TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

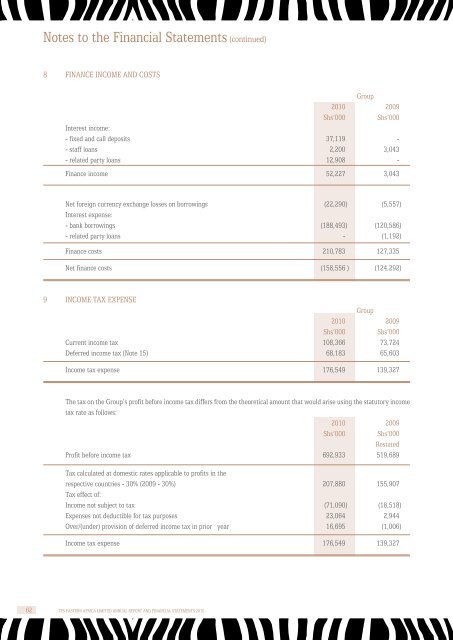

Notes to the <strong>Financial</strong> Statements (continued)<br />

8 FINANCE INCOME AND COSTS<br />

Group<br />

<strong>2010</strong> 2009<br />

Shs’000 Shs’000<br />

Interest income:<br />

- fixed and call deposits 37,119 -<br />

- staff loans 2,200 3,043<br />

- related party loans 12,908 -<br />

Finance income 52,227 3,043<br />

Net foreign currency exchange losses on borrowings (22,290) (5,557)<br />

Interest expense:<br />

- bank borrowings (188,493) (120,586)<br />

- related party loans - (1,192)<br />

Finance costs 210,783 127,335<br />

Net finance costs (158,556 ) (124,292)<br />

9 Income tax expense<br />

Group<br />

<strong>2010</strong> 2009<br />

Shs’000 Shs’000<br />

Current income tax 108,366 73,724<br />

Deferred income tax (Note 15) 68,183 65,603<br />

Income tax expense 176,549 139,327<br />

The tax on the Group’s profit before income tax differs from the theoretical amount that would arise using the statutory income<br />

tax rate as follows:<br />

<strong>2010</strong> 2009<br />

Shs’000 Shs’000<br />

Restated<br />

Profit before income tax 692,933 519,689<br />

Tax calculated at domestic rates applicable to profits in the<br />

respective countries - 30% (2009 - 30%) 207,880 155,907<br />

Tax effect of:<br />

Income not subject to tax (71,090) (18,518)<br />

Expenses not deductible for tax purposes 23,064 2,944<br />

Over/(under) provision of deferred income tax in prior year 16,695 (1,006)<br />

Income tax expense 176,549 139,327<br />

62 TPS EASTERN AFRICA LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2010</strong>