Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

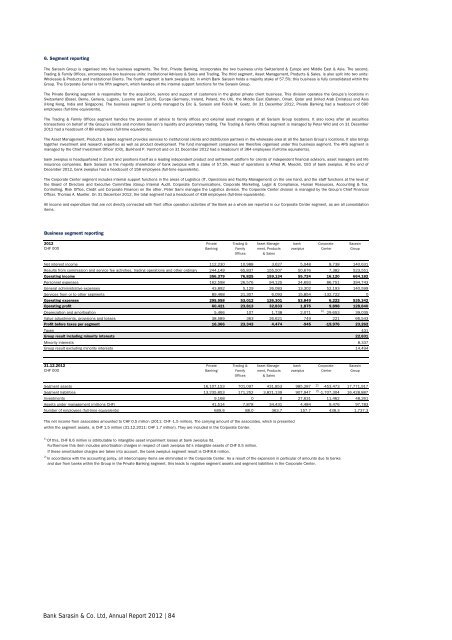

6. Segment reporting<br />

The <strong>Sarasin</strong> Group is organised into five business segments. The first, Private <strong>Bank</strong>ing, incorporates the two business units Switzerland & Europe and Middle East & Asia. The second,<br />

Trading & Family Offices, encompasses two business units: Institutional Advisory & Sales and Trading. The third segment, Asset Management, Products & Sales, is also split into two units:<br />

Wholesale & Products and Institutional Clients. The fourth segment is bank zweiplus ltd, in which <strong>Bank</strong> <strong>Sarasin</strong> holds a majority stake of 57.5%; this business is fully consolidated within the<br />

Group. The Corporate Center is the fifth segment, which handles all the internal support functions for the <strong>Sarasin</strong> Group.<br />

The Private <strong>Bank</strong>ing segment is responsible for the acquisition, service and support of customers in the global private client business. This division operates the Groups’s locations in<br />

Switzerland (Basel, Berne, Geneva, Lugano, Lucerne and Zurich), Europe (Germany, Ireland, Poland, the UK), the Middle East (Bahrain, Oman, Qatar and United Arab Emirates) and Asia<br />

(Hong Kong, India and Singapore). The business segment is jointly managed by Eric G. <strong>Sarasin</strong> and Fidelis M. Goetz. On 31 December <strong>2012</strong>, Private <strong>Bank</strong>ing had a headcount of 690<br />

employees (full-time equivalents).<br />

The Trading & Family Offices segment handles the provision of advice to family offices and external asset managers at all <strong>Sarasin</strong> Group locations. It also looks after all securities<br />

transactions on behalf of the Group's clients and monitors <strong>Sarasin</strong>’s liquidity and proprietary trading. The Trading & Family Offices segment is managed by Peter Wild and on 31 December<br />

<strong>2012</strong> had a headcount of 88 employees (full-time equivalents).<br />

The Asset Management, Products & Sales segment provides services to institutional clients and distribution partners in the wholesale area at all the <strong>Sarasin</strong> Group’s locations. It also brings<br />

together investment and research expertise as well as product development. The fund management companies are therefore organised under this business segment. The APS segment is<br />

managed by the Chief Investment Officer (CIO), Burkhard P. Varnholt and on 31 December <strong>2012</strong> had a headcount of 364 employees (full-time equivalents).<br />

bank zweiplus is headquartered in Zurich and positions itself as a leading independent product and settlement platform for clients of independent financial advisors, asset managers and life<br />

insurance companies. <strong>Bank</strong> <strong>Sarasin</strong> is the majority shareholder of bank zweiplus with a stake of 57.5%. Head of operations is Alfred W. Moeckli, CEO of bank zweiplus. At the end of<br />

December <strong>2012</strong>, bank zweiplus had a headcount of 158 employees (full-time equivalents).<br />

