2005 Annual Report - Touax

2005 Annual Report - Touax

2005 Annual Report - Touax

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

sale are financed entirely by financial debt. In summary,<br />

the Group’s investment policy is to limit the<br />

debt-to-equity ratio to 2-to-1 to finance assets on its<br />

balance sheet, part of which is intended for sale.<br />

The sale of assets to investors forms part of the<br />

Group’s strategy and allows it to finance growth<br />

without recourse to debt. The Group’s growth allows<br />

economies of scale and hence increased margins.<br />

The Group does not use financing tools for current<br />

assets such as “Dailly” assignment, factoring, securitization<br />

or assignment of receivables.<br />

It should be noted that leasing contracts are classified<br />

as finance leases where the Group benefits from<br />

the advantages and risks inherent in ownership. For<br />

example, the existence of an automatic ownership<br />

transfer clause, the existence of a purchase option<br />

at a value well below market value, equivalence between<br />

the term of the lease and the life of the asset<br />

or between the discounted value of future payments<br />

in respect of the lease and the value of the asset are<br />

factors which generally lead to leasing contracts<br />

being considered as finance leases.<br />

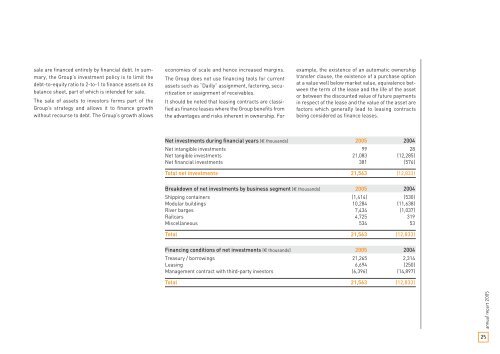

Net investments during financial years (€ thousands) <strong>2005</strong> 2004<br />

Net intangible investments 99 28<br />

Net tangible investments 21,083 (12,285)<br />

Net financial investments 381 (576)<br />

Total net investments 21,563 (12,833)<br />

Breakdown of net investments by business segment (€ thousands) <strong>2005</strong> 2004<br />

Shipping containers (1,414) (530)<br />

Modular buildings 10,284 (11,638)<br />

River barges 7,434 (1,037)<br />

Railcars 4,725 319<br />

Miscellaneous 534 53<br />

Total 21,563 (12,833)<br />

Financing conditions of net investments (€ thousands) <strong>2005</strong> 2004<br />

Treasury / borrowings 21,265 2,314<br />

Leasing 6,694 (250)<br />

Management contract with third-party investors (6,396) (14,897)<br />

Total 21,563 (12,833)<br />

annual report <strong>2005</strong><br />

25