TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

TPSEAL 2010 Financial Results. - Serena Hotels

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

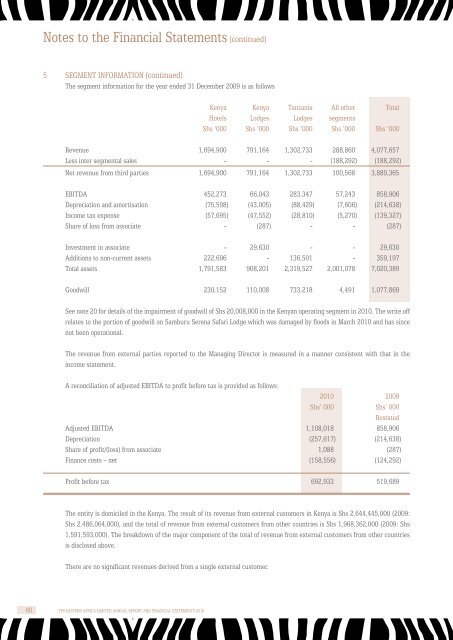

Notes to the <strong>Financial</strong> Statements (continued)<br />

5 Segment information (continued)<br />

The segment information for the year ended 31 December 2009 is as follows<br />

Kenya Kenya Tanzania All other Total<br />

<strong>Hotels</strong> Lodges Lodges segments<br />

Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000<br />

Revenue 1,694,900 791,164 1,302,733 288,860 4,077,657<br />

Less inter segmental sales - - - (188,292) (188,292)<br />

Net revenue from third parties 1,694,900 791,164 1,302,733 100,568 3,889,365<br />

EBITDA 452,273 66,043 283,347 57,243 858,906<br />

Depreciation and amortisation (75,598) (43,005) (88,429) (7,606) (214,638)<br />

Income tax expense (57,695) (47,552) (28,810) (5,270) (139,327)<br />

Share of loss from associate - (287) - - (287)<br />

Investment in associate - 29,630 - - 29,630<br />

Additions to non-current assets 222,696 - 136,501 - 359,197<br />

Total assets 1,791,583 908,201 2,319,527 2,001,078 7,020,389<br />

Goodwill 230,152 110,008 733,218 4,491 1,077,869<br />

See note 20 for details of the impairment of goodwill of Shs 20,008,000 in the Kenyan operating segment in <strong>2010</strong>. The write off<br />

relates to the portion of goodwill on Samburu <strong>Serena</strong> Safari Lodge which was damaged by floods in March <strong>2010</strong> and has since<br />

not been operational.<br />

The revenue from external parties reported to the Managing Director is measured in a manner consistent with that in the<br />

income statement.<br />

A reconciliation of adjusted EBITDA to profit before tax is provided as follows:<br />

<strong>2010</strong> 2009<br />

Shs’ 000 Shs’ 000<br />

Restated<br />

Adjusted EBITDA 1,108,018 858,906<br />

Depreciation (257,617) (214,638)<br />

Share of profit/(loss) from associate 1,088 (287)<br />

Finance costs – net (158,556) (124,292)<br />

Profit before tax 692,933 519,689<br />

The entity is domiciled in the Kenya. The result of its revenue from external customers in Kenya is Shs 2,644,445,000 (2009:<br />

Shs 2,486,064,000), and the total of revenue from external customers from other countries is Shs 1,968,362,000 (2009: Shs<br />

1,591,593,000). The breakdown of the major component of the total of revenue from external customers from other countries<br />

is disclosed above.<br />

There are no significant revenues derived from a single external customer.<br />

60 TPS EASTERN AFRICA LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2010</strong>