TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>Financial</strong> Statements (continued)<br />

14 Borrowings (continued)<br />

The carrying amounts of short-term borrowings approximate to their fair value. Fair values are based on discounted cash flows<br />

using a discount rate based upon the borrowing rate that directors expect would be available to the Group at the balance sheet<br />

date.<br />

It is impracticable to assign fair values to the Group’s long term liabilities due to inability to forecast interest rate and foreign<br />

exchange rate changes.<br />

None of the above borrowings was in default in at any time in the year.<br />

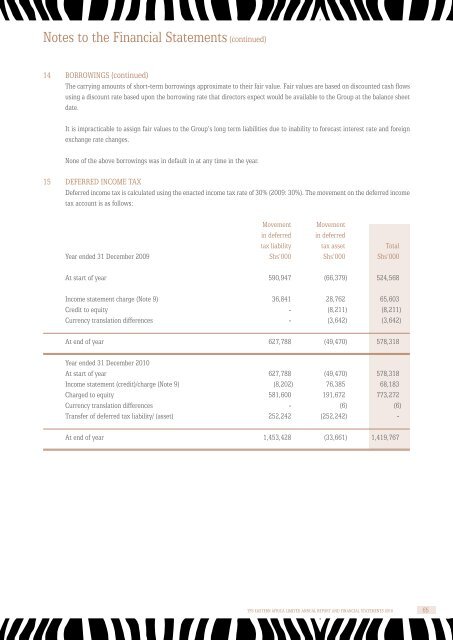

15 Deferred income tax<br />

Deferred income tax is calculated using the enacted income tax rate of 30% (2009: 30%). The movement on the deferred income<br />

tax account is as follows:<br />

Movement Movement<br />

in deferred in deferred<br />

tax liability tax asset Total<br />

Year ended 31 December 2009 Shs’000 Shs’000 Shs’000<br />

At start of year 590,947 (66,379) 524,568<br />

Income statement charge (Note 9) 36,841 28,762 65,603<br />

Credit to equity - (8,211) (8,211)<br />

Currency translation differences - (3,642) (3,642)<br />

At end of year 627,788 (49,470) 578,318<br />

Year ended 31 December <strong>2010</strong><br />

At start of year 627,788 (49,470) 578,318<br />

Income statement (credit)/charge (Note 9) (8,202) 76,385 68,183<br />

Charged to equity 581,600 191,672 773,272<br />

Currency translation differences - (6) (6)<br />

Transfer of deferred tax liability/ (asset) 252,242 (252,242) -<br />

At end of year 1,453,428 (33,661) 1,419,767<br />

TPS EASTERN AFRICA LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2010</strong> 65