquid assets”, “money market investments”, “money market liabilities” and, depending on the maturity, “due from banks”, “due from customers”, “due to banks” and “due to customers”.<br />

In the case of short-term financial instruments that do not have a published market value on a recognised stock exchange or a representative market (hereinafter market value), the carrying value essentially<br />

corresponds to the fair value.<br />

Long-term financial instruments<br />

These instruments, which may fall into the categories of claims on and liabilities to banks and customers, medium-term notes or loans, have a maturity or a refinancing profile of over one year.<br />

If the interest rate or the flow of payments is not determined in advance, we use replicating portfolios. Fair value is based on market rates if a liquid market exists. Otherwise it is<br />

determined by the cash value method.<br />

Trading portfolios, financial investments<br />

For the majority of financial instruments held in trading portfolios and among financial investments, fair value corresponds to market value. The fair value of instruments with no market value<br />

is determined by means of recognised valuation methods.<br />

Derivative financial instruments<br />

Fair value corresponds to market value for most positive and negative replacement values (Note 2.19). The fair value of derivative instruments with no market value is determined by means<br />

of recognised models, which take account of relevant parameters such as the contract specifications, the market price of the underlying security, the yield curve and volatility.<br />

Sensitivity of fair value compared with the use of alternative realistic valuation assumptions<br />

For a small number of financial instruments stated at fair value in the balance sheet, our valuation is derived from valuation models and not from actual market prices or other market observations.<br />

Such valuation models are continuously monitored before their introduction and during the period of their application. The adoption of less favourable assumptions would not significantly<br />

affect the fair value of the financial instruments used.<br />

<strong>Bank</strong> <strong>Sarasin</strong> & Co. Ltd, <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> | 90