Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

Annual Report 2012 - Bank Sarasin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

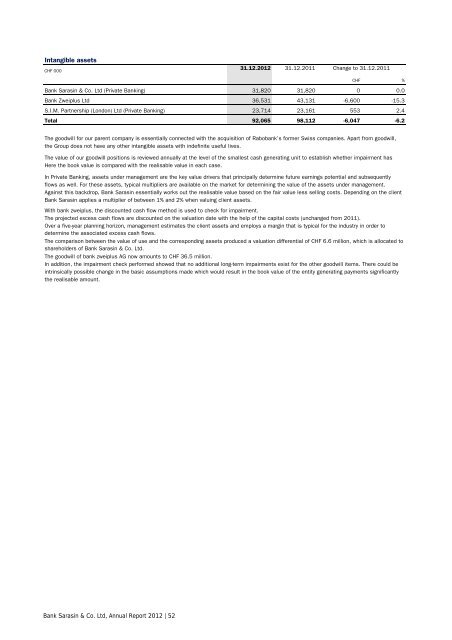

Intangible assets<br />

CHF 000<br />

31.12.<strong>2012</strong> 31.12.2011<br />

Change to 31.12.2011<br />

CHF %<br />

<strong>Bank</strong> <strong>Sarasin</strong> & Co. Ltd (Private <strong>Bank</strong>ing) 31,820 31,820 0 0.0<br />

<strong>Bank</strong> Zweiplus Ltd 36,531 43,131 -6,600 -15.3<br />

S.I.M. Partnership (London) Ltd (Private <strong>Bank</strong>ing) 23,714 23,161 553 2.4<br />

Total 92,065 98,112 -6,047 -6.2<br />

The goodwill for our parent company is essentially connected with the acquisition of Rabobank’s former Swiss companies. Apart from goodwill,<br />

the Group does not have any other intangible assets with indefinite useful lives.<br />

The value of our goodwill positions is reviewed annually at the level of the smallest cash generating unit to establish whether impairment has<br />

Here the book value is compared with the realisable value in each case.<br />

In Private <strong>Bank</strong>ing, assets under management are the key value drivers that principally determine future earnings potential and subsequently<br />

flows as well. For these assets, typical multipliers are available on the market for determining the value of the assets under management.<br />

Against this backdrop, <strong>Bank</strong> <strong>Sarasin</strong> essentially works out the realisable value based on the fair value less selling costs. Depending on the client<br />

<strong>Bank</strong> <strong>Sarasin</strong> applies a multiplier of between 1% and 2% when valuing client assets.<br />

With bank zweiplus, the discounted cash flow method is used to check for impairment.<br />

The projected excess cash flows are discounted on the valuation date with the help of the capital costs (unchanged from 2011).<br />

Over a five-year planning horizon, management estimates the client assets and employs a margin that is typical for the industry in order to<br />

determine the associated excess cash flows.<br />

The comparison between the value of use and the corresponding assets produced a valuation differential of CHF 6.6 million, which is allocated to<br />

shareholders of <strong>Bank</strong> <strong>Sarasin</strong> & Co. Ltd.<br />

The goodwill of bank zweiplus AG now amounts to CHF 36.5 million.<br />

In addition, the impairment check performed showed that no additional long-term impairments exist for the other goodwill items. There could be<br />

intrinsically possible change in the basic assumptions made which would result in the book value of the entity generating payments significantly<br />

the realisable amount.<br />

<strong>Bank</strong> <strong>Sarasin</strong> & Co. Ltd, <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> | 52