The Corporate Center segment includes internal support functions in the areas of Logistics (IT, Operations and Facility Management) on the one hand, and the staff functions at the level of<br />

the Board of Directors and Executive Committee (Group Internal Audit, Corporate Communications, Corporate Marketing, Legal & Compliance, Human Resources, Accounting & Tax,<br />

Controlling, Risk Office, Credit und Corporate Finance) on the other. Peter Sami manages the Logistics division. The Corporate Center division is managed by the Group’s Chief Financial<br />

Officer, Thomas A. Mueller. On 31 December <strong>2012</strong>, the total segment had a headcount of 438 employees (full-time equivalents).<br />

All income and expenditure that are not directly connected with front office operation activities of the <strong>Bank</strong> as a whole are reported in our Corporate Center segment, as are all consolidation<br />

items.<br />

Business segment reporting<br />

<strong>2012</strong> Private Trading & Asset Manage- bank Corporate <strong>Sarasin</strong><br />

CHF 000 <strong>Bank</strong>ing Family ment, Products zweiplus Center Group<br />

Offices & Sales<br />

Net interest income 112,230 10,988 3,627 5,048 8,738 140,631<br />

Results from commission and service fee activities, trading operations and other ordinary 244,149 65,837 155,507 50,676 7,382 523,551<br />

Operating income 356,379 76,825 159,134 55,724 16,120 664,182<br />

Personnel expenses 162,598 26,576 94,125 24,693 86,751 394,743<br />

General administrative expenses 43,892 5,129 26,083 13,302 52,193 140,599<br />

Services from or to other segments 89,468 21,307 6,093 15,854 -132,722 0<br />

Operating expenses 295,958 53,012 126,301 53,849 6,222 535,342<br />

Operating profit 60,421 23,813 32,833 1,875 9,898 128,840<br />

Depreciation and amortisation 5,466 107 1,738 2,071<br />

1)<br />

29,653 39,035<br />

Value adjustments, provisions and losses 38,589 363 26,621 749 221 66,543<br />

Profit before taxes per segment 16,366 23,343 4,474 -945 -19,976 23,262<br />

Taxes 431<br />

Group result including minority interests 22,831<br />

Minority interests 8,337<br />

Group result excluding minority interests 14,494<br />

31.12.<strong>2012</strong> Private Trading & Asset Manage- bank Corporate <strong>Sarasin</strong><br />

CHF 000 <strong>Bank</strong>ing Family ment, Products zweiplus Center Group<br />

Offices & Sales<br />

Segment assets 16,107,153 701,097 431,853 985,287 2) -453,473 17,771,917<br />

Segment liabilities 13,235,853 171,252 3,821,139 907,947 2) -1,707,304 16,428,887<br />

Investments 9,168 0 0 27,631 11,462 48,261<br />

Assets under management (millions CHF) 41,514 7,878 34,431 4,484 9,476 97,783<br />

Number of employees (full-time equivalents) 689.6 88.0 363.7 157.7 438.3 1,737.3<br />

The net income from associates amounted to CHF 0.5 million (2011: CHF -1.5 million). The carrying amount of the associates, which is presented<br />

within the segment assets, is CHF 1.5 million (31.12.2011: CHF 1.7 million). They are included in the Corporate Center.<br />

1)<br />

Of this, CHF 6.6 million is attributable to intangible asset impairment losses at bank zweiplus ltd.<br />

Furthermore this item includes amortisation charges in respect of cash zweiplus ltd’s intangible assets of CHF 0.5 million.<br />

If these amortisation charges are taken into account, the bank zweiplus segment result is CHF-8.6 million.<br />

2)<br />

In accordance with the accounting policy, all intercompany items are eliminated in the Corporate Center. As a result of the expansion in particular of amounts due to banks<br />

and due from banks within the Group in the Private <strong>Bank</strong>ing segment, this leads to negative segment assets and segment liabilities in the Corporate Center.<br />

<strong>Bank</strong> <strong>Sarasin</strong> & Co. Ltd, <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> | 84