2005 Annual Report - Touax

2005 Annual Report - Touax

2005 Annual Report - Touax

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Risk factors<br />

These risks or any of these or other risks, not currently<br />

identified or considered to be insignificant by<br />

TOUAX, may have a negative effect on the business,<br />

financial position or results of TOUAX, or on its share<br />

price.<br />

Dependence factors<br />

The Group is not significantly dependent on any holders<br />

of patents or licenses, industrial, commercial<br />

or financial supply contracts, new manufacturing<br />

processes, suppliers or public authorities.<br />

Leasing is a recurrent and stable activity. Leasing<br />

revenues consequently have low volatility. The business<br />

sectors are distinct and the customers and<br />

suppliers in each business are different. The businesses<br />

use low-technology equipment which is easy<br />

to construct. In each of its businesses, the Group has<br />

diversified customers and suppliers and is not in a<br />

significant position of Dependence on any of its customers<br />

or suppliers.<br />

Management on behalf of third parties is also a<br />

recurrent activity. However, the conclusion of new<br />

management programs and hence equipment sales<br />

or asset disposals may fluctuate widely from one<br />

quarter to the next or from one year to the next. To<br />

minimize the risk of Dependence on investors, the<br />

Group seeks to increase and diversify the number of<br />

investors with whom it operates. However, it should<br />

be noted that 61.5% of revenues from equipment<br />

sales were generated with a single investor in <strong>2005</strong>.<br />

In other words, the Group concluded several new<br />

management programs in <strong>2005</strong>, the most significant<br />

of which represents 61.5% of equipment sales.<br />

Risk factors<br />

Market risk<br />

The Group does not have any open positions in the<br />

derivative markets and has not used any speculative<br />

financial instrument which could have significantly<br />

exposed it to financial risks.<br />

The Group’s financial flows are therefore only exposed<br />

to changes in interest and exchange rates up to<br />

the level of its foreign currency positions and borrowings<br />

from financial institutions.<br />

Interest rate and currency risks are monitored by<br />

means of monthly reports prepared by subsidiaries<br />

for the Group Treasury department; these reports<br />

include loans granted by external institutions and<br />

loans concluded between the subsidiaries of the<br />

Group. This information is checked, analyzed,<br />

consolidated and reported to the Executive<br />

Committee. The Group Treasury department makes<br />

suggestions on the management of interest and currency<br />

risks and the decisions are taken by the<br />

Executive Committee. Standard office automation<br />

tools meet the Group’s requirements for the monitoring<br />

of these risks.<br />

In addition, off balance sheet liabilities are regularly<br />

listed, particularly on the drawing of each new loan,<br />

in order to ensure that comprehensive information is<br />

provided.<br />

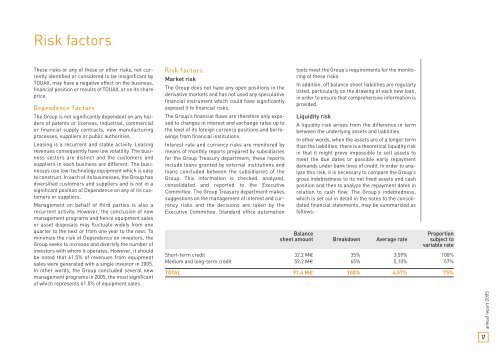

Liquidity risk<br />

A liquidity risk arises from the difference in term<br />

between the underlying assets and liabilities.<br />

In other words, when the assets are of a longer term<br />

than the liabilities, there is a theoretical liquidity risk<br />

in that it might prove impossible to sell assets to<br />

meet the due dates or possible early repayment<br />

demands under bank lines of credit. In order to analyze<br />

this risk, it is necessary to compare the Group’s<br />

gross indebtedness to its net fixed assets and cash<br />

position and then to analyze the repayment dates in<br />

relation to cash flow. The Group’s indebtedness,<br />

which is set out in detail in the notes to the consolidated<br />

financial statements, may be summarized as<br />

follows:<br />

Balance<br />

Proportion<br />

sheet amount Breakdown Average rate subject to<br />

variable rate<br />

Short-term credit 32.2 M€ 35% 3,59% 100%<br />

Medium and long-term credit 59.2 M€ 65% 5,10% 57%<br />

TOTAL 91.4 M€ 100% 4,57% 75%<br />

annual report <strong>2005</strong><br />

17