TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>Financial</strong> Statements (continued)<br />

4 <strong>Financial</strong> risk management (continued)<br />

(ii) Price risk<br />

The Group has invested in the unquoted shares of Tourism Promotion Services (Rwanda) Limited which have been classified<br />

under Available-for-sale financial assets. In the opinion of the directors, there is no material exposure to price risk.<br />

(iii) Cash flow and fair value interest rate risk<br />

The Group has borrowings at variable rates. The Group does not hedge itself against interest rate risk. No limits are placed on<br />

the ratio of variable rate borrowing to fixed rate borrowing. At 31 December <strong>2010</strong>, an increase/decrease of 2% on interest rate<br />

would have resulted in an increase/decrease in consolidated post tax profit of Shs 1,040,081 (2009: 3,146,987).<br />

Credit risk<br />

Credit risk arises from cash and cash equivalents and deposits with banks and financial institutions as well as credit exposures<br />

to customers, including outstanding receivables and committed transactions. Credit risk is the risk that a counterparty will<br />

default on its contractual obligations resulting in financial loss to the Group.<br />

The credit controller is responsible for managing and analysing credit risk for each new customer before standard payment and<br />

delivery terms are offered. Credit risk arises from cash at bank and short term deposits with banks, as well as trade and other<br />

receivables. The Group does not have any significant concentrations of credit risk.<br />

For banks and financial institutions, only reputable well established financial institutions are accepted. For trade receivables,<br />

the credit controller assesses the credit quality of the customer, taking into account its financial position, past experience and<br />

other factors. The Group does not grade the credit quality of receivables. Individual risk limits are set based on internal ratings<br />

in accordance with limits set by the Board. The utilisation of credit limits is regularly monitored.<br />

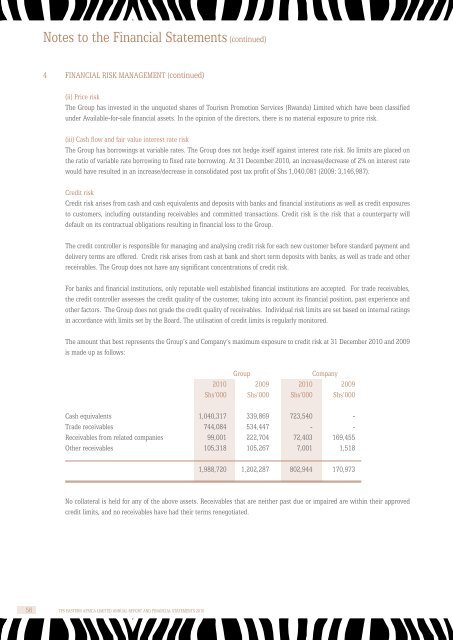

The amount that best represents the Group’s and Company’s maximum exposure to credit risk at 31 December <strong>2010</strong> and 2009<br />

is made up as follows:<br />

Group<br />

Company<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Shs’000 Shs’000 Shs’000 Shs’000<br />

Cash equivalents 1,040,317 339,869 723,540 -<br />

Trade receivables 744,084 534,447 - -<br />

Receivables from related companies 99,001 222,704 72,403 169,455<br />

Other receivables 105,318 105,267 7,001 1,518<br />

1,988,720 1,202,287 802,944 170,973<br />

No collateral is held for any of the above assets. Receivables that are neither past due or impaired are within their approved<br />

credit limits, and no receivables have had their terms renegotiated.<br />

56 TPS EASTERN AFRICA LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2010</strong>