Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

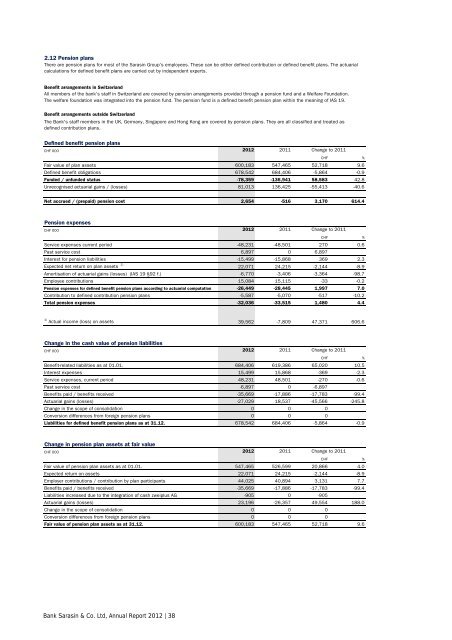

2.12 Pension plans<br />

There are pension plans for most of the <strong>Sarasin</strong> Group’s employees. These can be either defined contribution or defined benefit plans. The actuarial<br />

calculations for defined benefit plans are carried out by independent experts.<br />

Benefit arrangements in Switzerland<br />

All members of the bank’s staff in Switzerland are covered by pension arrangements provided through a pension fund and a Welfare Foundation.<br />

The welfare foundation was integrated into the pension fund. The pension fund is a defined benefit pension plan within the meaning of IAS 19.<br />

Benefit arrangements outside Switzerland<br />

The <strong>Bank</strong>'s staff members in the UK, Germany, Singapore and Hong Kong are covered by pension plans. They are all classified and treated as<br />

defined contribution plans.<br />

Defined benefit pension plans<br />

CHF 000 <strong>2012</strong> 2011 Change to 2011<br />

CHF %<br />

Fair value of plan assets 600,183 547,465 52,718 9.6<br />

Defined benefit obligations 678,542 684,406 -5,864 -0.9<br />

Funded / unfunded status -78,359 -136,941 58,583 42.8<br />

Unrecognised actuarial gains / (losses) 81,013 136,425 -55,413 -40.6<br />

Net accrued / (prepaid) pension cost 2,654 -516 3,170 614.4<br />

Pension expenses<br />

CHF 000 <strong>2012</strong> 2011 Change to 2011<br />

CHF %<br />

Service expenses current period -48,231 -48,501 270 0.6<br />

Past service cost 6,897 0 6,897<br />

Interest for pension liabilities -15,499 -15,868 369 2.3<br />

Expected net return on plan assets 1) 22,071 24,215 -2,144 -8.9<br />

Amortisation of actuarial gains (losses) (IAS 19 §92 f.) -6,770 -3,406 -3,364 -98.7<br />

Employee contributions 15,084 15,115 -33 -0.2<br />

Pension expenses for defined benefit pension plans according to actuarial computation -26,449 -28,445 1,997 7.0<br />

Contribution to defined contribution pension plans -5,587 -5,070 -517 -10.2<br />

Total pension expenses -32,036 -33,515 1,480 4.4<br />

1) Actual income (loss) on assets 39,562 -7,809 47,371 606.6<br />

Change in the cash value of pension liabilities<br />

CHF 000 <strong>2012</strong> 2011 Change to 2011<br />

CHF %<br />

Benefit-related liabilities as at 01.01. 684,406 619,386 65,020 10.5<br />

Interest expenses 15,499 15,868 -369 -2.3<br />

Service expenses, current period 48,231 48,501 -270 -0.6<br />

Past service cost -6,897 0 -6,897<br />

Benefits paid / benefits received -35,669 -17,886 -17,783 -99.4<br />

Actuarial gains (losses) -27,029 18,537 -45,566 -245.8<br />

Change in the scope of consolidation 0 0 0<br />

Conversion differences from foreign pension plans 0 0 0<br />

Liabilities for defined benefit pension plans as at 31.12. 678,542 684,406 -5,864 -0.9<br />

Change in pension plan assets at fair value<br />

CHF 000 <strong>2012</strong> 2011 Change to 2011<br />

CHF %<br />

Fair value of pension plan assets as at 01.01. 547,465 526,599 20,866 4.0<br />

Expected return on assets 22,071 24,215 -2,144 -8.9<br />

Employer contributions / contribution by plan participants 44,025 40,894 3,131 7.7<br />

Benefits paid / benefits received -35,669 -17,886 -17,783 -99.4<br />

Liabilities increased due to the integration of cash zweiplus AG -905 0 -905<br />

Actuarial gains (losses) 23,196 -26,357 49,554 188.0<br />

Change in the scope of consolidation 0 0 0<br />

Conversion differences from foreign pension plans 0 0 0<br />

Fair value of pension plan assets as at 31.12. 600,183 547,465 52,718 9.6<br />

<strong>Bank</strong> <strong>Sarasin</strong> & Co. Ltd, <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> | 38