TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

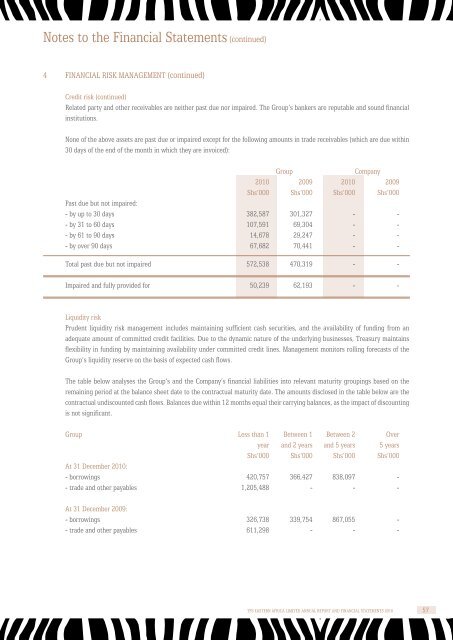

Notes to the <strong>Financial</strong> Statements (continued)<br />

4 <strong>Financial</strong> risk management (continued)<br />

Credit risk (continued)<br />

Related party and other receivables are neither past due nor impaired. The Group’s bankers are reputable and sound financial<br />

institutions.<br />

None of the above assets are past due or impaired except for the following amounts in trade receivables (which are due within<br />

30 days of the end of the month in which they are invoiced):<br />

Group<br />

Company<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Shs’000 Shs’000 Shs’000 Shs’000<br />

Past due but not impaired:<br />

- by up to 30 days 382,587 301,327 - -<br />

- by 31 to 60 days 107,591 69,304 - -<br />

- by 61 to 90 days 14,678 29,247 - -<br />

- by over 90 days 67,682 70,441 - -<br />

Total past due but not impaired 572,538 470,319 - -<br />

Impaired and fully provided for 50,239 62,193 - -<br />

Liquidity risk<br />

Prudent liquidity risk management includes maintaining sufficient cash securities, and the availability of funding from an<br />

adequate amount of committed credit facilities. Due to the dynamic nature of the underlying businesses, Treasury maintains<br />

flexibility in funding by maintaining availability under committed credit lines. Management monitors rolling forecasts of the<br />

Group’s liquidity reserve on the basis of expected cash flows.<br />

The table below analyses the Group’s and the Company’s financial liabilities into relevant maturity groupings based on the<br />

remaining period at the balance sheet date to the contractual maturity date. The amounts disclosed in the table below are the<br />

contractual undiscounted cash flows. Balances due within 12 months equal their carrying balances, as the impact of discounting<br />

is not significant.<br />

Group Less than 1 Between 1 Between 2 Over<br />

year and 2 years and 5 years 5 years<br />

Shs’000 Shs’000 Shs’000 Shs’000<br />

At 31 December <strong>2010</strong>:<br />

- borrowings 420,757 366,427 838,097 -<br />

- trade and other payables 1,205,488 - - -<br />

At 31 December 2009:<br />

- borrowings 326,738 339,754 867,055 -<br />

- trade and other payables 611,298 - - -<br />

TPS EASTERN AFRICA LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2010</strong> 57