TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

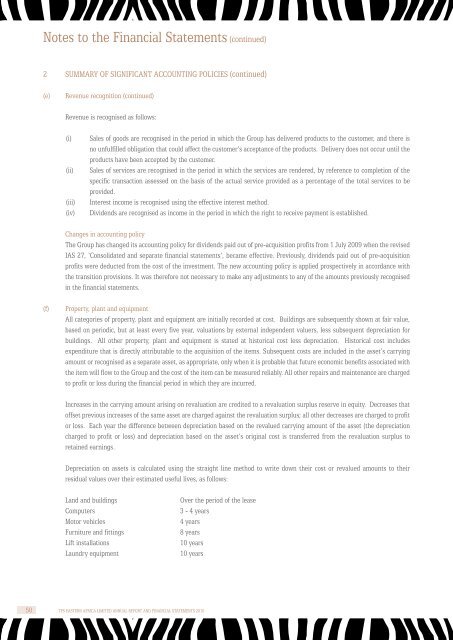

Notes to the <strong>Financial</strong> Statements (continued)<br />

2 Summary of significant accounting policies (continued)<br />

(e)<br />

Revenue recognition (continued)<br />

Revenue is recognised as follows:<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

Sales of goods are recognised in the period in which the Group has delivered products to the customer, and there is<br />

no unfulfilled obligation that could affect the customer’s acceptance of the products. Delivery does not occur until the<br />

products have been accepted by the customer.<br />

Sales of services are recognised in the period in which the services are rendered, by reference to completion of the<br />

specific transaction assessed on the basis of the actual service provided as a percentage of the total services to be<br />

provided.<br />

Interest income is recognised using the effective interest method.<br />

Dividends are recognised as income in the period in which the right to receive payment is established.<br />

Changes in accounting policy<br />

The Group has changed its accounting policy for dividends paid out of pre-acquisition profits from 1 July 2009 when the revised<br />

IAS 27, ‘Consolidated and separate financial statements’, became effective. Previously, dividends paid out of pre-acquisition<br />

profits were deducted from the cost of the investment. The new accounting policy is applied prospectively in accordance with<br />

the transition provisions. It was therefore not necessary to make any adjustments to any of the amounts previously recognised<br />

in the financial statements.<br />

(f)<br />

Property, plant and equipment<br />

All categories of property, plant and equipment are initially recorded at cost. Buildings are subsequently shown at fair value,<br />

based on periodic, but at least every five year, valuations by external independent valuers, less subsequent depreciation for<br />

buildings. All other property, plant and equipment is stated at historical cost less depreciation. Historical cost includes<br />

expenditure that is directly attributable to the acquisition of the items. Subsequent costs are included in the asset’s carrying<br />

amount or recognised as a separate asset, as appropriate, only when it is probable that future economic benefits associated with<br />

the item will flow to the Group and the cost of the item can be measured reliably. All other repairs and maintenance are charged<br />

to profit or loss during the financial period in which they are incurred.<br />

Increases in the carrying amount arising on revaluation are credited to a revaluation surplus reserve in equity. Decreases that<br />

offset previous increases of the same asset are charged against the revaluation surplus; all other decreases are charged to profit<br />

or loss. Each year the difference between depreciation based on the revalued carrying amount of the asset (the depreciation<br />

charged to profit or loss) and depreciation based on the asset’s original cost is transferred from the revaluation surplus to<br />

retained earnings.<br />

Depreciation on assets is calculated using the straight line method to write down their cost or revalued amounts to their<br />

residual values over their estimated useful lives, as follows:<br />

Land and buildings<br />

Computers<br />

Motor vehicles<br />

Furniture and fittings<br />

Lift installations<br />

Laundry equipment<br />

Over the period of the lease<br />

3 - 4 years<br />

4 years<br />

8 years<br />

10 years<br />

10 years<br />

50 TPS EASTERN AFRICA LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2010</strong>