TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>Financial</strong> Statements (continued)<br />

12 Share capital (continued)<br />

During the year, the total authorised number of ordinary shares was increased from 106,000,000 shares to 192,000,000 shares<br />

with a par value of Shs 1.00 per share. 148,210,640 (2009: 105,864,742) shares are issued at a par value of Shs 1.00 per share<br />

and are fully paid.<br />

In the year, the Company capitalised its reserves through a bonus issue of 17,644,124 at a ratio of one share of Shs 1.00 for<br />

every six held to existing shareholders.<br />

The Company also issued additional 24,701,774 shares with a par value of Shs 1.00 at Shs 48.00 per share, on the basis of one<br />

new share for every five held, to existing shareholders in a rights issue. This resulted in a share premium, net of rights issue<br />

transaction costs, of Shs 1,125,755,161.<br />

13 Revaluation reserve<br />

The revaluation reserve represents solely the surplus on the revaluation of buildings net of deferred income tax and is nondistributable.<br />

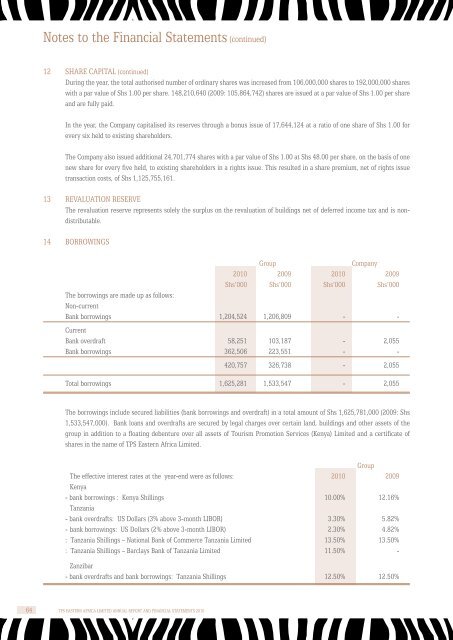

14 Borrowings<br />

Group<br />

Company<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Shs’000 Shs’000 Shs’000 Shs’000<br />

The borrowings are made up as follows:<br />

Non-current<br />

Bank borrowings 1,204,524 1,206,809 - -<br />

Current<br />

Bank overdraft 58,251 103,187 - 2,055<br />

Bank borrowings 362,506 223,551 - -<br />

420,757 326,738 - 2,055<br />

Total borrowings 1,625,281 1,533,547 - 2,055<br />

The borrowings include secured liabilities (bank borrowings and overdraft) in a total amount of Shs 1,625,781,000 (2009: Shs<br />

1,533,547,000). Bank loans and overdrafts are secured by legal charges over certain land, buildings and other assets of the<br />

group in addition to a floating debenture over all assets of Tourism Promotion Services (Kenya) Limited and a certificate of<br />

shares in the name of TPS Eastern Africa Limited.<br />

Group<br />

The effective interest rates at the year-end were as follows: <strong>2010</strong> 2009<br />

Kenya<br />

- bank borrowings : Kenya Shillings 10.00% 12.16%<br />

Tanzania<br />

- bank overdrafts: US Dollars (3% above 3-month LIBOR) 3.30% 5.82%<br />

- bank borrowings: US Dollars (2% above 3-month LIBOR) 2.30% 4.82%<br />

: Tanzania Shillings – National Bank of Commerce Tanzania Limited 13.50% 13.50%<br />

: Tanzania Shillings – Barclays Bank of Tanzania Limited 11.50% -<br />

Zanzibar<br />

- bank overdrafts and bank borrowings: Tanzania Shillings 12.50% 12.50%<br />

64 TPS EASTERN AFRICA LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2010</strong>