Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

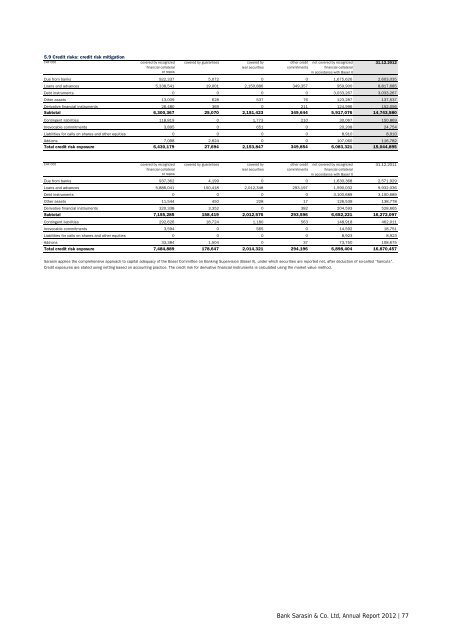

5.9 Credit risks: credit risk mitigation<br />

CHF 000 covered by recognized covered by guarantees covered by other credit not covered by recognized 31.12.<strong>2012</strong><br />

financial collateral real securities commitments financial collateral<br />

or repos<br />

in accordance with Basel II<br />

Due from banks 922,337 5,072 0 0 1,675,626 2,603,035<br />

Loans and advances 5,338,541 19,001 2,150,886 349,357 959,900 8,817,685<br />

Debt instruments 0 0 0 0 3,033,267 3,033,267<br />

Other assets 13,009 628 537 76 123,287 137,537<br />

Derivative financial instruments 26,480 369 0 211 124,996 152,056<br />

Subtotal 6,300,367 25,070 2,151,423 349,644 5,917,076 14,743,580<br />

Contingent liabilities 118,819 0 1,773 210 30,067 150,869<br />

Irrevocable commitments 3,895 0 651 0 20,208 24,754<br />

Liabilities for calls on shares and other equities 0 0 0 0 8,910 8,910<br />

Add-ons 7,098 2,624 0 0 107,060 116,782<br />

Total credit risk exposure 6,430,179 27,694 2,153,847 349,854 6,083,321 15,044,895<br />

CHF 000 covered by recognized covered by guarantees covered by other credit not covered by recognized 31.12.2011<br />

financial collateral real securities commitments financial collateral<br />

or repos<br />

in accordance with Basel II<br />

Due from banks 937,362 4,199 0 0 1,630,368 2,571,929<br />

Loans and advances 5,886,041 150,418 2,012,348 293,197 1,590,032 9,932,036<br />

Debt instruments 0 0 0 0 3,100,689 3,100,689<br />

Other assets 11,544 450 228 17 126,539 138,778<br />

Derivative financial instruments 320,338 3,352 0 382 204,593 528,665<br />

Subtotal 7,155,285 158,419 2,012,576 293,596 6,652,221 16,272,097<br />

Contingent liabilities 292,626 18,724 1,180 563 148,918 462,011<br />

Irrevocable commitments 3,594 0 565 0 14,592 18,751<br />

Liabilities for calls on shares and other equities 0 0 0 0 8,923 8,923<br />

Add-ons 33,384 1,504 0 37 73,750 108,675<br />

Total credit risk exposure 7,484,889 178,647 2,014,321 294,196 6,898,404 16,870,457<br />

<strong>Sarasin</strong> applies the comprehensive approach to capital adequacy of the Basel Committee on <strong>Bank</strong>ing Supervision (Basel II), under which securities are reported net, after deduction of so-called “haircuts”.<br />

Credit exposures are stated using netting based on accounting practice. The credit risk for derivative financial instruments is calculated using the market value method.<br />

<strong>Bank</strong> <strong>Sarasin</strong> & Co. Ltd, <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> | 77